New GST for Hotel Rooms in India: Tax Rate Based on Tariff

Quick Summary

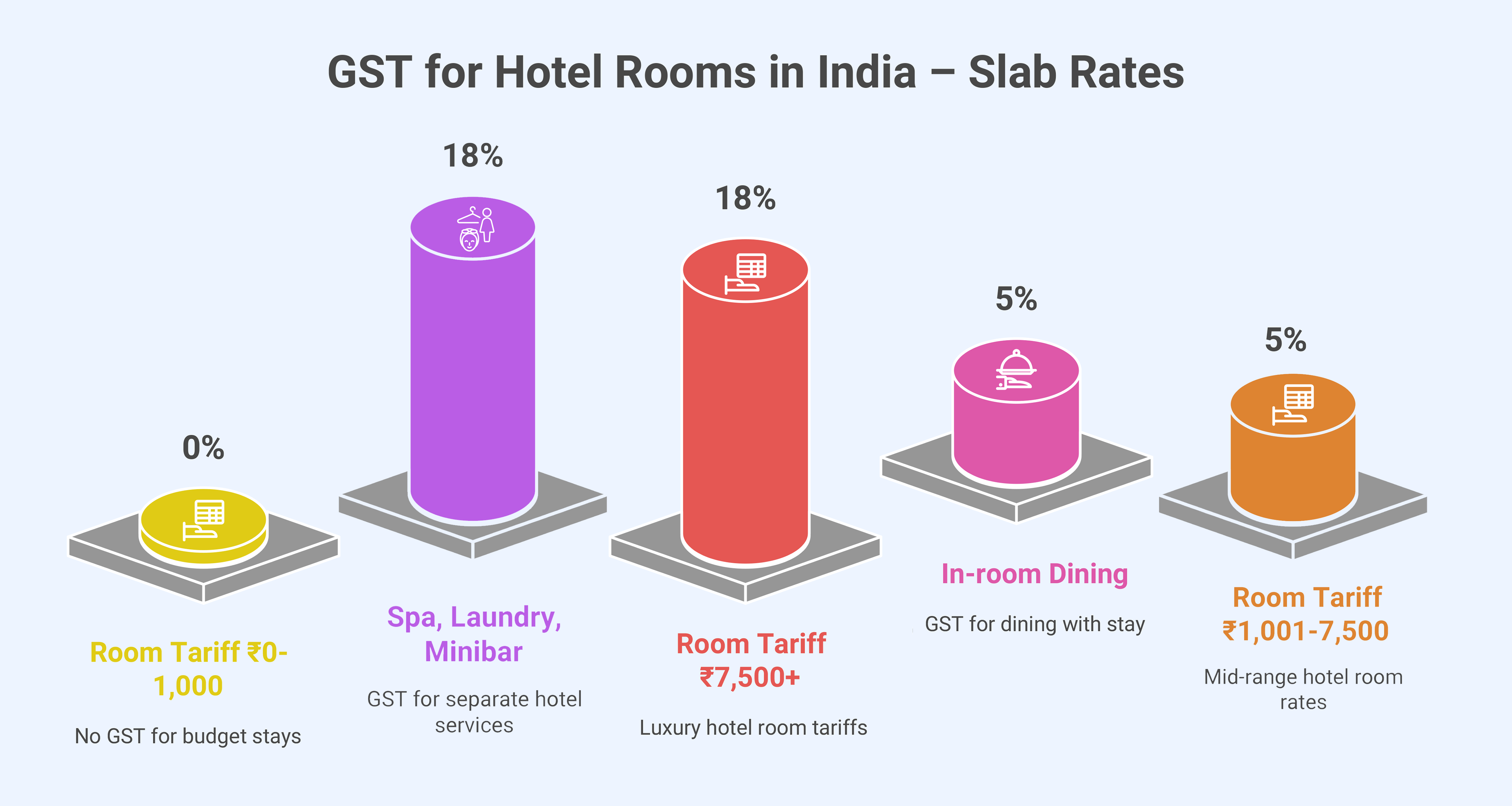

- New GST rates for hotel rooms in India depend on the room tariff, with 0% for tariffs below ₹1,000, 5% for ₹1,001–₹7,500 (no input tax credit), and 18% for tariffs above ₹7,500 (with input tax credit).

- GST is applied based on the declared room tariff before any discounts, meaning a room originally priced at ₹8,000 but discounted to ₹6,500 still incurs 18% GST.

- Hotel services like in-room dining, banquet services, and spa treatments have separate GST rates, with in-room dining taxed at 5% if billed with the room and 18% if billed separately.

- Input Tax Credit (ITC) can be claimed on GST paid for business-related hotel stays, provided the business is GST-registered and a valid tax invoice is issued.

- GST is applicable to the declared room tariff, not the discounted price, ensuring standard tax application regardless of promotions or discounts.

Booking a hotel room in India? Whether it’s for a vacation, a business trip, or a weekend getaway, it’s important to know how much of your bill goes to taxes. This guide explains the GST (Goods and Services Tax) rates applicable to hotel stays based on room tariffs and provides insights on HSN codes, input tax credits, and exemptions.

Book A Demo

New GST Rate on Hotel Rooms in India

The Government of India is updating GST rates effective after 22 Sep 2025. Below are the expected new GST rates for hotel room tariffs (no compensation cess).

| Room Tariff (per night) | New GST Rate | Conditions |

|---|---|---|

| Below ₹1,000 | 0% | Exempt from GST |

| ₹1,001 – ₹7,500 | 5% (No ITC) | Mid-segment stays; input tax credit not available |

| Above ₹7,500 | 18% (with ITC) | High-end & luxury hotels; ITC available |

Tariff = declared rate before discount

So, even if you get a discount and pay ₹6,500 for a room originally priced at ₹8,000, 18% GST will still apply.

Old GST on Hotel Room Tariff: A Slab-Wise Breakdown

(Old GST Rates – Applicable Until 21st September)

Under GST, hotel accommodation is taxed based on the declared room tariff per night. The higher the tariff, the higher the GST rate.

Here’s a quick look:

| Room Tariff (per night) | GST Rate | Conditions |

|---|---|---|

| Below ₹1,000 | 0% | Exempt from GST |

| ₹1,001 – ₹7,500 | 5% (No ITC) | Mid-segment stays; input tax credit not available |

| Above ₹7,500 | 18% (with ITC) | High-end & luxury hotels; ITC available |

Tariff = declared rate before discount

So, even if you get a discount and pay ₹6,500 for a room originally priced at ₹8,000, 18% GST will still apply.

Get a Free Trial – Best Accounting Software For Small Business

HSN Code for Hotel Services

Hotel and accommodation services fall under the HSN code 9963 , which is used for classifying services related to lodging, boarding, and other accommodations.

| Service Type | HSN Code | Description | GST Rate |

|---|---|---|---|

| Hotel accommodation | 996311 | Lodging services by hotels, inns, guest houses | 0% / 12% / 18% |

| Convention services | 996334 | Hall rentals, wedding venues | 18% |

Get a Free Demo – Best Billing and Invoicing Software

How to Calculate GST on Hotel Bookings

Let’s say you book a room for ₹5,000 per night for 3 nights:

- Base Amount = ₹15,000

- GST @12% = ₹1,800

- Total Bill = ₹16,800

If the room tariff were above ₹7,500 per night, GST @18% would be applicable.

Input Tax Credit (ITC) for Businesses

Businesses that incur hotel expenses for official purposes can claim Input Tax Credit (ITC) on GST paid, provided:

- The stay is used for official business purposes

- A valid tax invoice with GSTIN is issued

- The business is GST-registered

However, ITC is not available for personal travel or entertainment expenses, as per Section 17(5) of the CGST Act.

Get a Free Trial – Best GST Accounting Software For Small Business

GST on Room Tariff vs Actual Payment

It’s important to remember:

- GST is based on declared tariff, not on discounted price.

- So if a ₹10,000 room is offered at ₹6,999 due to an offer, GST is still charged at 18%.

This rule ensures standard tax application regardless of promotions or discounts.

Other Hotel Services and Their GST Rates

Hotels often offer services in addition to room stays, like spa treatments, restaurants, and conference halls. These are taxed separately:

| Service Type | GST Rate |

|---|---|

| In-room dining | 5% (no ITC) if billed with room, else 18% |

| Banquet services | 18% |

| Laundry & spa | 18% |

| Mini-bar items | 18% |

GST on these is applicable only if billed separately.

Explore a Free Demo of – Best Inventory Management Software For Small Business

Final Thoughts

Whether you’re booking a budget stay or a luxury suite, knowing the GST rates helps you avoid surprises on your final bill. For business travelers, understanding input credit rules ensures proper tax planning. The key takeaway—GST on hotels is slab-based, and the final cost can differ significantly depending on your room tariff and add-on services.