The Deputy Conservator Of Forests, Bangalore Urban Division vs. N/A

(AAAR (Appellate Authority For Advance Ruling), Karnataka)

PROCEEDINGS

(Under Section 101 of the CGST Act, 2017 and the KGST Act, 2017)

1. At the outset we would like to make it clear that the provisions of CGST, Act 2017 and SGST, Act 2017 are in pari materia and have the same provisions in like matter and differ from each other only on a few specific provisions. Therefore, unless a mention is particularly made to such dissimilar provisions, a reference to the CGST Act would also mean reference to the corresponding similar provisions in the KGST Act.

2. The present appeal has been filed under section 100 of the Central Goods and Service Tax Act 2017 and Karnataka Goods and Service Tax Act 2017 (herein after referred to as CGST Act, 2017 and SGST Act, 2017) by The Deputy Conservator of Forests, Bangalore Urban Division, Department of Forest, Government of Karnataka, Aranya Bhavan, 18th Cross, Malleshwaram, Bangalore 560003 (herein after referred to as Appellant) against the advance Ruling No. KAR/ADRG 20/2019 dated 26-08-2019.

Brief Facts of the case:

3. The Appellant is a Government Department (Karnataka forest Department) and under its sovereign functions, raises “plants” of tree species, plants them in forest, waste and common lands. Over time, with the nurturing and management of the Department, these plants grow up to become trees when they are harvested to yield timber, poles, billets, firewood, pulpwood, etc which are raw material for carpentry, fuel and fibre industries.

4. The task of harvesting these trees which grew from plants planted by the Department is given to Government Corporations. The Corporations fell the trees, convert them into timber, firewood, poles, etc so that they become marketable for the primary market, load and transport the marketable timber, firewood, etc by vehicles, unload and stack the marketable timber, firewood, etc in government timber depots. All these operations done by the Corporation is termed as “logging” for which charges are paid by the Appellant to the Corporations. The Appellant submitted an application dated 02.03.2018 seeking advance ruling on the following issues: -

Issue No. 1

“(A) Is it legally correct to infer that the entire service of “logging” and its components described before do not attract GST under the CGST Act, 2017? If not, what is the correct position by law?

(B) In case the trees have grown from “plants” not planted by the Karnataka Forest Department, but that which grew by natural regeneration but were nurtured, managed and protected by the Karnataka Forest Department, does the same nil rate of SGST and CGST apply to them too? If not, what would be the rate?”.

Issue No. 2

“(a) In case of sale of forest produce or any other goods belonging to Karnataka Forest Department, where the buyer is registered or is based in and transports the goods to outside the State of Karnataka, what should be charged under the CGST Act 2017, (A) SGST and CGST or (B) IGST?

(b) In case of forest produce or any other goods belonging to Karnataka Forest Department, where the buyer is registered or is based outside the State of Karnataka, but uses the goods within the State of Karnataka, what should be charged under the CGST Act 2017, (A) SGST and CGST, or (B) IGST?.”

5. The Advance Ruling Authority passed Advance Ruling order No. KAR ADRG 20/2019 dated 26.08.2019, wherein they ruled as follows: -

“1. The operation of “logging” as described in Issue 1 of the application would attract tax under the Goods and Services Tax Acts and it is independent of the trees, whether planted by the Forest Department or which grew out of natural regeneration.

2. The transaction described in the application in Issue No. 2, is an intra-State supply and attracts CGST and SGST and is independent of where the goods are taken by the recipient after the supply is completed.”

6. The Appellant is aggrieved by the ruling given in respect of logging activities and has filed this appeal on the following grounds.

6.1 Logging operations amounts to forestry and the same attracts nil rate of tax against entry Sl.no. 24 of Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017 as amended which pertains to support services to agriculture, forestry, fishing, animal husbandry falling under heading 9986. As per explanation (iii) to the said entry, support services to forestry means

‘(iii) Carrying out an intermediate production process as job work in relation to cultivation of plants and rearing of all life forms of animals, except the rearing of horses, for food, fibre, fuel, raw material or other similar products or agricultural produce’

Therefore, the finding of the Advance Ruling Authority in para 5.8 of impugned Ruling to the effect that activity of logging is not support service to forestry and hence, is not covered under entry No. 24 of Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017 is not correct/rational and the same is not in harmony with the wordings of the Notification.

6.2. Further, the Hon’ble Advance Ruling Authority have made finding to the effect that such logging service received by the Appellant Applicant is of the nature of composite supply and the principal supply is covered under Sub entry (ii) of Entry No. 26 of the Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017 and therefore, the same is taxable under CGST at 9% and SGST at 9% and similarly, the same is taxable at 18% towards IGST, as is applicable. The findings of the Hon’ble Advance Ruling Authority is not correct for the reason that Entry No. 26 in the Notification No. 11/2017-CentraI Tax (Rate) dated 28.06.2017 relates to activities not specifically covered by entry 24 above. Entry 26 is reproduced below for immediate appreciation:

| 26 |

Heading 9988 (Manufacturing services on physical inputs (goods) owned by others)

|

(i) Services by way of job work in relation to- (a) Printing of newspapers; (b) Textile yams (other than of man-made fibres) and textile fabrics; (c) Cut and polished diamonds; precious and semi-precious stones; or plain and studded jewellery of gold and other precious metals, falling under Chapter 71 in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975); (d) Printing of books (including Braille books), journals and periodicals; (e) Processing of hides, skins and leather falling under Chapter 41 in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975). Explanation.- “man made fibres” means staple fibres and filaments of organic polymers produced by manufacturing processes either,- (a) by polymerisation of organic monomers to produce polymers such as polyamides, polyesters, polyolefins or polyurethanes, or by chemical modification of polymers produced by this process [for example, poly (vinyl alcohol) prepared by the hydrolysis of poly (vinyl acetate)]; or (b) by dissolution or chemical treatment of natural organic polymers (for example, cellulose) to produce polymers such as cuprammonium rayon (cupro) or viscose rayon, or by chemical modification of natural organic polymers (for example, cellulose, casein and other proteins; or alginic acid), to produce polymers such as cellulose acetate or alginates. |

2.5 |

- |

| (ii) Manufacturing services on physical inputs (goods) owned by others, other than (i) above. |

9 |

- |

6.3. The impugned Ruling of the Advance Ruling Authority holds that logging operations is covered under entry 26(iv) and therefore, liable to tax at 9% each as CGST and SGST. The Appellant makes it clear that there is entry s.no.24 which covers logging operations, and the same occurs first in the order of the Notification and therefore, the same is to be preferred. Furthermore, “manufacture’ has a distinct understanding in law. Logging operations doesn’t amount to ‘manufacture’. The logging operation does not result in change in basic features/ characteristics of the product/goods to mean it as manufacturing. Therefore, findings of the learned Advance Ruling Authority is not proper and the same is not in accordance with law. Therefore, the impugned ruling in so far as it relates to logging operations is liable to set aside as not sustainable and not lawful.

6.4 The Hon’ble Advance Ruling Authority has not offered an opportunity to the Appellant applicant to defend themselves with written submissions against the proposed ruling holding logging operations to be manufacturing service attracting CGST of 9% and SGST of 9% OR IGST of 18% against entry no. 26 vide Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017. The Advance Ruling Authority ought to have given an opportunity to the Appellant Applicant to defend himself against proposed adverse conclusion affecting the Appellant Applicant. Having not heard the Appellant applicant, it is violation of the principles of natural justice because of which the impugned ruling is liable to be set aside in so far as it relates to logging operations.

6.5 Manufacturing is an activity which brings out a new product with different nomenclature, usage, identity in the market. However, the operation of logging is only an activity of segregating timbers, poles, firewood, pulp etc., from tree. This activity is said to be harvesting activity of forest. Therefore, these activities does not result in emergence of new product to amount to ‘manufacture’. Thus, it is evidently clear that there is no manufacturing and the same is a misconception by the respected Advance Ruling Authority. Resultantly, the said ruling to the extent it relates to this aspect is liable to be set aside as not sustainable in facts of the case and in law.

6.6 The Appellant strongly submits that their logging operations is covered by entry no. 24 falling under heading 9986 attracting nil rate of tax as the same pertains to support services provided to agricultural, forestry, fishing, animal husbandry wherein explanation (iii) provides that ‘support services to agriculture, forestry, fishing, animal husbandry’ means ‘carrying out intermediary production process as job work in relation to cultivation of plants and rearing of life forms of animals, except rearing horses, for food, fibre, fuel, raw material or other similar products or agricultural products’. Thus, the activity of logging of trees into timber, poles, firewood, pulp wood etc., is support services relating to forestry as is obvious from the heading caption of entry no. 24 to Notification No. 11/2017-CentraI Tax (Rate) dated 28.06.2017. Thus, there is no ambiguity as to logging operations being covered by entry No. 24 to the said Notification No. 11/2017-Centra1 Tax (Rate) dated 28.06.2017 attracting nil rate of tax.

PERSONAL HEARING: -

7. The appellant was called for a personal hearing on 31.01.2020. They had sought for an adjournment and the same was held on 24th February 2020. The appellants were represented by Shri. M Sidramappa, Deputy Conservator of Forests, Urban Division & Shri-Eswarappa G.B, Consultant, who reiterated that submissions made in the grounds of appeal They also submitted that the main activity is to manage the forest area which involves removal of fallen and dead wood and timber. This activity of forest management is commonly called ‘logging’ and is outsourced to contractors They contended that this activity of logging is to be considered as support services in the management of forests. They further submitted that periodically, a working plan is evolved for management of forests by the Department to achieve the general objectives of the management of forests; that the working plan is a detailed document of activities to be taken up by the Forest Department to conserve and develop forests. One of the important area of action towards this objective is to maintain the health and hygiene of the forests; that for achieving this, removal of debris which is lying in the form of dead and fallen wood and mature standing trees from forest areas is to be taken out on regular basis; to take this material out of the forest, trees need to be cut further to make it convenient for transportation to the forest Depot. This operation also creates favourable conditions on the ground for taking up regeneration activities. These activities are collectively and loosely termed as logging or extraction which is otherwise part of functions necessary for conserving and developing forest; that they are similar to the process of harvesting the agricultural corps. In addition, they submitted a copy of the working plan of Yellapura Forest Division and drew attention to the objectives of the forest management listed therein whereby it can be seen that timber /firewood are by products of the activity of forest management. They further submitted that all the functions of extraction of unwanted material from the forest to the place of storage is primary function of the department involving engaging labour/services through an entity only for the sake of functional convenience. Therefore, all these activities are essentially support services to the forestry sector. They also relied on the Handbook of Silviculture to buttress their case that “Forestry” is the true equivalent of ‘agriculture; that silviculture deals with the theory and practice of raising forest crops, their growth and care up to the time of harvesting. They also submitted that the activities enumerated in their application do not qualify as ‘manufacture’ as no raw material or input subjected to any processing is involved and there is no new product emerging with a distinct name, character and use. Therefore, the findings of the lower Authority to this extent are not correct.

7.1. During the personal hearing, it was pointed out by the Members that the appeal was filed beyond the period of 60 days from the date of receipt of the advance ruling. In this connection, the appellant confirmed that they received the ruling on 05.10.2019 as the same was diarised in the appellant’s office on 05.10.2019. It is consistently held by various judicial decisions that the day on which cause of action arises is to be excluded for computation of time limitation. In the instant case cause of action arose on 05.10.2019 and the same is to be excluded for computation of time. It means, time begins, in the instant case from 06.10.2019 and30 days normal time for preferring appeal ends on 04.11.2019. Further, grace period available for discretionary exercise of power by the Appellate Authority begins on 05.11.2019 and 30 days grace period in the instant case of the Appellant ends on 04.12.2019. The Appellant filed the appeal on 04.12.2019. Therefore, it is prayed that the Appellate authority may exercise its discretionary power, in the facts and circumstances of the case, to hold that the appeal submitted is within time and accordingly prayed for condonation of delay, as is provided by the Act,

7.2. The Appellant further submitted that the law applicable for time computation is as per Section 9 of the General Clauses Act, The said legal provision is well expounded by the Hon’ble Supreme Court in the case of M/s. Econ Antri Ltd Vs M/s. Rom Industries Ltd & another (2014) 11 SCC 769,decided on 26.08.2013 upholding the law to exclude the date on which cause of action. In this regard, they reproduced para 25 of the decision in the case of M/s. Econ Antri:

“25. Having considered the question of law involved in this case in proper perspective, in light of relevant judgments, we are of the opinion that Saketh lays down the correct proposition of law. We hold that for the purpose of calculating the period of one month, which is prescribed under Section 142(b) of the N.I. Act the period has to be reckoned by excluding the date on which the cause of action arose.”

In view of the above submissions, the Appellant most prayed that the Appellate Authority may exercise their discretionary powers and condone the delay in filing the appeal and dispose off the same on merits in the interest of justice.

DISCUSSION & FINDINGS: -

8. We have gone through the records of the case and taken into consideration the submissions made by the Appellant in their grounds of appeal and at the time of the personal hearing. We find that the appeal is on the limited point of whether the activity of “logging” done for the Forest Department is taxable under GST. Before getting into the discussion on this issue, we find that there appears to be a delay in filing the appeal. We will examine this issue first.

9. The appeal against Advance Ruling order No 20/2019 dated 26.08.2019 was received in the office of the Appellate Authority for Advance Ruling on 04.12.2019. In terms of Section 100 of the CGST Act, an appeal should be filed within 30 days from the date of communication of the advance ruling order that is sought to be challenged. However, the Appellate Authority is empowered to allow the appeal to be presented within a further period not exceeding 30 days if it is satisfied that the appellant was prevented by sufficient cause from presenting the appeal within the initial period of 30 days. In the Form ARA-02, the appellant has stated that the date of communication of the advance ruling order is 05.10.2019. Clearly the appeal has not been filed within the prescribed time period of thirty days from the date of communication of the order. The question arises whether the appeal filed on Dec 2019 is within the condonable period of another 30 days.

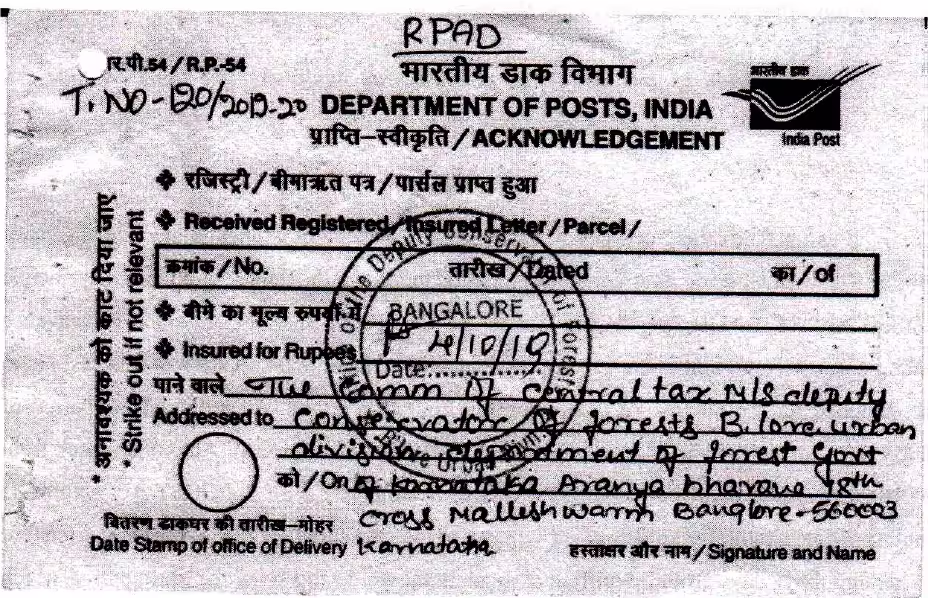

10. For this we need to establish when the Advance Ruling order No 20/2019 dated 26.08.2019 was communicated to the appellant. Section 169 of the CGST Act prescribes the modes of service of orders and registered post with acknowledgement due is one such mode of service. It is seen from the records available in the office of the Advance Ruling order No 20/2019 dated 26.08.2019 was communicated to the Deputy Conservator of Forests, Bangalore Urban by registered post with acknowledgement due and the same was received at Office of the Deputy Conservator of Forests, Bangalore Urban Division on 04-10-2019. A scanned copy of the acknowledgement of the Postal department as appended below:

The above acknowledgement indicates that the Advance Ruling order was sent to the Deputy Conservator of Forests, Bangalore Urban by RPAD and the same was received by the Office of the Deputy Conservator of Forests, Bangalore urban Division on 04-10-2019. Therefore, the submission made by the appellant that the advance ruling order was received and diarized in the appellant’s office on 05.10.2019 is not acceptable.

11. We however agreed with the appellant’s submission that the day on which the cause of action arises is to be excluded for computation of time limitation. The general rule in cases in which a period is fixed within which a person must act or take the consequences is that, the day of the act or event from which the period runs should not be counted against him. The law on this point has been stated by Halsbury in Halsbury’s Laws of England, Third Edition. Vol. 37 page 95. This general rule applies irrespective of whether the limitation of time is imposed by the act of a party or by statute. The same principle is enunciated in Section 9 of the General Clauses Act which reads as under:

“9. Commencement and termination of time:- (1) In any (Central Act) or regulation made after the commencement of this Act, it shall be sufficient, for the purpose of excluding the first in a series of days or any other period of time, to use the word “from and, for the purpose of including the last in a series of days or any other period of time, to use the word “to”.

(2) This section applies also to all (Central Act) made after the third day of January, 1968, and to all Regulations made on or after the fourteenth day of January, 1887.”

12. It can be seen that Section 9 of the General Clauses Act applies to any of the Central Act or Regulations made after commencement of the said Act. Hence, applying the principle of Section 9 of the General Clauses Act to the CGST Act, the day on which the advance ruling order is communicated/served on the appellant (which is 04.10.2019 in this case) is to be excluded for the purpose of computing the limitation period. Accordingly, the period of thirty days to file the appeal in terms of Section 100(2) of the CGST Act commences from 05.10.2019 and ends on 03.11.2019. Proviso to Section 100(2) of the CGST Act empowers the Appellate Authority to allow the appeal to be presented within a further period not exceeding thirty days provided sufficient cause is shown. In this case, the grace period which was available to the appellant for filing the appeal commenced on 04.11.2019 and ended on 03.12.2019. The appeal in this case, has been filed on 04.12.2019 which is one day after the expiry of the grace period and beyond the condonable powers of the Appellate Authority.

13. The question whether this Appellate Authority can entertain an appeal under Section 100 of the CGST Act beyond the condonable period does not require much debate and has been answered in the negative by the Supreme Court in the case of Singh Enterprises vs CCE reported in (2008) 3 SCC 70 The Supreme Court in the said case interpreted Section 35 of the Central Excise Act, 1944 which is similar to Section 100 of the CGST Act and examined the question whether the Commissioner (Appeals) has the power to condone the delay beyond the period of 30 days from the date of expiry of the period prescribed for filing the statutory appeal and also whether the High Court, in exercise of the power conferred under Article 226 of the Constitution of India, can condone the delay. The Hon’ble Supreme Court in Para 8 of its order held thus:

8. The Commissioner of Central Excise (Appeals) as also the Tribunal being creatures of Statute are vested with jurisdiction to condone the delay beyond the permissible period provided under the Statute. The period up to which the prayer for condonation can be accepted is statutorily provided. It was submitted that the logic of Section 5 of the Indian Limitation Act, 1963 (in short the Limitation Act) can be availed for condonation of delay. The first proviso to Section 35 makes the position clear that the appeal has to be preferred within three months from the date of communication to him of the decision or order. However, if the Commissioner is satisfied that the appellant was prevented by sufficient cause from presenting the appeal within the aforesaid period of 60 days, he can allow it to be presented within a further period of 30 days. In other words, this clearly shows that the appeal has to be filed within 60 days but in terms of the proviso further 30 days’ time can be granted by the appellate authority to entertain the appeal. The proviso to sub-section (1) of Section 35 makes the position crystal clear that the appellate authority has no power to allow the appeal to be presented beyond the period of 30 days. The language used makes the position clear that the legislature intended the appellate authority to entertain the appeal by condoning delay only up to 30 days after the expiry of 60 days which is the normal period for preferring appeal. Therefore, there is complete exclusion of Section 5 of the Limitation Act. The Commissioner and the High Court were therefore justified in holding that there was no power to condone the delay after the expiry of 30 days period.

14. Section 5 of the Limitation Act, 1963 gives an opportunity to a litigant to file applications beyond the prescribed period of limitation provided, he is able to establish that he was prevented by sufficient cause from approaching the Court within the said period. However, the Supreme Court in the case of Consolidated Engineering Enterprises vs Principal Secretary, Irrigation Department and Others - (2008) 7 SCC 169, while considering Section 34(3) of the Arbitration and Conciliation Act, 1996 observed that

“When any special statute prescribes certain period of limitation as well as provision for extension up to specified time limit, on sufficient cause being shown, then the period of limitation prescribed under the special law shall prevail, and to that extent the provisions of the Limitation Act shall stand excluded”

Further, in the case of Commissioner of Customs and Central Excise vs Hongo India (P) Ltd. (2009) 5 SCC 791, the Hon’ble Supreme Court considered the question whether Section 5 of the Limitation Act can be invoked for condonation of delay in filing an appeal or reference to the High Court and observed thus:

“As pointed out earlier, the language used in Sections 35, 35-B, 35-EE, 35-G and 35-H makes the position clear that an appeal and reference to the High Court should be made within 180 days only from the date of communication of the decision or order. In other words, the language used in other provisions makes the position clear that the legislature intended the appellate authority to entertain the appeal by condoning the delay only up to 30 days after expiry of 60 days which is the preliminary limitation period for preferring an appeal. In the absence of any clause condoning the delay by showing sufficient cause after the prescribed period there is complete exclusion of Section 5 of the Limitation Act, The High Court was, therefore, justified in holding that there was no power to condone the delay after expiry of the prescribed period of 180 days.”

15. In view of the above settled legal position, it is evident that this Appellate Authority being a creature of the statue is empowered to condone a delay of only a period of 30 days after the expiry of the initial period for filing appeal. As far as the language of Section 100 of the CGST Act is concerned, the crucial words are “not exceeding thirty days” used in the proviso to sub-section (2). To hold that this Appellate Authority could entertain this appeal beyond the extended period under the proviso would render the phrase “not exceeding thirty days” wholly otiose. No principle of interpretation would justify such a result. Therefore, we hold that we are not empowered to condone the delay of one day in filing this appeal.

16. Since the appeal cannot be allowed to be presented on account of time limitation, the question of discussing the merits of the issue in appeal does not arise.

17. In view of the above we pass the following order

ORDER

We dismiss the appeal filed by the appellant The Deputy Conservator of Forests, Bangalore Urban Division, Department of Forest, Government of Karnataka, Aranya Bhavan, 18th Cross, Malleshwaram, Bangalore 560003, on grounds of time limitation.