New GST Rate for Bricks and Building Materials in India

Quick Summary

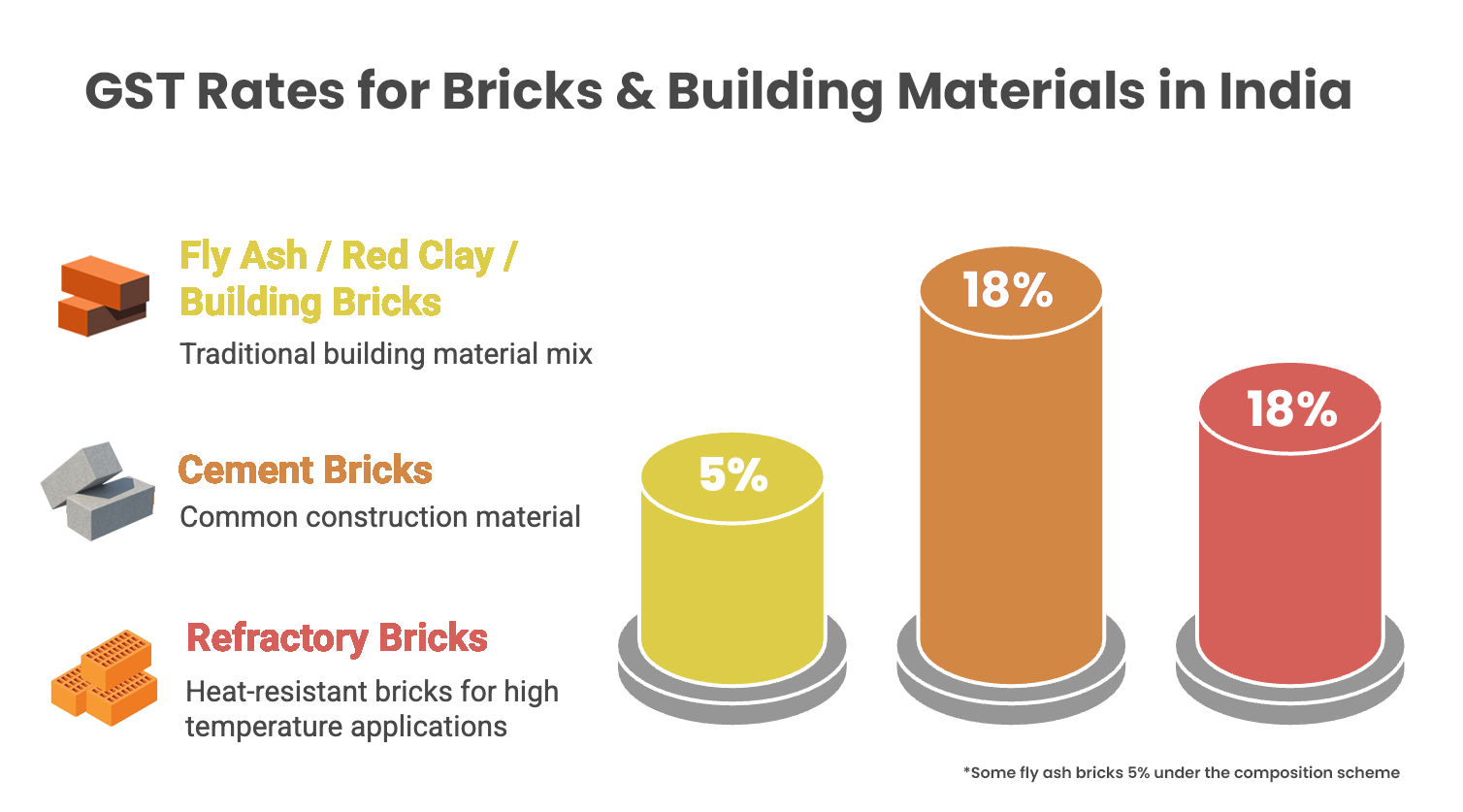

- The GST rate for fly ash and red clay bricks in India has been reduced from 12% to 5% as of September 22, 2025.

- Cement bricks now have a GST rate of 18%, down from 28%, aligning them with other construction materials.

- Refractory bricks, used in furnaces, maintain an 18% GST rate.

- The GST rate for general building bricks is now 5%, reduced from the previous 12%.

- Businesses must use correct HSN codes for bricks to ensure tax compliance and eligibility for input tax credit (ITC).

Bricks are one of the oldest and most essential building materials used in construction. Whether you’re building a house, a factory, or a commercial property, understanding the GST rate for bricks and other related materials can help you plan your budget better. In this blog, we explain the gst on bricks, how the rates vary by type (like red bricks or fly ash bricks), HSN codes, and input tax credit (ITC) rules .

Book A Demo

New GST Rate on Bricks in India

The Government of India is updating GST rates effective after 22 Sep 2025. Below are the expected new GST rates for common brick categories (no compensation cess).

| Brick Type | New GST Rate | Notes |

|---|---|---|

| Fly Ash Bricks / Blocks | 5% | Earlier 12%; reduced under the new rationalisation |

| Red Clay Bricks | 5% | Earlier 12%; brought to 5% |

| Cement Bricks | 18% | Earlier 28%; aligned with other construction materials at 18% |

| Refractory Bricks | 18% | Heat-resistant bricks used in furnaces/kilns |

| Building Bricks (General) | 5% | Applies to non-specified/common building bricks earlier at 12% |

Old GST on Bricks: Latest Rates and Classification

(Old GST Rates – Applicable Until 21st September)

The gst rate on bricks was revised by the GST Council with effect from April 1, 2022. Here’s how different types of bricks are taxed:

| Brick Type | GST Rate | Notes |

|---|---|---|

| Fly Ash Bricks / Blocks | 12% | Earlier 5%; revised to 12% from April 2022 |

| Red Clay Bricks | 12% | Tax increased from 5% to 12% |

| Cement Bricks | 28% | Considered under higher slab due to input |

| Refractory Bricks | 18% | Heat-resistant, used in furnaces |

| Building Bricks (General) | 12% | Applies to all non-specified types |

These rates are uniform for all buyers, including contractors, builders, or individual consumers.

Get a Free Demo of – Real Estate Accounting & Billing Software

HSN Codes for Bricks

Bricks fall under Chapter 69 of the HSN classification. Here’s how they’re grouped:

| Brick Type | HSN Code | GST Rate |

|---|---|---|

| Fly Ash Bricks / Blocks | 6815 | 12% |

| Red Bricks / Building Bricks | 6901 | 12% |

| Cement / Concrete Bricks | 6810 | 28% |

| Refractory Bricks | 6902 | 18% |

Businesses must use the correct HSN codes in invoices to ensure tax compliance and eligibility for ITC.

Get a Free Trial – Best GST Accounting Software For Small Business

Why the GST Rate Was Increased

Previously, bricks attracted 5% GST, but it led to issues with input tax credit chains and revenue leakage. From April 2022, the GST Council revised the rate to 12% for most bricks and introduced mandatory GST registration for brick manufacturers with a turnover above ₹20 lakh.

This move streamlined the tax structure and ensured better ITC flow.

Get a Free Trial – Best GST Accounting Software For Small Business

Input Tax Credit (ITC) on Bricks

If you’re a GST-registered builder or contractor, you can claim ITC on bricks used in construction projects.

However:

- ITC is not allowed if used for personal building construction (e.g., your own house).

- ITC is available only for bricks procured with a valid tax invoice.

This makes correct billing and vendor registration critical.

Get a Free Demo – Best Billing and Invoicing Software

Final Thoughts

Understanding the gst rate for bricks is important not just for large contractors but also for small builders and individuals. From April 2022, both red bricks and fly ash bricks now attract 12% GST, aligning them with other construction goods. Using the correct HSN codes and ensuring tax compliance can help you claim ITC and manage your costs more effectively.