Ramdev Food Products Pvt. Ltd. vs. Na

(AAR (Authority For Advance Ruling), Gujrat)

A. BRIEF FACTS

The applicant M/s. Ramdev Food Products Pvt. Ltd., supplies varieties of instant mix flours under the brand name of Ramdev.

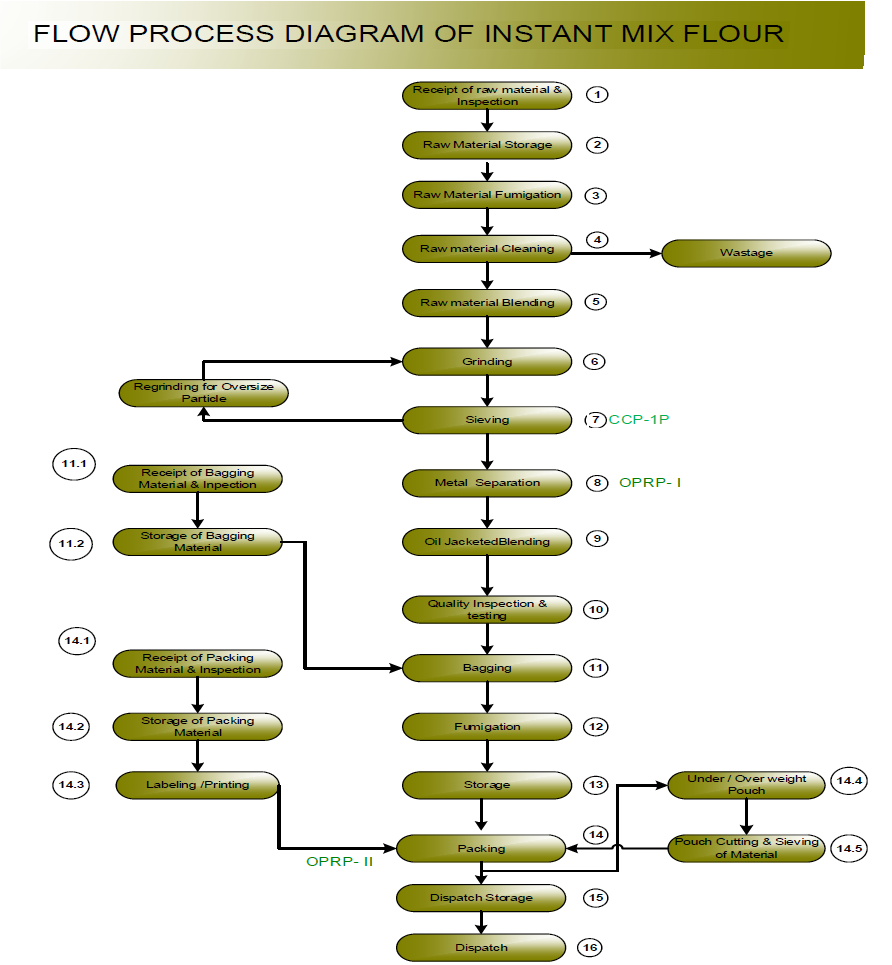

2. The applicant has submitted the method of making instant mix flours as follows:

(a) The applicant purchases food grains/pulses such as wheat, rice, chana dal, udad dal, etc from vendors.

(b) The food grains/pulses are fumigated and cleaned for removal of wastage.

(c) The food grains/pulses are then grinded and converted into flour.

(d) The flour is sieved for removal of impurities.

(e) The flour is then mixed with other ancillary ingredients such as salt, spices, etc. The proportion of flour in most of the instant mixes is ranging from 70% to 90%.

(f) The flour mix is then subjected to quality inspection and testing.

(g) The flour mix is thereafter packaged and stored for dispatch.

3. Table showing constituent components of instant mix flours(as per table Annexure-B(revised) submitted by them on 2-7-21) is as under:

| Sr.No. | Product Name | (A) Dried Leguminous Vegetable Flours | (B) Rice & Wheat Flours | Total Flours (A+B) (%) | (C) Additives | (D) Spices | Total (A+B+C+D) (%) | ||||||||

| Bengal Gram (Chana Dal) (%) | Black Gram (Udad Dal) (%) | Green Gram (Moong Dal) /Red Gram (Toor Dal)% | Total (%) | Rice Flour (%) | Refined Wheat Flour (%) | Wheat Flour (%) | Total (%) | Additives (%) | Name of Additives | Spices (%) | Name of Spices | ||||

| 1 | Gota Instant Mix Flour 400 gm (including chutney powder of 40 gm) | 66.60 |

|

| 66.60 |

|

|

| 0.00 | 66.60 | 25.60 | Sugar, Iodised Salt, Raising agent (Sodium bicarbonate INS 500(ii)), Acidity regulator (Citric acid INS 330) | 7.80 | Chilli Powder, Garam Masala Powder, Black Pepper Crushed, Coriander Crushed, Ajwain, Fennel | 100.00 |

| 1A | Chutney Powder 40 gm | Crushed Sugar, Iodised Salt, Acidity regulator (Citric acid INS 330) | Amchur Powder, Chilli Powder, Cumin Powder, Coriander Powder | ||||||||||||

| 2 | Khaman Instant Mix Flour 400 gm (including masala pack of 15 gm) | 88.95 |

|

| 88.95 |

|

|

| 0.00 | 88.95 | 11.05 | Iodised Salt, Acidity regulator (Citric acid INS 330), Raising agent (Sodium bicarbonate INS 500(ii)) | Nil | N.A. | 100.00 |

| 2A | Masala Pack 15 gm | Raising agent (Sodium bicarbonate INS 500(ii)) | |||||||||||||

| 3 | Dalwada Instant Mix Flour 400 gm |

|

| 92.00 | 92.00 |

|

|

| 0.00 | 92.00 | 7.25 | Iodised Salt, Raising agent (Sodium bicarbonate INS 500(ii)), Acidity regulator (Citric acid INS 330) | 0.75 | Compounded Asafoetida, Cumin | 100.00 |

| 4 | Dahiwada Instant Mix Flour 400 gm |

| 85.00 | 8.50 | 93.50 |

|

|

| 0.00 | 93.50 | 6.50 | Iodised Salt, Raising agent (Sodium bicarbonate INS 500(ii)), Acidity regulator (Citric acid INS 330) | Nil | N.A. | 100.00 |

| 5 | Idli Instant Mix Flour 400 gm |

| 27.00 |

| 27.00 | 66.00 |

|

| 66.00 | 93.00 | 7.00 | Iodised Salt, Acidity regulator (Citric acid INS 330), Raising agent (Sodium bicarbonate INS 500(ii)) | Nil | N.A. | 100.00 |

| 6 | Dhokla Instant Mix Flour 400 gm | 15.00 | 12.00 |

| 27.00 | 60.50 |

|

| 60.50 | 87.50 | 12.50 | Sugar, Iodised Salt, Raising agent (Sodium bicarbonate INS 500(ii)), Acidity regulator (Citric acid INS 330) | Nil | N.A. | 100.00 |

| 7 | Dhosa Instant Mix Flour 400 gm |

| 20.00 |

| 20.00 | 59.00 | 15.50 |

| 74.50 | 94.50 | 5.50 | Iodised Salt, Acidity regulator (Citric acid INS 330), Raising agent (Sodium bicarbonate INS 500(ii)) | Nil | N.A. | 100.00 |

| 8 | Pizza Instant Mix Flour 400 gm |

|

|

| 0.00 |

| 75.50 |

| 75.50 | 75.50 | 24.50 | Hydrogenated Vegetable Oil, Acidity regulator (Citric acid INS 330), Raising agent (Sodium bicarbonate INS 500(ii)) | Nil | N.A. | 100.00 |

| 9 | Methi Gota Instant Mix Flour 400 gm (including kadhi powder of 40 gm) | 70.75 |

|

| 70.75 |

|

|

| 0.00 | 70.75 | 22.00 | Iodised Salt, Acidity regulator (Citric acid INS 330), Sugar, Raising agent (Sodium bicarbonate INS 500(ii)) | 7.25 | Dry Fenugreek Leaves (Kasuri Methi), Coriander Crushed, Black Pepper Crushed, Turmeric Powder, Chilli Powder, Compounded Asafoetida, Garam Masala Powder, Ajwain | 100.00 |

| 9A | Kadhi Powder 40 gm | Crushed Sugar, Iodised Salt, Hydrogenated Vegetable Oil, Acidity regulator (Citric acid INS 330) | White Chilli Powder, Mustard Seed, Turmeric Powder, Fresh Curry Leaves, Compounded Asafoetida | ||||||||||||

| 10 | Handvo Instant Mix Flour 400 gm | 15.00 | 8.00 | 15.00 | 38.00 | 33.00 |

| 8.00 | 41.00 | 79.00 | 19.00 | Sugar, Iodised Salt, Acidity regulator (Citric acid INS 330), Raising agent (Sodium bicarbonate INS 500(ii)) | 2.00 | Chilli Powder, Turmeric Powder | 100.00 |

4. Diagrammatic process flow chart is as follows:

5. The Schedule entry as contained in Schedule I of Notification No. 1/2017 – Central Tax (Rate) dated 28.6.2017 reads as follows:

| S.No. | Chapter /Heading /Sub-heading/ Tariff item | Description of Goods | Rate of tax |

| 54. | 1101 | Wheat or meslin flour put up in unit container and,- (a) bearing a registered brand name; or (b) bearing a brand name on which an actionable claim or enforceable right in a court of law is available other than those where any actionable claim or any enforceable right in respect of such right has been voluntarily foregone subject to conditions as in the Annexure | 2.5% CGST + 2.5% SGST |

| 55. | 1102 | Cereal flours other than of wheat or meslin i.e. maize (corn) flour, Rye flour, etc. put up in unit container and,- (a) bearing a registered brand name; or (b) bearing a brand name on which an actionable claim or enforceable right in a court of law is available other than those where any actionable claim or any enforceable right in respect of such right has been voluntarily foregone subject to conditions as in the Annexure | 2.5% CGST + 2.5% SGST |

| 59. | 1106 | Meal and powder of the dried leguminous vegetables of heading 0713 (pulses) other than guar meal 1106 10 10 and guar gum refined split 1106 10 90, of sago or of roots or tubers of heading 0714 or of the products of Chapter 8, put up in unit container and – (a) bearing a registered brand name (b) bearing a brand name on which an actionable claim or enforceable right in a court of law is available other than those where any actionable claim or any enforceable right in respect of such right has been voluntarily foregone subject to conditions as in the Annexure | 2.5% CGST + 2.5% SGST |

6. The applicant has submitted the methodology of making instant mix flours as follows:

6.1 Flour mix is classifiable under the entry for flour because of its composition and preparation process. There is a high percentage of pulse/cereal flour in the instant flour mixes. Further the process of making flour mixes is simple in as much as the flour is simply mixed with ancillary ingredients such as salt, spices, etc for added flavor. The flour is not processed in any manner for the purpose of making the instant flour mix. The instant flour mix is further not in ready to consume form. The flour mix needs to be subjected to further processing and cooking for conversion into ready to eat food. It is therefore submitted that the instant flour mix retains its identity as flour and therefore it is classifiable under Heading 1101, 1102 or 1106 as the case may be which is pertaining to wheat flour, rice flour and meal and powder of dried leguminous vegetables respectively.

6.2 Table showing the dominant flour component of each commodity and resultant classification:

| Name of instant flour mix | Dominant flour component | HSN heading |

| Gota Instant mix flour | Chana Dal | 1106 |

| Khaman Instant mix flour | Chana Dal | 1106 |

| Dalwada Instant Mix Flour | Moong Dal | 1106 |

| Dahiwada Instant Mix Flour | Udad Dal | 1106 |

| Idli Instant Mix Flour | Rice | 1102 |

| Dhokla Instant Mix Flour | Rice | 1102 |

| Dhosa Instant Mix Flour | Rice | 1102 |

| Pizza Instant Mix Flour | Wheat | 1101 |

| Methi Gota Instant Mix Flour | Chana Dal | 1106 |

| Handvo Instant Mix Flour | Rice | 1102 |

6.3 Such classification is supported by Rule 3(b) of General Rules of Interpretation

1. The General Rules of interpretation of customs tariff have been specifically borrowed by clause (iv) of the Explanation to the Rate Notification which reads as follows:

“Explanation. – For the purposes of this notification,-

(iv) The rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall, so far as may be, apply to the interpretation of this notification.”

2. The relevant extract of such rules of interpretation of Customs tariff reads as follows:

“2(b) Any reference in a heading to a material or substance shall be taken to include a reference to mixtures or combinations of that material or substance with other materials or substances. Any reference to goods of a given material or substance shall be taken to include a reference to goods consisting wholly or partly of such material or substance. The classification of goods consisting of more than one material or substance shall be according to the principles of rule 3.

3. When by application of Rule 2(b) or for any other reason, goods are, prima facie, classifiable under two or more headings, classification shall be effected as follows:

(a) the heading which provides the most specific description shall be preferred to headings providing a more general description. However, when two or more headings each refer to part only of the materials or substances contained in mixed or composite goods or to part only of the items in a set put up for retail sale, those headings are to be regarded as equally specific in relation to those goods, even if one of them gives a more complete or precise description of the goods.

(b) mixtures, composite goods consisting of different materials or made up of different components, and goods put up in sets for retail sale, which cannot be classified by reference to (a), shall be classified as if they consisted of the material or component which gives them their essential character, in so far as the criterion is applicable.

(c) When goods cannot be classified by reference to (a) or (b), they shall be classified under the heading which occurs last in numerical order among those which equally merit consideration.”

6.4 Since the instant flour mixes are mixtures of various products, the different headings would only refer to part of the materials and therefore the relevant rule will be Rule 3(b) according to which mixtures shall be classified as if they consisted of material or component which gives them their essential character. In the present case the essential character of the instant flour mixes is given by the flour. The other ingredients are added only for flavours. Therefore Rule 3(b) supports the classification of instant flour mixes under Chapter 11 of the HSN Code under headings 1101, 1102 or 1106 as the case may be.

6.5 The applicant relies upon the judgement of Hon. Supreme Court in the case of The Collector of Central Excise v/s Bakelite Hylam Ltd. (1997) 10 SCC 350 which is squarely applicable in this case, wherein the following was observed while applying Rule 3(b) of the Rules of interpretation:

“The other interpretation is Rule 3(b) which provides that mixtures or composite goods consisting of different materials which cannot be classified with reference to Rule 3(a) as in the present case, are to be classified as if they consisted of the material or component which gives them their essential character. In the present case, the essential character of a decorative laminated sheet is its rigidity or strength and its resistance to heat and moisture. These are essentially characteristics which are imparted by resins. Paper does not process any of these characteristics. Therefore, applying Rule 3(b) and going by the essential characteristics of such laminated sheets, these goods are more appropriately classifiable under chapter 39.”

The aforementioned judgement is squarely applicable in the case of the applicant.

6.6 The applicant is further supported in its contention by a circular no. 80/54/2018-GST dated 31.12.2018 issued by the Central Board of Indirect Taxes and Customs wherein the following has been clarified with regard to classification of “Sattu” and is squarely applicable to this case:

“3. Applicability of GST on Chhatua or Sattu:

3.1 Doubts have been raised regarding applicability of GST on Chhatua (Known as “Sattu” in Hindi Belt).

3.2 Chhatua or Sattu is a mixture of flour of ground pulses and cereals. HSN code 1106 includes the flour, meal and powder made from peas, beans or lentils (dried leguminous vegetables falling under 0713). Such flour improved by the addition of very small amounts of additives continues to be classified under HSN code 1106. If unbranded, it attracts Nil GST (S. No. 78 of notification No. 2/2017- Central Tax (Rate) dated 28.06.2017) and if branded and packed it attracts 5%GST (S. No. 59 of schedule I of notification No. 1/2017-Central Taxes (Rate) dated 28.06.2017).”

Thus it is expressly clarified that mixture of flour of ground pulses and cereals will fall under HSN code 1106 and addition of small amount of additives will not change the classification.

6.7 It is well settled that circular of CBIC is binding and the same is required to be followed. Reference may be made in this regard to the judgement of Hon. Supreme Court in the case of Paper Products Ltd. v/s Commissioner of Central Excise (1999) 7 SCC 84 wherein it is held and observed as under:

“The question for our consideration in these appeals is : what is the true nature and effect of the Circulars issued by the Board in exercise of its power under Section 37-B of the Central Excise Act, 1944? This question is no more res integra in view of the various judgments of this Court. This Court in a catena of decisions has held that the Circulars issued under Section 37-B of the said Act are binding on the Department and the Department cannot be permitted to take a stand contrary to the instructions issued by the Board. These judgments have also held that the position may be different with regard to an assessee who can contest the validity or legality of such instructions but so far as the Department is concerned, such right is not available. [See Collector of Central Excise, Patna v. Usha Martin Industries 1997 ECR 257 (SC)]. In the case of Ranadey Micronutrients v. Collector of Central Excise 1996 (87) ELT 19 (SC), this Court held that the whole objective of such Circulars is to adopt a uniform practice and to inform the trade as to how a particular product will be treated for the purposes of excise duty. The Court also held that it does not lie in the month of the Revenue to repudiate a Circular issued by the Board on the basis that it is inconsistent with a statutory provision (emphasis supplied). Consistency and discipline are, according to this Court, of far greater importance than the winning or losing of court proceedings. In the case of Collector of Central Excise, Bombay v. Jayant Dalai Pvt. Ltd. 1996 (88) ELT 638 (SC), this Court has held that it is not open to the Revenue to advance an argument or even file an appeal against the correctness of the binding nature of the Circulars issued by the Board. Similar is the view taken by this Court in the case of Collector of Central Excise, Bombay v. Kores [India] Ltd. 1997 (89) ELT 441 (SC).”

6.8 The applicant further points out that for the same products Kitchen Xpress Overseas Limited had filed application for determination under Section 80 of the Gujarat Value Added Tax Act, 2003 (herein after referred to as “the Vat Act”). The relevant entry for consideration before the determining authority was Entry 12(ii) of Schedule I to the Vat Act which read as “Flour of cereals and pulses except maize flour”. The learned determining authority by order no. 2010/D/171-177/No. 356-359 dated 12.8.2010 held that instant flour mixes such as gota flour, khaman flour, dalwada flour, dahiwada flour, idli flour, dhokla flour and dosa flour were classifiable under Entry 12(ii) of the Vat Act.

6.9 The applicant has submitted that determination orders passed under the Vat Act which was the legislation preceding the GST Acts are relevant for the purpose of deciding classification under the GST Acts. The applicant relies upon the judgement of Hon. Gujarat High Court in the case of West Coast Waterbase Pvt. Ltd. v/s State of Gujarat (2016) 95 VST 370 (Guj.) wherein determination order passed under Section 62 of the Gujarat Sales Tax Act, 1969 was held to be binding for the purpose of the Vat Act in the context of classification of prawn feed. The applicant further invites reference to the judgement of Hon. Gujarat High Court in the case of Samsung India Electronics Pvt. Ltd. v/s State of Gujarat Special Civil Application No. 6109 of 2019 decided on 28.3.2019 wherein circular issued under the Central Excise Act, 1944 was held to be binding for the purpose of classification under the Vat Act since the Excise tariff had been incorporated in the Vat notification. Even in the present case ultimately the question is whether flour mix falls under the entry for flour or not. The decisions rendered under the Vat Act in this regard are therefore relevant even for the purpose of deciding classification under the GST Acts.

7. In the submission of the applicant the classification as being proposed by the aforestated submissions is squarely supported by the order passed by Gujarat Advance Ruling Authority in the case of Talod Gruh Udyog Advance Ruling no. GUJ/GAAR/R/43/2020 dated 30-7-2020 wherein after detailed analysis of identical products and the legal provisions, it was inter-alia held as follows: “The following products manufactured and supplied by the applicant Shri Dipakkumar Kantilal Chotai(Talod Gruh Udyog) bearing brand name ‘Talod’ are classified as under:

(1) Khaman mix flour, Gota mix flour, Handwa mix flour, Dahi wada mix flour, Dalwada mix flour, Meduvada mix flour, Pudla mix flour, Moong bhajiya mix flour, Chorafali mix flour, Bhajiya mix flour, Dhokla mix flour, Idli mix flour and Dosa mix flour are classifiable under sub- heading 11061000 of the First Schedule to the Customs Tariff Act, 1975(51 of 1975). They appear at Entry No.59 of Schedule-I of Notification No.01/2017-Central Tax (Rate) dated 28.06.2017 and the GST liability on all these products is 5%(2.5% CGST + 2.5% SGST).

7.1 The applicant submits that uniformity needs to be maintained in applicabilty of rate of tax in respect of identical products in accordance with fundamental right of equality as enshrined under Article 14 of the Constitution of India. Reference may be made in this regard to the following judgements of Hon. Supreme Court:

(a) Ayurveda Pharmacy v/s State of Tamil Nadu (1989) 2 SCC 285;

(b) State of Uttar Pradesh v/s Deepak Fertilizers & Petrochemical Corporation Ltd. (2007) 10 SCC 342.

7.2 The applicant clarifies that they are aware of the technical criteria for flour to be classifiable under heading 1101/1102 as contained in General Chapter Note 2(B) of the HSN. The applicant submits that the flour mixes containing rice/wheat flour fulfill such criteria. Presuming for the sake of argument that the criteria is not fulfilled, even then such flour mix will be classifiable under the following entry:

| S.No. | Chapter / Heading /Sub-heading / Tariff item | Description of Goods | Rate of tax |

| 103A. | 2302 | Bran, sharps and other residues, whether or not in the form of pellets, derived from the sifting, milling or other working of cereals or of leguminous plants [other than aquatic feed including shrimp feed and prawn feed, poultry feed and cattle feed, including grass, hay and straw, supplement and husk of pulses, concentrates and additives, wheat bran and de-oiled cake]”; | 2.5% CGST + 2.5% SGST |

The applicant states that they are squarely supported in their submission by the advance ruling rendered in the case of Talod Gruh Udyog (supra) wherein it was held that flour mixes made of cereals which did not satisfy the technical requirement of the general chapter notes are classifiable under heading 2302 for which again the applicable rate of tax is 2.5% CGST + 2.5% SGST.

8. In so far as the second question raised by the applicant is concerned, while chutney powder is made of amchur powder, iodized salt, chilli powder, coriander powder, crushed sugar and citric acid and the same is supplied along with instant gota mix flour, kadhi chutney powder is made of White chilli powder, mustard seed, turmeric powder, fresh curry leaves, crushed sugar, iodised salt, hydrogenated vegetable oil and compounded asafoetida and the same is supplied along with methi gota instant flour mix.

8.1 It is submitted that in case of two or more goods being supplied together for a single price, the determination of rate of tax is required to be done as per Section 8 of the GST Acts which reads as under:

“8. The tax liability on a composite or a mixed supply shall be determined in the following manner, namely:-

(a) a composite supply comprising two or more supplies, one of which is a principal supply, shall be treated as a supply of such principal supply; and

(b) a mixed supply comprising two or more supplies shall be treated as a supply of that particular supply which attracts the highest rate of tax.”

8.2 For the purpose of deciding which of the two clauses of Section 8 will get attracted, definitions of “composite supply” and “mixed supply” need to be analyzed which read as under:

“2(30) “composite supply” means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply;

Illustration.- Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply;

2(74) “mixed supply” means two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply.

Illustration.- A supply of a package consisting of canned foods, sweets, chocolates, cakes, dry fruits, aerated drinks and fruit juices when supplied for a single price is a mixed supply. Each of these items can be supplied separately and is not dependent on any other. It shall not be a mixed supply if these items are supplied separately;”

8.3 Thus if two or more supplies are naturally bundled in the ordinary course of business then they are “composite supply”; otherwise they are “mixed supply”. In the instant case, the chutney powder/kadhi chutney powder is naturally bundled along with the gota flour mix. They are meant for consumption together in ordinary course. Therefore, this supply being composite supply, the classification would be in the heading for the principal supply i.e. flour under heading 1106.

8.4 Alternatively, presuming for the sake of argument that the supply of gota/methi gota instant flour mix with chutney powder is “mixed supply” and not “composite supply”, the classification of chutney powder is under Entry 100A of Schedule I to the rate notification which reads as under:

| S.No. | Chapter /Heading /Sub-heading /Tariff item | Description of Goods | Rate of tax |

| 100A | 2106 | Roasted gram, idli/dosa batter, chutney powder | 2.5% CGST + 2.5% SGST |

8.5 Thus the applicable rate of tax for chutney powder being 5% and the rate of tax for gota/methi gota flour mix also being 5% under heading 1106 as submitted herein before, even if supply of instant gota/methi gota flour mix along with chutney powder/kadhi chutney powder is considered to be a “mixed supply”, even then the highest applicable rate of tax being 5% the supply will be taxable at that rate.

8.6 The applicant states that they are again supported in their submission by the advance ruling rendered in the case of Talod Gruh Udyog (supra) wherein it was held and observed as under:

“So, in view of Section 8(a) above, it can be seen that a mixed supply comprising of two or more supplies, shall be treated as a supply of that particular supply which attracts the highest rate of tax. However, in the instant case, we find that the rate of tax of all the three products i.e. Gota mix, Bhajiya mix and Chutney powder is the same i.e. 5% GST (2.5% CGST + 2.5% SGST), that a single price is being charged by the applicant for the ‘mixed supply’ of Gota Mix and Chutney powder or Bhajiya Mix and Chutney powder and no extra charge is collected for the Chutney powder. Hence, we conclude that the mixed supply of Gota Mix and Chutney powder will be considered as a supply of Gota Mix (falling under Sub-heading 11061000 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975)) on which the GST liability will be 5%(2.5% CGST + 2.5% SGST).”

9. In so far as the third question is concerned, a masala pack is inserted in the instant khaman mix flour which consists of 30% chana dal flour and 70% Sodium bicarbonate. The only reason why it is supplied in a separate packet and not mixed in the flour is because it enhances the quality of the khaman if added at the time of cooking. Such masala pack is part and parcel of the supply of instant mix khaman flour and the entire supply is taxable under heading 1106 at the rate of 2.5% CGST + 2.5% SGST for the reasons already given herein before. The applicant says that the sole fact that the same is supplied separately for enhancing quality of the preparation cannot make it a separate supply.

9.2 Alternatively, in any case, supply of instant khaman mix flour along with masala pack is a composite supply and therefore taxable at the applicable rate of tax for the principal supply i.e. khaman mix flour. The masala pack is a mixture of chana dal flour along with sodium bicarbonate. It can only be used for making the khaman. The masala pack is therefore naturally bundled in the ordinary course of business along with supply of khaman and therefore in any case the composite supply is taxable at the rate of 2.5% CGST + 2.5% SGST.

10. The applicant vide their additional submission dated 28-6-21 submitted that Instant mix flour of idli/dhosa manufactured by Ramdev Food Products pvt.ltd. is nothing but idli/dhosa batter for the simple reason that a batter is a flour from which idli/dhosa is prepared; that similarly instant mix flour products of idli/dhosa is a flour from which idli/dhosa is prepared; that as there is no specific entry for idli/dhosa batter along with roasted gram and chutney powder, which means that all basic flours or mixtures for preparation of idli/dhosa falls under this entry and should be classified under tariff heading no.2106 with GST @5%.

10.1 The applicant has further submitted that as per Circular No.80/54/2018-GST dated 31.12.2018 issued by CBIC, Chhatua or Sattu is a mixture of flour of ground pulses and cereals; that HSN code 1106 includes the flour, meal and powder made from peas, beans or lentils (dried leguminous vegetable falling under 0713); that such flour improved by the addition of very small amounts of additives continues to be classified under HSN code 1106, if unbranded it attracts NIL GST(S.No.78 of notification No.2/2017-Central Tax(Rate) dated 28-6-17 and if branded and packed it attracts 5% GST (S.No.59 of Schedule I of Notification No.1/2017-Central Tax(Rate) dated 28-617; that the above clarification was not accepted by Gujarat Appellate Authority for Advance Ruling in the matter of Talod Gruh Udyog vide their Order No.GAAAR/AR-2020/F-17/8-89/91 dated 25-5-21 on the premise that CBIC has clarified in the aforesaid circular that the flour of ground pulses and cereals improved by the addition of very small amounts of additives only are covered under HSN 1106 but as the products of the applicant in that case contained spices and other ingredients, the said clarification was not applicable; that they would like to submit that in the alternative, the instant mix flour of idli/dhosa manufactured and sold by the applicant is nothing but mixture of flours and added by very small amount of additives and no spices are added to it and therefore the circular in sattu is directly applicable to these products and so in that manner these products should be distinguished from GAAAR order where the circular was not followed on the ground of addition of spices which is absent in these products; that similarly mix flour of khaman, dalwada and dhokla is simply a mixture of flour with few additives and therefore qualify for classification under HSN 1106; that inspite of decision of GAAAR in Talod Gruh Udyog, items viz. Idli, Dhosa, Khaman, Dahiwada and Dhokla which are mixture of flours with addition of very small amounts of additives gets covered under HSN 1106 and if goods are branded, it is to be charged @5%.

11. The applicant vide their additional submission dated 2-7-21 stated that the details of percentage of the ingredients of their products given in Annexure-B is correct. However, they have re-arranged the same in a more logical way in Annexure-B(revised), hence Annexure-B submitted earlier stands revised.

B. Question on which Advance Ruling sought:

(a) What is the applicable rate of tax under the GST Acts on supply of instant mix flours for gota, khaman, dalwada, dahiwada, idli, dhokla, dhosa, pizza, methi gota and handvo?

(b) What is the applicable rate of tax under the GST Acts on supply of instant mix flour for gota/methi gota along with chutney powder/kadhi chutney powder?

(c) What is the applicable rate of tax under the GST Acts on supply of khaman along with masala pack?

Personal hearing

12. Shri Manan Shah, C.A. and Shri Hardik Bhatt, Manager appeared on 306-21and reiterated the contents of the application.

FINDINGS

13. At the outset we would like to make it clear that the provisions of CGST Act, 2017 and GGST Act, 2017 are in parimateria and have the same provisions in like matter and differ from each other only on a few specific provisions. Therefore, unless a mention is particularly made to such dissimilar provisions, a reference to the CGST Act would also mean reference to the corresponding similar provisions in the GGST Act.

14. We have carefully considered all the submissions made by the applicant.

15. We hold that Classification of goods under GST is based on HSN. The customs Tariff is based on HSN. The general Interpretative Rules are to be sequentially followed as the way to classify the goods. We are to classify within the confines of law and procedure as laid down in GST regime. The Section notes and chapter notes of Custom Tariff are part and parcel of the Custom Tariff Act, 1975 which is to say, part and parcel of law enacted by the Parliament and therefore, we are obliged in GST regime to follow the classification based on HSN as per law. The Explanatory notes to HSN have guidance value to classify goods. The contention of the applicant to take into account Vat Determination order and the case laws cited by the applicant pertaining to VAT regime does not hold ground in wake of GST classification based on Harmonised System of Nomenclature ( HSN) and the Rules framed for classification, which was not the case with the Schedule-I of the Gujarat Value Added Tax Act, 2003. The applicant is manufacturing and supplying Instant mix flours of Khaman, Gota , Dalwada , Dahiwada, Dhokla, Idli, Dosa, Pizza, Methi Gota and Handvo. We are to classify goods based on HSN.

16. The applicant submits that Instant mix flours of Khaman, Gota , Dalwada , Dahiwada and Methi Gota merit classification under HSN 1106. Chapter Heading 11.06 covers “Flour, Meal and Powder of the dried leguminous vegetables of Heading 0713, of sago or of roots or tubers of Heading 0714 or of the products of Chapter 8”.

Chapter Heading 1106 as per Customs Tariff:

1106 FLOUR, MEAL AND POWDER OF THE DRIED LEGUMINOUS VEGETABLES OF HEADING 0713, OF SAGO OR OF ROOTS OR TUBERS OF HEADING 0714 OR OF THE PRODUCTS OF CHAPTER 8:

1106 10 00- Of the dried leguminous vegetables of heading 0713

1106 20- Of sago or of roots or tubers of heading 0714:

1106 20 10— Of sago

1106 20 20 — Of manioc (cassava)

1106 20 90— Of other roots and tubers

1106 30 – Of the products of Chapter 8:

1106 30 10— Of tamarind

1106 30 20— Of singoda

1106 30 30— Mango flour

1106 30 90— Other

(A) Flour, meal and powder of the dried leguminous vegetables of heading 0713:

As per Rule 1 of the General Rules for the Interpretation of CTA, 1975, for legal purposes, classification shall be determined according to the terms of the headings and any relative Section of Chapter Notes. Thus, the classification of the product is required to be determined in accordance with the terms of the headings. As per Chapter Heading11.06, it covers Flour, Meal and Powder of the dried leguminous vegetables of Chapter Heading 07.13 and other specified products. On inspection of the Packets of each product, we find that each of the packet is marked ‘ Instant Mix’. On examination of the list of ingredients we find that Spices and additives apart from flour of dried leguminous vegetables, rice and wheat are contained in different proportions. The Spices and additives contained in these products include Sugar, Iodised Salt, Red Chili Powder, Garam Masala, Black Pepper, Coriander, Ajwain , Fennel, Raising agent(Sodium bicarbonate INS 500(ii)), Acidity Regulator (INS 330) means Citric Acid etc. The proportion of Spices and additives contained in these products ranges from 5% to 33.4%. The proportion of Spices and additives is 11% in Khaman Flour, 33.4% in Gota Flour, 8% in Dalwada Flour, 6.5% in Dahiwada Flour, 29.25% in Methi Gota Flour. As the products of the applicant contain Spices and additives in different proportions, which are not mentioned in the Chapter Heading 11.06 or the relevant Explanatory Notes of HSN. The applicant has referred to CBIC Circular No. 80/54/2018-GST dated 31.12.2018, which has inter-alia clarified the applicability of GST on ‘Chhatua or Sattu’. The CBIC has clarified in the aforesaid Circular that the flour of ground pulses and cereals, improved by the addition of very small amounts of additives continues to be classified under HSN Code 1106. On examination of the percentage breakup of the subject products and the composition of the products, we find that this is not the case of addition of very small amounts of additives in subject products. We hold that the subject Circular is not applicable in present case as the said products are different from Sattu and have spices and additives in varying proportions as cited by the applicant and are in the nature of instant mix. Therefore, as per our findings, we are not inclined to admit CTH 1106 for said products

17. The applicant submits that Instant mix of Idli, Dhokla, Dhosa and Handvo merit classification under HSN 1102 whereas Pizza Instant mix merits classification under HSN 1101. Chapter Heading 1102 covers “Cereal Flours other than that of wheat or meslin” whereas Chapter Heading 1101 covers ‘Wheat or meslin flour’.

1101 00 00 WHEAT OR MESLIN FLOUR

1102 CEREAL FLOURS OTHER THAN THAT OF WHEAT OR MESLIN

1102 20 00 — Maize (corn) flour 1102 90 – Other :

1102 90 10 – – – Rye flour

1102 90 90 – – – Other

Explanatory notes to HSN in respect of Headings 1101 and 1102 read as under:

11.01 Wheat or meslin flour.

This heading covers wheat or meslin flour (i.e. the pulverised products obtained by milling the cereals of heading 10.01) which fulfil the requirements as to starch content and ash content set out in paragraph (A) of Chapter Note 2(see General Explanatory Note) and comply with the criterion of passage through a standard sieve as required by paragraph (B) of that Note. Flours of this heading may be improved by the addition of very small quantities of mineral phosphates, anti-oxidants, emulsifiers, vitamins or prepared baking powders (self raising flour). Wheat flour may be further enriched by an addition of gluten, generally not exceeding 10%. The heading also covers ‘swelling’ (pregelatinised) flours which have been heat treated to pregelatinise the starch. They are used for making preparations of heading 19.01, bakery improvers or animal feeds or in certain industries such as the textile or paper industries or in metallurgy (for the preparation of foundry core binders). Flours which have been further processed or had other substances added with a view to their use as food preparations are excluded (generally heading 19.01). This heading also excludes flours mixed with cocoa (heading 18.06 if they contain 40% or more by weight of cocoa calculated on a totally defatted basis, or heading 19.01, if less)

11.02 Cereal flours other than of wheat or meslin.

This heading covers flours (i.e. the pulverised products obtained by milling the cereals of chapter 10) other than flours of wheat or meslin. Products of the milling of rye, barley, oats, maize (corn) (including whole cobs ground with or without their husks) grain sorghum, rice or buckwheat are classified in this heading as flours if they fulfil the requirements as to starch content and ash content set out in paragraph (A) of Chapter Note 2(see General Explanatory Note) and comply with the criterion of passage through a standard sieve as required by paragraph (B) of that Note. Flours of this heading may be improved by the addition of very small quantities of mineral phosphates, anti-oxidants, emulsifiers, vitamins or prepared baking powders (self raising flour). The heading also covers ‘swelling’ (pregelatinised) flours which have been heattreated to pregelatinise the starch. They are used for making preparations of heading 19.01, bakery improvers or animal feeds or in certain industries such as the textile or paper industries or in metallurgy( for the preparation of foundry core binders). Flours which have been further processed or had other substances added with a view to their use as food preparations are excluded (generally heading 19.01). This heading also excludes flours mixed with cocoa (heading 18.06 if they contain 40% or more by weight of cocoa calculated on a totally defatted basis, or heading 19.01, if less).

18. In respect of Chapter Heading 1101 and 1102, it has been inter-alia mentioned in the Explanatory Notes of HSN that “Flours of this heading may be improved by the addition of very small quantities of mineral phosphates, antioxidants, emulsifiers, vitamins or prepared baking powders (self-raising flour)”; that “Flours which have been further processed or had other substances added with a view to their use as food preparations are excluded(generally heading 19.01).Thus, the Flours may remain classified in Chapter Heading 1101 or 1102 if the flour has been improved by the addition of very small quantities of specified substances. However, if other substances (other than specified substances) are added to the flours with a view to use as ‘food preparations’, then the same gets excluded from the Chapter Heading 1101 or 1102.

19. The various products being supplied by the applicant contain Spices and additives apart from flour of dried leguminous vegetables, rice and wheat, in different proportions. The Spices and additives contained in these products include Sugar, Iodised Salt, Chili Powder, Turmeric powder, Sodium Bicarbonate, Citric Acid, Hydrogenated Vegetable Oil, Citric Acid etc. These Spices and additives are other than those substances mentioned in the Explanatory Notes of HSN for Chapter Heading 11.01 and 11.02 which could be added in very small quantities to improve or enrich the flours and the resultant product still remain classified in those Chapter Headings. The proportion of Spices and other additives contained in these products ranges from 5.5% to 29.25%. The proportion of Spices and other additives is 7% in Idli Instant mix flour, 12.5% in Dhokla Instant mix flour, 5.5% in Dhosa Instant mix flour, 21% in Handvo Instant mix flourand 24.50% in Pizza Instant mix flour. It is also evident from the recipe submitted by the applicant that the Spices and additives have been added to the flours with a view to their use as food preparations. As such, in view of the Explanatory Notes of the HSN, these products are excluded from the Chapter Heading 1101 and 1102.

20. The applicant has also contended that their Instant mix flours of Idli and Dhosa are nothing but idli/dhosa batter for the simple reason that batter is a flour from which idli/dhosa is prepared; that there is a specific entry for idli/dhosa batter along with roasted gram and chutney powder and is classifiable under heading no.2106 with GST @5%. In this regard, we find that entry referred to by the applicant appears at Entry No.100A of Schedule-I of Notification No.1/2017-Central Tax(Rate) dated 28-6-17 on which GST rate is 5% and reads as under:

| S.No. | Chapter/Heading/ Subheading / Tariff item | Description of goods |

| 100A | 2106 | Roasted gram, idli/dosa batter, chutney powder |

In this regard, we find that the idli mix or dhosa mix are completely different from idli/dhosa batters. Idli/Dhosa batters are in semi- liquid form which can be directly poured on to the frying pans for preparation of idlis and dhosas. The difference between idli/dhosa instant mixes and idli/dhosa batters can be very clearly understood from the images of idli/dhosa batters obtained from the internet as shown below:

On the basis of the above facts, we conclude that Instant mix of idli/dhosa are not idli/dhosa batters and therefore does not get covered under the aforementioned entry.

21. The applicant has also stated that as an alternative, the instant mix of idli, dhosa, khaman, dahiwada and dhokla are nothing but mixture of floors by very small amount of additives and no spices are added to it, therefore the circular in ‘sattu’ was directly applicable to these products and should be distinguished from GAAAR order where the circular was not followed on ground of addition of spices. We note para-13.5 of the cited order of the Appellate Authority in the case of M/s. Dipakkumar Kantilal Chatoi (Talod food) with regard to the issue, reproduced as follows: ‘The CBIC has clarified in the aforesaid Circular that the flour of ground pulses and cereals, improved by the addition of very small amounts of additives continues to be classified under HSN Code 1106. However, the said clarification is not applicable in the present case as the products being supplied by the applicant contain Spices and other ingredients, which is not the case with the ‘Chhatua or Sattu’.’

22. We note that HSN 2106 covers Food Preparations not elsewhere specified or included. The Explanatory Notes of HSN for Chapter Heading 2106 provides as follows :-

“Provided that they are not covered by any other heading of the Nomenclature, this heading covers :

A) Preparations for use, either directly or after processing (such as cooking, dissolvingor boiling in water, milk, etc.), for human consumption.

B) Preparations consisting wholly or partly of foodstuffs, used in the making of beverages or food preparations for human consumption. The heading includes preparations consisting of mixtures of chemicals (organic acids, calcium salts, etc.) with foodstuffs (flour, sugar, milk powder, etc.), for incorporation in food preparations either as ingredients or to improve some of their characteristics(appearance, keeping qualities, etc.) (see the General Explanatory Note to Chapter 38).

…….”

23. The subject 10 products of Mix Flour/ Instant Mix Flour are preparations for use, after processing, such as cooking, carrying out the detailed procedure for cooking as mentioned on the packets of all the said products, then ready for human consumption. The applicant submitted that the products are not ‘in ready to consume form’ but needs to be subjected to further processing and cooking for conversion into ‘ready to eat food’. We find that Chapter Heading 2106 is not confined to processed or semi processed food, cooked or semi cooked food, preserved food and ready to eat food. In fact, a food preparation which is not elsewhere specified in the HSN, gets covered under HSN 2106. On the packets of all the above products-Category: Instant Mix has been printed on the packets and the detailed procedure recipe is printed on back side of the packets. We find no merit to treat the subject goods as flour. As these products are not specifically mentioned under any specific Tariff item, the products merit classification under the residual entry “other” at HSN 210690. We are of the view that the 10 products of Mix Flour/ Instant Mix Flour are appropriately classifiable under HSN 2106.

24. We note that Central excise Tariff 2106 is also based on HSN. We find that our stand is in compliance and consonance with the case law Commissioner of Central Excise, Ahmedabad Vs. R.M. Foods [2010 (249) E.L.T. 363 (Tri. – Ahmd.), wherein Hon’ble CESTAT held that the products (Gota Mix, Khaman Mix, Dal Wada Mix etc.) were entitled to benefit of Sl. No. 28 of Notification No. 3/2006-Central Excise. The said Sl. No. 28 of Notification No. 3/2006-Central Excise reads as follows –

| S.No. | Chapter or heading or sub-heading or tariff item of the First Schedule | Description of excisable goods | Rate | Condition No. |

| 28 | 2106 | Texturised Vegetable Proteins (Soya bari), and instant food mixes such as Pongal mix, Vadai mix, Pacoda mix, Payasam mix, Gulab jamun mix, RavaDosa mix, Idli mix, dosai mix, Murruku mix, and Kesari mix. | 8% | – |

25. Though the issue involved in that case was regarding admissibility of Sl. No. 28 of Notification No. 3/2006-Central Excise to the Instant Food Mixes (Gota Mix, Khaman Mix, Dal Wada Mix etc.), the fact that in the said Sl. No. 28, the description of goods mentioned against Chapter Heading 2106 included Instant Food Mixes such as Pongal mix, Vadai mix, Pacoda mix, Payasam mix, Gulab Jamun mix, Rava Dosa mix, Idli mix, Dosa mix, Murruku mix, and Kesari mix, supports our view that various Instant Food Mixes (Instant Mix / Ready Mix Flour) being supplied by the applicant are classifiable under HSN 2106.

APPLICABLE RATE OF GOODS AND SERVICES TAX

26. The various Instant Mix/Ready Mix Flour being supplied by the applicant classifiable under HSN 2106 and in precise subheading 2106 90.

26.1 Notification No. 1/2017-Central Tax (Rate) dated 28-6-17, as amended, entry at Sr. No. 23 of Schedule – III reads as follows –

| S.No. | Chapter/ Heading/ heading/ item Sub-Tariff | Description of Goods |

| 23. | 2106 | Food preparations not elsewhere specified or included [other than roasted gram, sweetmeats, batters including idli/dosa batter, namkeens, bhujia, mixture, chabena and similar edible preparations in ready for consumption form, khakhra, chutney powder, diabetic foods] |

26.2 Thus, ‘Food preparations not elsewhere specified or included’ falling under Chapter Heading 2106 are covered under the aforesaid Entry at Sr. No. 23 of Schedule- III of Notification No. 1/2017-Central Tax, as amended, attracting Goods and Services Tax @ 18% (CGST 9% + SGST 9%), though some of the specific products of Chapter Heading 2106 excluded from this entry are covered under different entries of Schedule-I or Schedule-II, attracting Goods and Services Tax @ 5% or 12%. None of the aforesaid 10 products of various Instant Mix / Ready Mix Flour being supplied by the applicant are the products which have been excluded from the entry at aforesaid Sr. No. 23 of Schedule – III or which have been specifically included in any other entry of other Schedule of Notification No. 1/2017-Central Tax, as amended or in any of the entries of Notification No. 2/2017-Central Tax.

27. Further, the applicant has requested to consider the ruling of the Gujarat Advance Ruling Authority issued vide its Order No. GUJ/GAAR/R/43/2020 dated 30-7-20 in the case of Dipakkumar Kantilal Chotai (Talod Gruh Udhyog). In this regard, it is pertinent to mention that the said Ruling is not applicable in the applicant’s case because as per Section 103 of the CGST Act, any Advance Ruling is binding on the Applicant who has sought it and on the concerned officer or the jurisdictional officer in respect of the Applicant. Also it is on record that the said Advance Ruling dated 30-7-20 has been appealed before the Appellate Authority for Advance Ruling vide Application number Advance/SGST & CGST/2020/AR/17 and decided by the Gujarat Appellate Authority for Advance Ruling vide Order GUJ/GAAR/APPEAL/2021/17 dated 21-5-21accordingly, AAR Ruling dated 30-7-20 as cited above, cannot be relied upon in the present case of the Applicant.

28. We now discuss the applicable rate of tax on supply of instant mix flour gota/methi gota along with chutney powder/kadhi chutney powder and also the applicable rate on supply of Khaman instant mix flour with masala pack. The applicant states that while chutney powder is made of amchur powder, iodized salt, chilli powder, coriander powder, crushed sugar and citric acid and the same is supplied along with instant gota mix flour, kadhi chutney powder is made of White chilli powder, mustard seed, turmeric powder, fresh curry leaves, crushed sugar, iodised salt, hydrogenated vegetable oil and compounded asafoetida and the same is supplied along with methi gota instant flour mix. In case of Khaman mix flour, applicant submits that masala pack is to enhance the quality of the khaman.

28.1 In the case of supply of two or more goods together for a single price, the determination of rate of tax is required to be done as per Section 8 of the GST Acts which reads as under:

“8. The tax liability on a composite or a mixed supply shall be determined in the following manner, namely:-

(a) a composite supply comprising two or more supplies, one of which is a principal supply, shall be treated as a supply of such principal supply; and

(b) a mixed supply comprising two or more supplies shall be treated as a supply of that particular supply which attracts the highest rate of tax.”

28.2 “composite supply” and “mixed supply” are as follows:

“2(30) “composite supply” means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply;

Illustration.- Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply;

2(74) “mixed supply” means two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply.

Illustration.- A supply of a package consisting of canned foods, sweets, chocolates, cakes, dry fruits, aerated drinks and fruit juices when supplied for a single price is a mixed supply. Each of these items can be supplied separately and is not dependent on any other. It shall not be a mixed supply if these items are supplied separately;”

28.3 We hold that gotas/methi gotas and chutney powder/kadhi chutney powder supply is not naturally bundled and the supply is for a single price. Also the supply of Khaman instant mix flour with masala pack is not naturally bundled and the supply is for a single price. These supplies fall under mixed supply. As per law, a mixed supply comprising two or more supplies shall be treated as a supply of that particular supply which attracts the highest rate of tax. Thus, these mixed supply shall be treated as a supply of Instant Gota Mix OR Instant Methi Gota Mix or instant Khaman mix flour in said matter.

29. In Conspectus of above findings, we issue the Ruling:

RULING

(1) The subject 10 goods merit classification at HSN. 2106 90 attracting 18% GST (9% CGST + 9% SGST) as per Sl. No. 23 of Schedule-III to the Notification No.01/2017-Central Tax (Rate) dated 28-6-17.

(2) The mixed supply of Instant mix flour of Gota/Methi Gota with Chutney powder/Kadi Chutney powder shall be treated as supply of Instant Gota Mix Flour/Instant Methi Gota Mix Flour respectively (falling under HSN 2106 90) on which the GST liability will be 18%(9% CGST + 9% SGST).

(3) The mixed supply of Instant mix flour of Khaman and masala pack shall be treated as supply of Instant Mix Flour of Khaman (falling under HSN 2106 90) on which the GST liability will be 18% (9% CGST + 9% SGST).