Pro Forma Invoice Format Sample, Structure, and Correct Usage for Businesses

Many SMEs share price details with customers without a proper document, causing confusion during billing. Customers may question rates, quantities, or taxes because the final invoice does not match the committed rate. This often happens due to incorrect pro forma invoice format usage. A pro forma invoice provides clarity before the sale or service begins. This guide covers when to use a proforma, its required fields, common mistakes, and how to prepare it for smooth billing and compliance.

India’s No.1 GST Billing & Accounting Software

check_circleLightning-Fast Billing with Barcode scanning

check_circleAuto E-Way Bill & E-Invoicing

check_circleMobile App

check_circleComplete Accounting

check_circleAdvanced Inventory Management

check_circleAuto Payment Reminders

check_circle1-Click GST Filing & Reconciliation

check_circle24*7 support

What is a Proforma Invoice Format, and When Is It Used?

A pro forma invoice is a preliminary document shared before issuing the final tax invoice. It gives the buyer a clear idea of pricing, quantity, taxes, and terms. Businesses use it for order confirmation, advance payment requests, exports, bulk deals, and customer approvals. It is not a tax invoice and does not create a tax liability. Once the buyer agrees, the pro forma invoice serves as the basis for generating the final invoice.

Download Free Pro Forma Invoice Format in Word, Excel, or PDF. Customize it as per your requirement with zero cost.

Mandatory Fields in Pro Forma Invoice Format

Pro Forma Invoice Number and Date

Helps track and reference the document for later reference.

Common Mistake: Not using numbering or reusing numbers.

Impact: Confusion during order confirmation or billing.

Seller Details

Business name, address, contact details, and GSTIN if registered.

Common Mistake: Missing GSTIN or incomplete address.

Impact: Professional credibility issues and compliance confusion.

Buyer Details

Customer name and address.

Common Mistake: Writing generic names or internal codes.

Impact: Disputes on acceptance or delivery.

Description of Goods or Services

Clear product or service details.

Common Mistake: Writing short or unclear descriptions.

Impact: Mismatch between pro forma and final invoice.

Quantity and Rate

Shows pricing calculation clearly.

Common Mistake: Mentioning a lump sum amount only.

Impact: Pricing disputes later.

Tax Details

GST rate and amount should be shown for clarity.

Common Mistake: Not clarifying whether tax is included.

Impact: Customer confusion at the invoice stage.

Total Value

Total payable amount including taxes.

Common Mistake: Manual calculation errors.

Impact: Trust issues with the customer.

Validity and Terms

Validity period, payment terms, and delivery timeline.

Common Mistake: Skipping validity.

Impact: Customer may demand old prices.

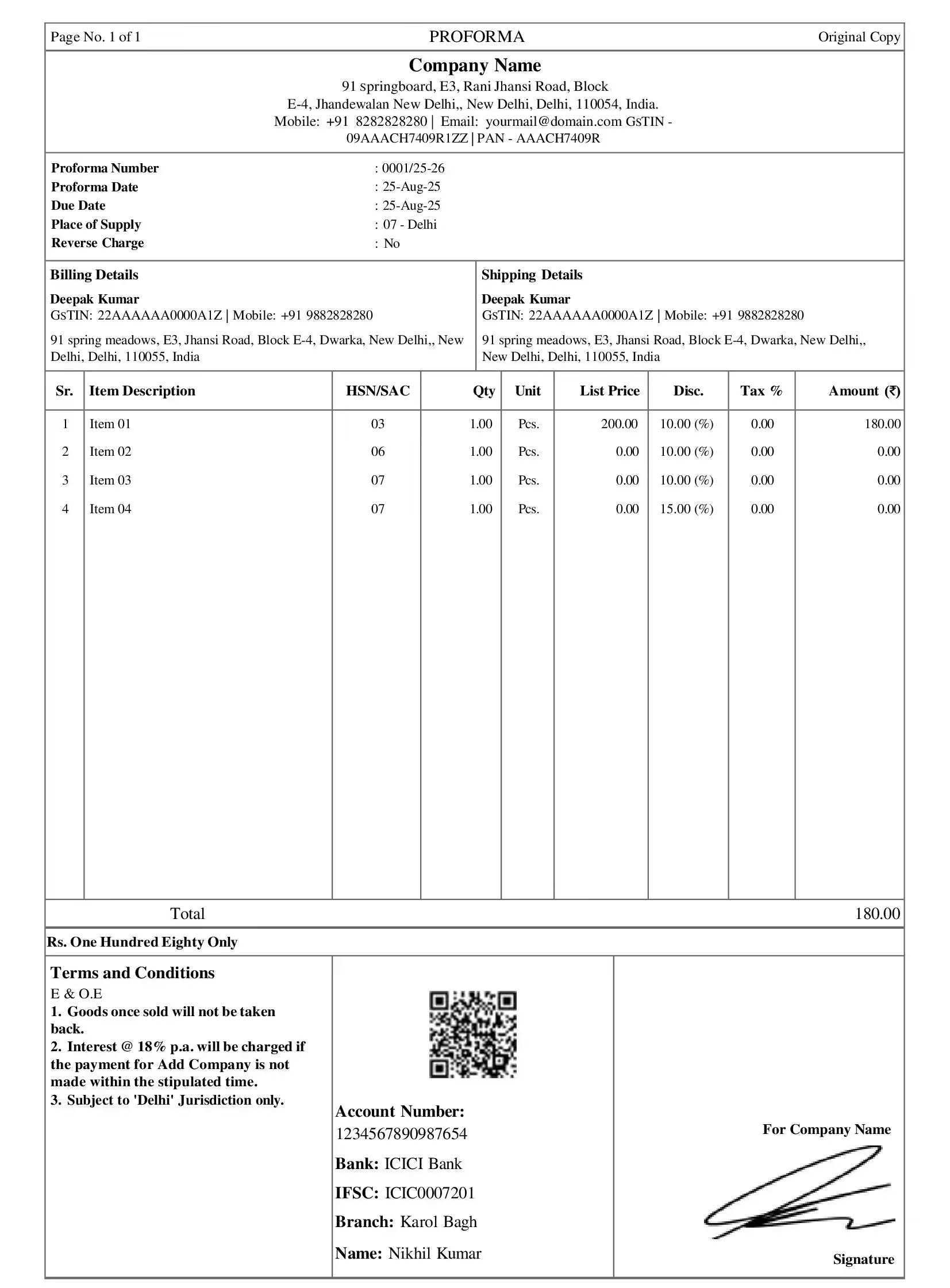

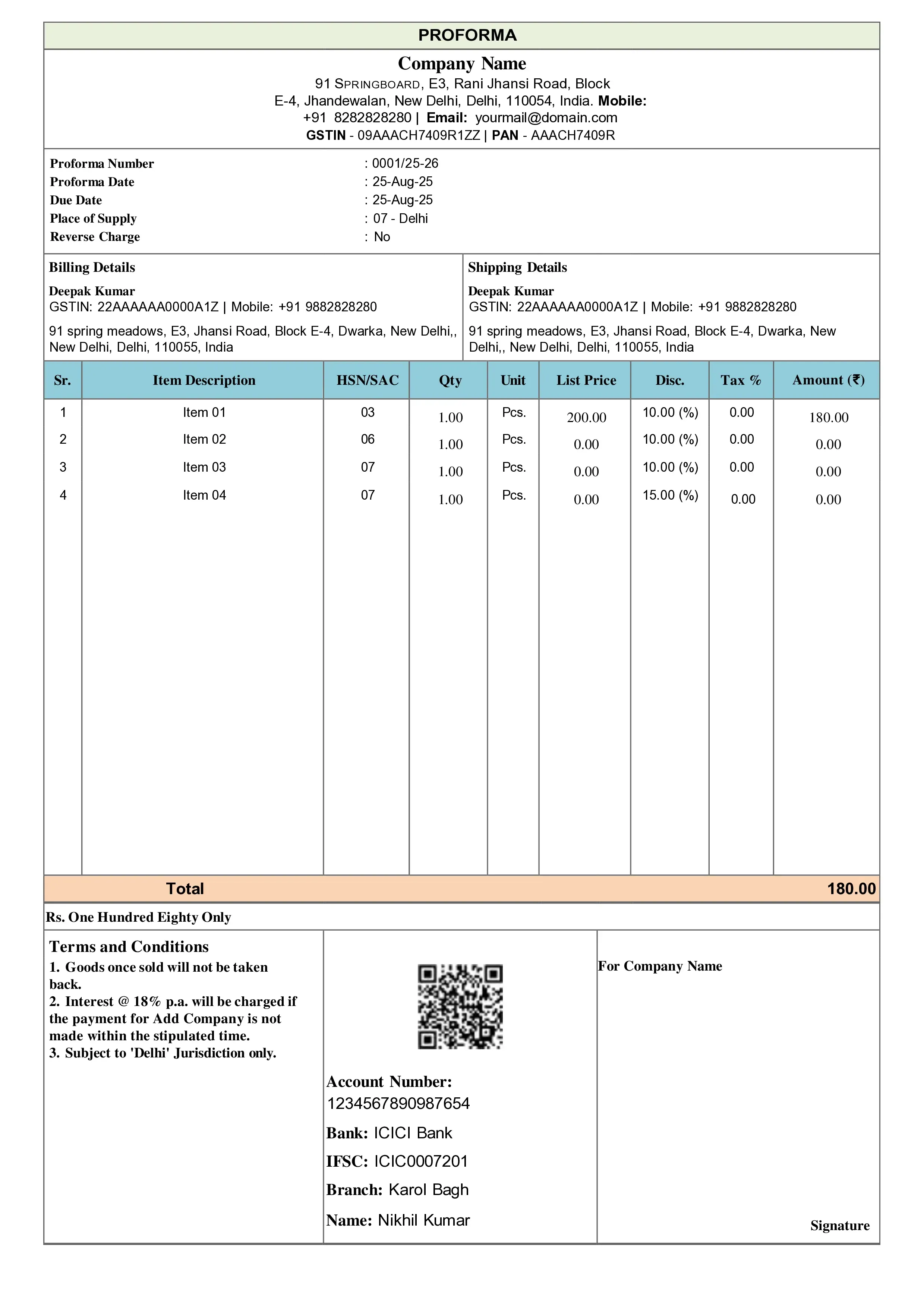

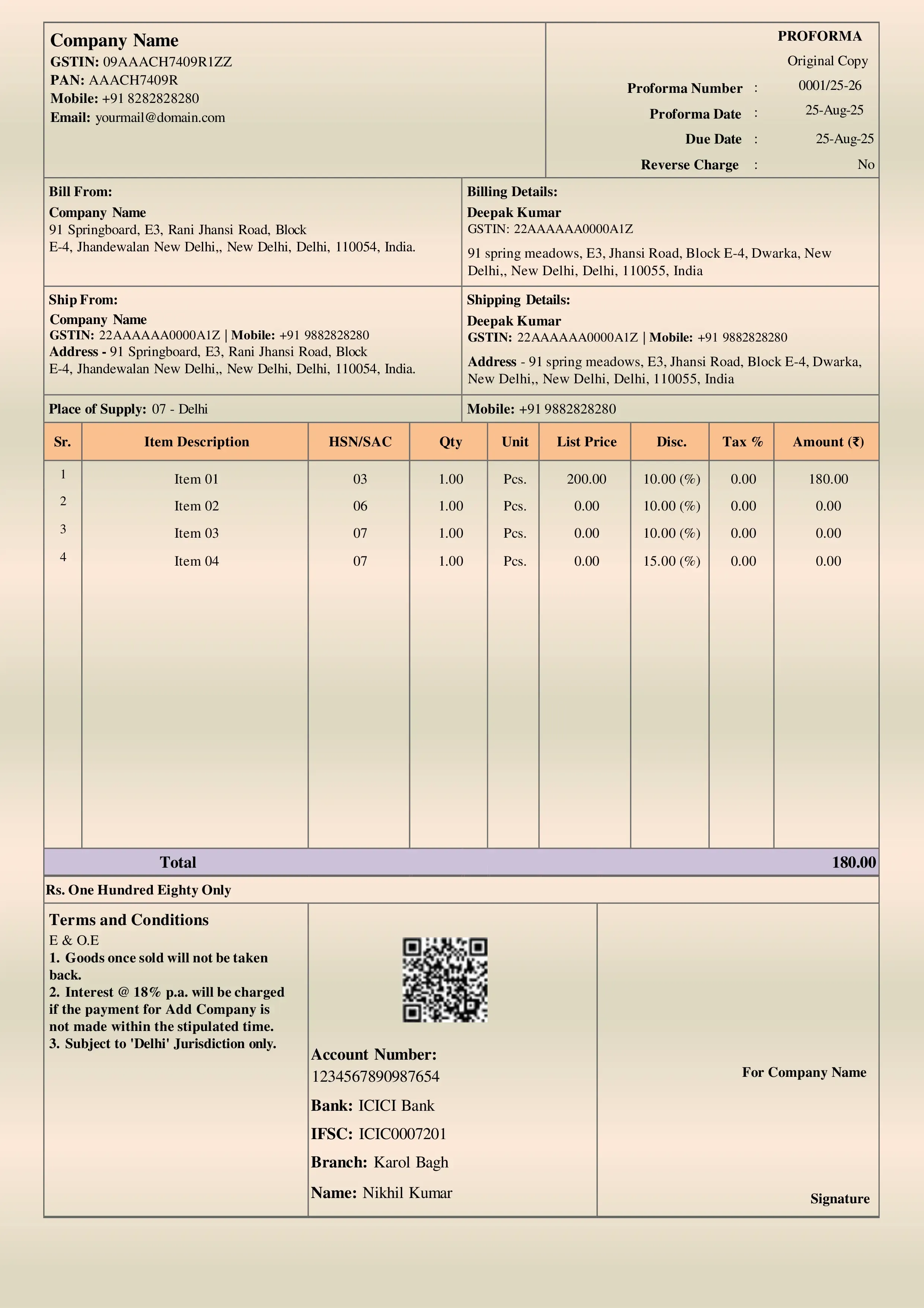

Sample Pro Forma Invoice Format

A standard pro forma invoice sample starts with the seller and buyer details at the top, followed by the pro forma invoice number and date. The middle section contains a table with descriptions, quantities, rates, taxable values, taxes, and total amounts. At the bottom, validity, payment terms, and notes are mentioned. Businesses commonly use a pro forma invoice format in Word, PDF, or XLS, depending on their workflow.

Common Mistakes SMEs Make in Pro Forma Invoice Formats

- Treating a pro forma invoice as a tax invoice

- Not converting the pro forma invoice into a final invoice

- Missing GST breakup

- No validity or payment terms

- Editing the same document instead of issuing a revised one

These mistakes often delay payments and create accounting mismatches.

How to Create a Pro Forma Invoice Easily?

Many businesses download pro forma invoice templates, such as Word templates or Excel formats. While these work for basic needs, they require manual checks and version control. Accounting software simplifies this by generating pro forma invoices, tracking approvals, and converting them directly into final invoices. BUSY helps SMEs accurately manage pro forma invoices while maintaining consistency and records with minimal manual effort.

Conclusion

Using the correct pro forma invoice format helps avoid billing disputes, improves transparency, and speeds up order confirmation. It creates clarity before issuing the final invoice and supports smooth business transactions. With proper formats and software such as BUSY, SMEs can confidently manage pro forma invoices, reduce errors, and maintain professional business records.

Explore Accounting & Billing Software for Small Businesses

Frequently Asked Questions

-

Is a pro forma invoice legally valid?

A proforma invoice is not legally binding like a tax invoice, but it becomes a commercial reference once accepted by the buyer.

-

Does GST apply to a pro forma invoice?

No, GST liability arises on a proforma invoice. Tax is applicable only when the final invoice is issued.

-

Can an advance payment be taken on a pro forma invoice?

Yes, many businesses accept advance payment based on a pro forma invoice.

-

What is the difference between a quotation and a pro forma invoice?

A quotation is a price offer, while a proforma invoice is a more detailed pre-invoice document used for confirmation.

-

Can a pro forma invoice be revised?

Yes, but a revised proforma invoice should be issued with a new reference number.