Delivery Challan Format Sample, Rules, and Mandatory Fields

Many small businesses send goods for delivery without issuing an invoice immediately, which is where the issue begins, as it often leads to GST mismatches, stock discrepancies, or ITC confusion later. Using the correct delivery challan format is important; missing fields can cause issues during audits or returns. In this guide, you will learn when to use a delivery challan, which fields are mandatory, common mistakes SMEs make, and how to create a challan correctly without compliance stress.

India’s No.1 GST Billing & Accounting Software

check_circleLightning-Fast Billing with Barcode scanning

check_circleAuto E-Way Bill & E-Invoicing

check_circleMobile App

check_circleComplete Accounting

check_circleAdvanced Inventory Management

check_circleAuto Payment Reminders

check_circle1-Click GST Filing & Reconciliation

check_circle24*7 support

What is a Delivery Challan, and When Is It Used?

A delivery challan is a document issued when goods are moved without a tax invoice being issued at that time. It is commonly used for stock transfer, job work, approval basis, free samples, or goods sent for repair. For example, when you send material to another branch or send goods to a customer for trial, a delivery challan is used instead of an invoice. It helps track the movement of goods and stock while remaining GST-compliant.

Download free Delivery Challan format in Word, Excel, or PDF. Customize it as per your requirement with zero cost.

Mandatory Fields in Delivery Challan Format

Delivery Challan Number and Date

This helps track goods movement and link it to an invoice later, if required.

Common Mistake: Using random numbers or duplicate challan numbers.

Impact: Audit confusion and document mismatch.

Supplier Details

Includes business name, address, and GSTIN if registered.

Common Mistake: Missing GSTIN or incomplete address.

Impact: Problems during GST scrutiny or e-way bill generation.

Recipient Details

Name and address of the person or branch receiving goods.

Common Mistake: Writing short names or internal codes only.

Impact: Delivery proof issues.

Description of Goods

Provide a clear product name, quantity, and unit.

Common Mistake: Writing “material” or “items” without details.

Impact: Stock reconciliation issues.

HSN Code

Required mainly for registered businesses and goods movement.

Common Mistake: Leaving HSN blank for stock transfer.

Impact: GST compliance gaps.

Reason for Delivery

Such as job work, free samples, stock transfers, approval basis, or repairs.

Common Mistake: Not mentioning the reason clearly.

Impact: GST officer may treat it as a sale.

Signature and Transport Details

Signature of sender and transporter details, if applicable.

Common Mistake: No signature or missing vehicle details.

Impact: Delivery proof issues.

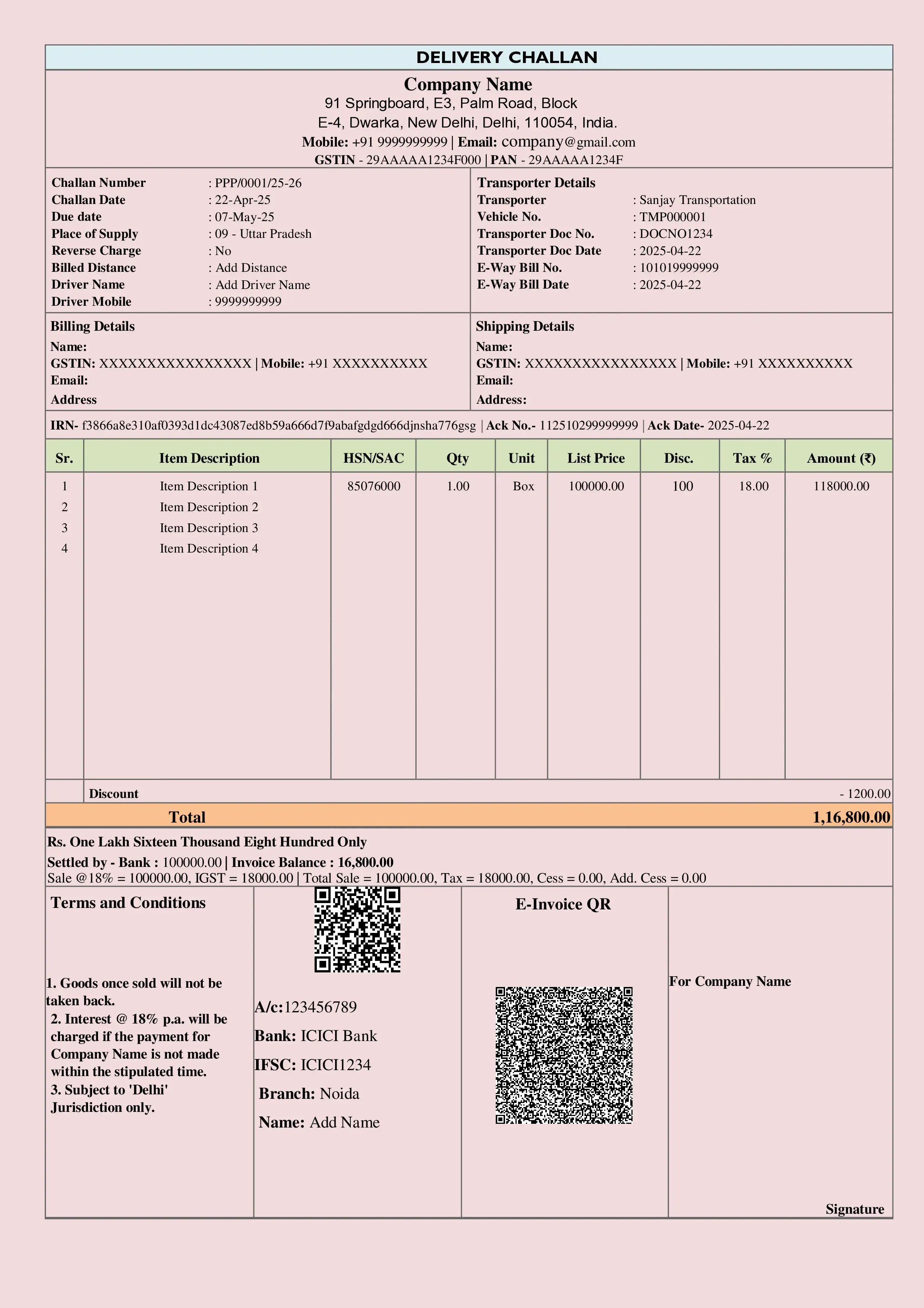

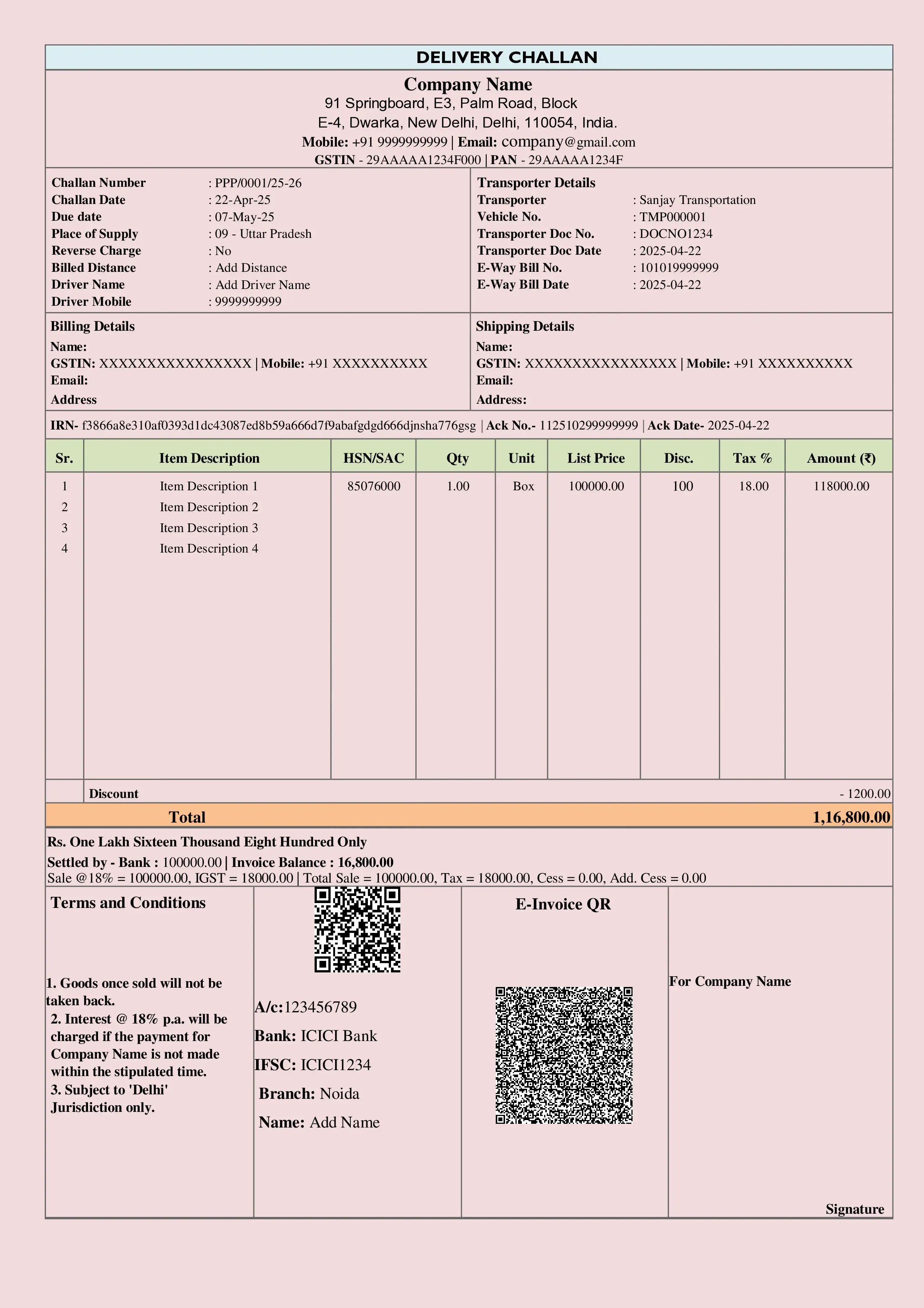

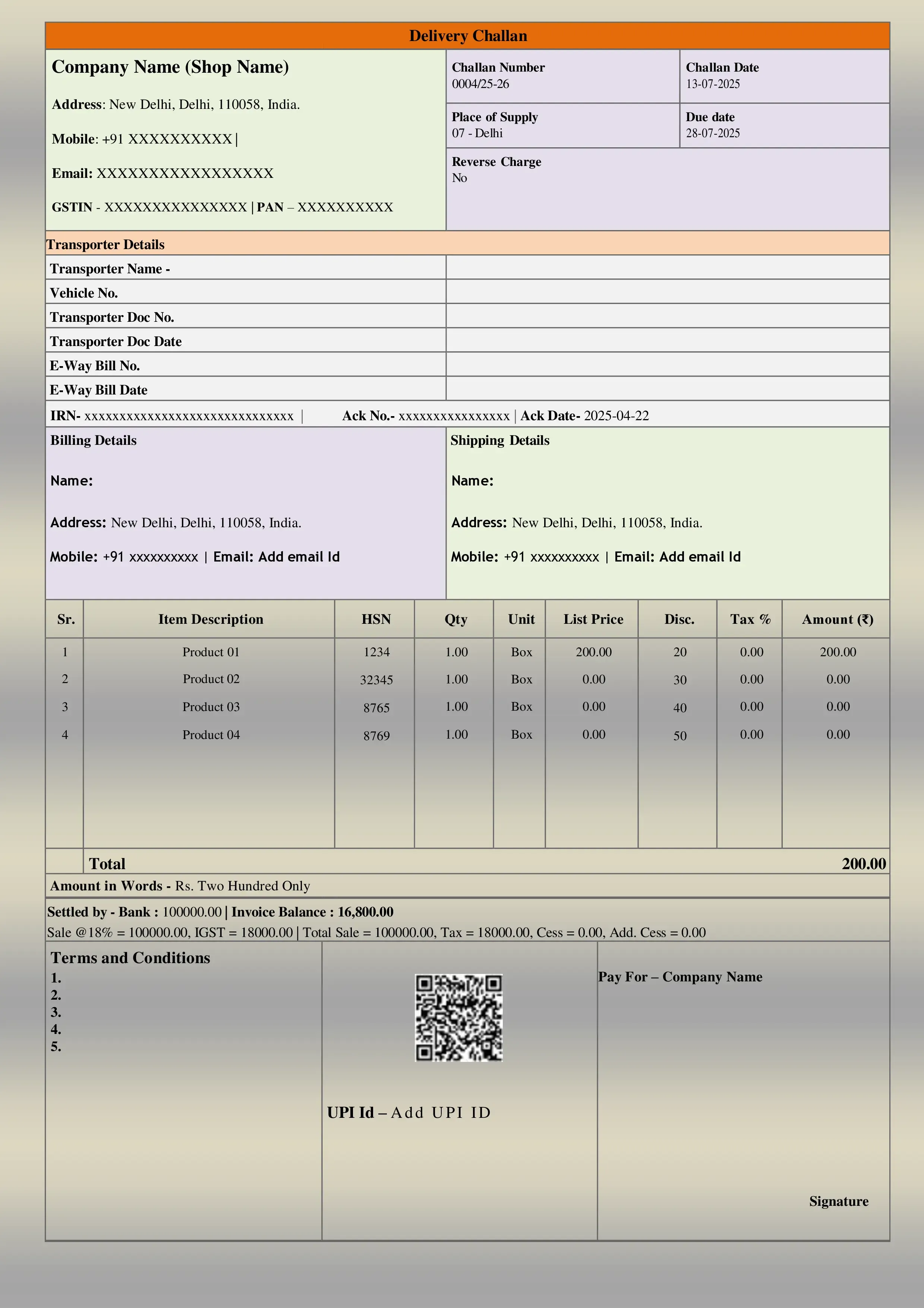

Sample Delivery Challan Format

A standard goods delivery challan format typically includes a header with company details, followed by the challan number and date, followed by the recipient details. The middle section contains a table of product details, including description, quantity, and HSN. At the bottom, the delivery reason, signature, and remarks are added. Unlike an invoice, there is no breakdown of taxes or the total GST amount shown. Note: For GST-registered businesses, this format changes slightly when linked to e-way bill details.

How to Create a Delivery Challan Easily?

Manually creating a blank delivery challan works for very small volumes but increases the risk of errors. Using software for online delivery challan creation saves time, maintains numbering, automatically links stock, and helps generate e-way bills easily. Software like BUSY allows SMEs to create challans for free samples, stock transfers, courier deliveries, and not-for-sale movements while keeping records clean and compliant.

Conclusion

Using the correct delivery challan format is more than just paperwork; it is essential for protecting your business from GST confusion, stock errors, and audit stress. When goods move without sale, a properly filled challan ensures transparency and compliance. With the right processes and software, such as BUSY, SMEs can confidently manage deliveries and focus on growing their business without worrying about documentation errors.

Explore Accounting & Billing Software for Small Businesses

Frequently Asked Questions

-

Is a handwritten delivery challan allowed?

Yes, handwritten challans are allowed, but they often lead to missing details and calculation errors. Digital formats are safer for compliance and record-keeping.

-

Can a delivery challan be used for free samples?

Yes, a delivery challan for a free sample is valid. The reason must clearly mention “free sample” or “not for sale.”

-

Is GST charged on the delivery challan?

No, GST is charged at the challan stage. Tax is applied only when a proper tax invoice is issued.

-

Is a delivery challan mandatory for stock transfer?

Yes, a stock transfer delivery challan format is required when goods move between branches without sale.

-

Can one challan cover multiple deliveries?

No, each delivery movement should have a separate challan to avoid tracking issues.