Ledger Format Sample, Structure, and Correct Usage for Businesses

Many small businesses record sales and expenses, but still struggle to understand where money is actually coming from or going out. This usually happens due to improper or incomplete ledger maintenance. A correct ledger format helps clearly track party balances, cash flow, and profit. Incorrect entries, missing dates, or mixed transactions often lead to account mismatches and confusion during GST filing or audits. In this guide, you will learn what a ledger is, how to use the right format, common mistakes SMEs make, and how to maintain ledgers accurately.

India’s No.1 GST Billing & Accounting Software

check_circleLightning-Fast Billing with Barcode scanning

check_circleAuto E-Way Bill & E-Invoicing

check_circleMobile App

check_circleComplete Accounting

check_circleAdvanced Inventory Management

check_circleAuto Payment Reminders

check_circle1-Click GST Filing & Reconciliation

check_circle24*7 support

What is Ledger and When Is It Used?

A ledger is a detailed record of all financial transactions related to a specific account. This could be a customer, supplier, cash, bank, or expense account. Businesses use a ledger to understand balances, outstanding amounts, and transaction history. For example, a customer ledger shows how much a customer owes you or how much advance you have received. Unlike a journal, which records transactions chronologically, a ledger organises them account-wise for clarity and control.

Download free Ledger Format in Word, Excel, or PDF. Customize it as per your requirement with zero cost.

Mandatory Fields in Ledger Format

Date

Shows when the transaction happened.

Common Mistake: Posting entries without the actual transaction date.

Impact: Wrong balances and reporting errors.

Particulars

Includes details of the transaction, such as the invoice number, payment reference, or narration.

Common Mistake: Writing vague terms like “sale” or “payment”.

Impact: Difficult to trace transactions later.

Voucher Type and Number

Helps identify whether the entry is from a sales invoice, receipt, or payment.

Common Mistake: Skipping voucher reference.

Impact: Audit and reconciliation problems.

Debit Amount

Shows money received or expense incurred, depending on the ledger type.

Common Mistake: Entering debit and credit in the wrong column.

Impact: Incorrect ledger balance.

Credit Amount

Shows money paid or income earned, depending on the ledger.

Common Mistake: Mixing up debit and credit logic.

Impact: Misleading financial position.

Balance

Displays running balance after each entry.

Common Mistake: Not maintaining a running balance.

Impact: No clarity on outstanding or available funds.

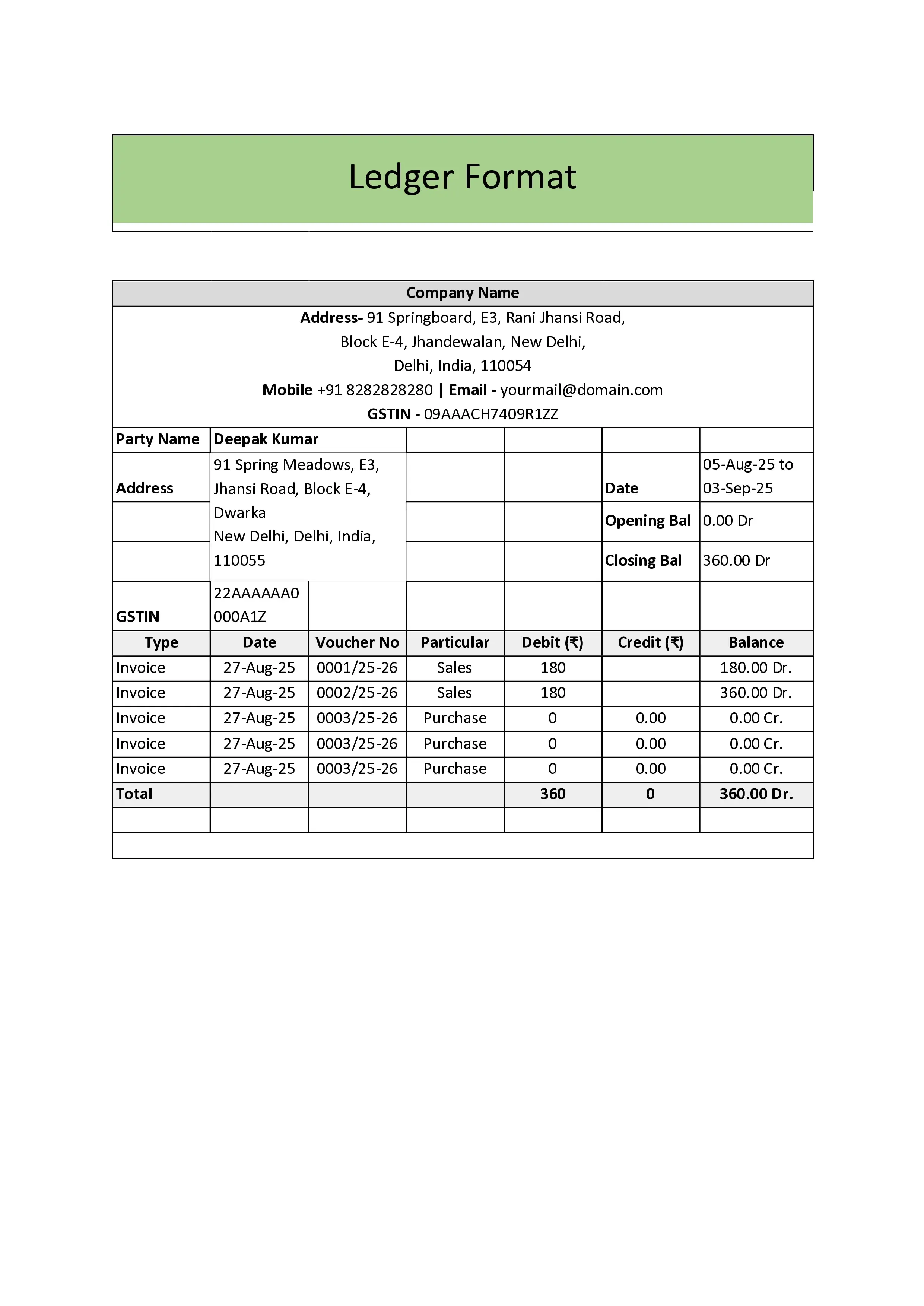

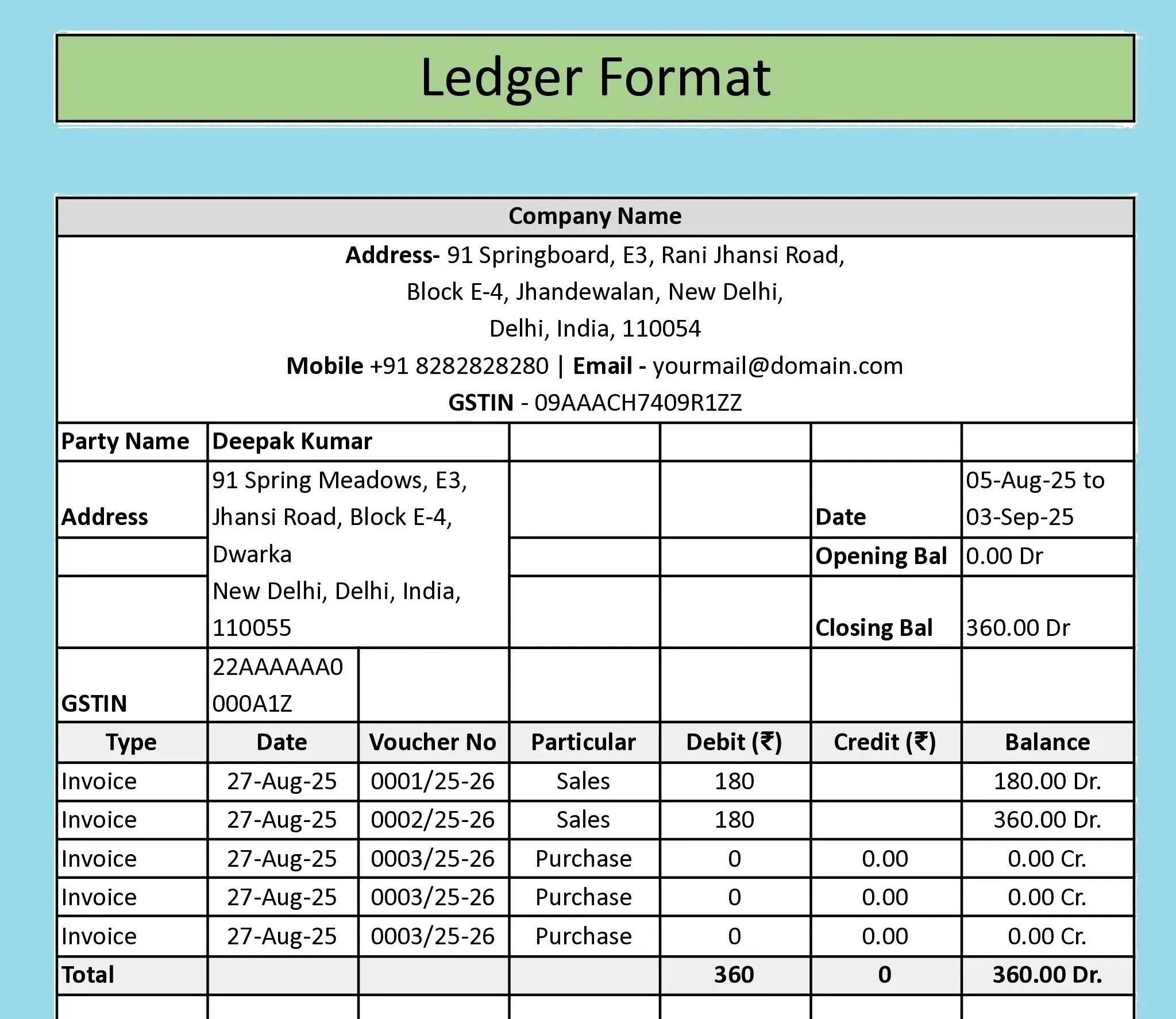

Sample Ledger Format

A standard ledger account format is typically presented in table form, with columns for date, particulars, voucher reference, debit, credit, and balance. In practice, SMEs commonly maintain separate ledgers, such as a cash ledger, a bank ledger, and a customer or party ledger. A sample of the general ledger

In digital accounting, this same structure is used in tools such as Excel and accounting software, which simplify sorting, searching, and comparing financial information.

Common Mistakes SMEs Make in Ledger Formats

- Mixing personal and business transactions in one ledger

- Not updating ledgers regularly

- Wrong debit and credit entries

- No separate customer ledger format

- Manual calculation errors in Excel

These mistakes often result in wrong profit figures, payment follow-up issues, and GST reconciliation problems.

How to Create Ledger Format Easily?

Maintaining ledgers manually in notebooks works only at a very small scale. Many businesses prefer ledger formats because they are ready-made templates, such as the account ledger template in Excel or the general ledger Excel template. Accounting software simplifies this by auto-posting entries, maintaining the customer ledgers, and generating reports instantly. Software like BUSY helps businesses manage party and cash ledgers and customer balances accurately, reducing manual errors.

Conclusion

A proper ledger format is the backbone of accurate accounting. It provides clarity on customer balances, cash position, and business performance. When maintained correctly, it reduces confusion, prevents errors, and supports compliance. Using digital tools like BUSY enables SMEs to automate data entry, minimise manual mistakes, access real-time reports, and quickly reconcile accounts, helping them maintain clean, up-to-date ledgers, gain peace of mind, and exercise better control over their finances.

Explore Accounting & Billing Software for Small Businesses

Frequently Asked Questions

-

What is the difference between a journal and a ledger?

A journal records transactions by date; a ledger sorts them by account for clarity.

-

Is a ledger mandatory for small businesses?

Yes, it helps track cash flow and financial health.

-

Can I maintain ledger format in Excel?

Yes, many SMEs use ledger format in Excel, but it needs regular updates and accuracy checks.

-

Does Ledger help in GST compliance?

Yes, accurate ledgers support GST compliance and audits.