New GST on iPhones in India: What You Should Know

Quick Summary

- The GST rate on all iPhones and most accessories in India is now 18%, effective from September 22, 2025.

- Before GST, different states had different taxes, but now there's a single 18% rate, making prices more uniform.

- Refurbished iPhones are taxed at 18%, but usually only on the profit margin, which can lower the tax burden.

- Businesses can claim Input Tax Credit on iPhones used for business if they follow GST rules and get a proper invoice.

- Some iPhone accessories like chargers were previously taxed at 28%, but now most align with the 18% GST rate.

Buying an iPhone in India means understanding how taxes affect the final price, especially the Goods and Services Tax (GST). This blog will walk you through everything you need to know about GST on iPhones, including gst rates, how it impacts pricing, and related tax benefits.

Book A Demo

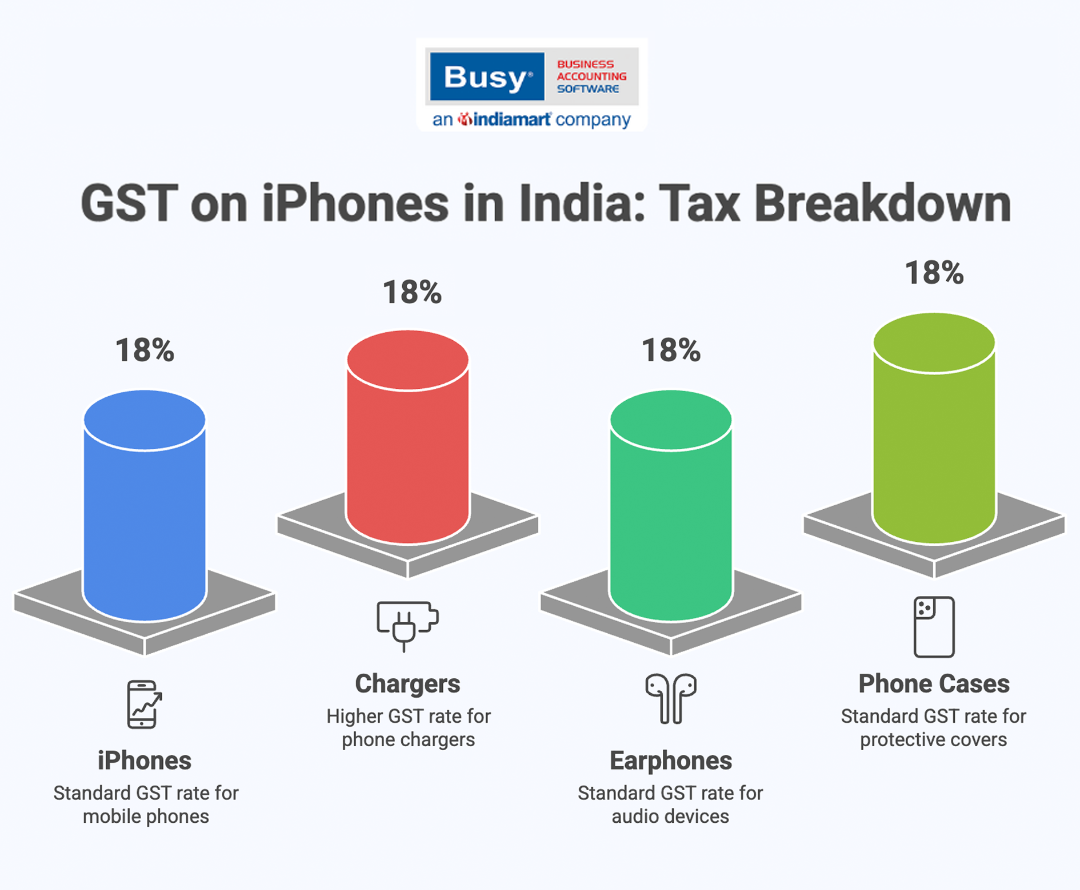

New GST Rate on iPhone and Accessories in India

Under the Next Gen GST Reforms, effective 22nd September 2025, the government streamlined GST slabs for consumer electronics. The biggest change was the discontinuation of the 28% slab for most electronic accessories, bringing them under a simplified 18% standard rate.

iPhones continue to attract 18% GST, while certain accessories that earlier fell under 28% have now been reduced to 18%. Additionally, GST on many leather goods has been revised.

Below is the updated GST structure along with the earlier applicable rates for reference. No compensation cess applies to iPhones or their accessories.

Iphone GST Rate Structure

| HSN Code | Product Description | GST Rate (After 22nd Sept 2025) |

GST Rate (Before 22nd Sept 2025) |

Status |

|---|---|---|---|---|

| 8517 | Apple iPhone (All models) | 18% | 18% | Unchanged |

| 8504 | Power Adapters / MagSafe Chargers | 18% | 28% (in many cases) | Reduced to 18% |

| 8518 | AirPods / EarPods | 18% | 18% | Standard |

| 8544 | USB C / Lightning Cables | 18% | 18% | Standard |

| 8507 | Power Banks | 18% | 28% (earlier classification) | Reduced to 18% |

| 4202 | Leather iPhone Cases | 9% or 18% | 18% | Revised for many categories |

(After 22nd Sept 2025) 18%

(Before 22nd Sept 2025) 18%

(After 22nd Sept 2025) 18%

(Before 22nd Sept 2025) 28% (in many cases)

(After 22nd Sept 2025) 18%

(Before 22nd Sept 2025) 18%

(After 22nd Sept 2025) 18%

(Before 22nd Sept 2025) 18%

(After 22nd Sept 2025) 18%

(Before 22nd Sept 2025) 28% (earlier classification)

(After 22nd Sept 2025) 9% or 18%

(Before 22nd Sept 2025) 18%

Customs Duty Impact on iPhone Pricing

Apart from GST, imported iPhones are also subject to Basic Customs Duty.

Basic Customs Duty on mobile phones was reduced from 20% to 15% following the 2024 Union Budget and is applicable on imported devices.

Tax Structure Based on Origin

Imported iPhones

15% Basic Customs Duty

18% IGST calculated on assessable value plus customs duty

Locally Manufactured iPhones

18% GST only

For intra state sales, this is split into 9% CGST and 9% SGST

Example Price Calculation

If an imported iPhone has an assessable value of ₹80,000:

Basic Customs Duty at 15% = ₹12,000

Taxable value for GST = ₹92,000

GST at 18% = ₹16,560

Total tax impact = ₹28,560

Final cost before retailer margin = ₹1,08,560

For a locally manufactured iPhone priced at ₹80,000:

GST at 18% = ₹14,400

Final invoice value = ₹94,400

GST on Refurbished iPhones

Refurbished iPhones also attract 18% GST, but the tax is usually applied only on the profit margin if the phone hasn’t undergone major changes. This is beneficial to buyers, as they end up paying less tax compared to new phones.

Example:

- Retailer Purchase Price: ₹50,000

- Selling Price: ₹70,000

- Profit Margin: ₹20,000

- GST (18% on ₹20,000): ₹3,600

- Final Price to Customer: ₹73,600

Explore a Free Demo of – Best Inventory Management Software For Small Business

Input Tax Credit (ITC) on iPhones

If a business buys an iPhone for official use, it may be eligible to claim Input Tax Credit (ITC) . This allows the business to reduce its overall tax liability by the GST amount paid on the purchase.

Conditions for Claiming ITC:

- The iPhone is used strictly for business purposes.

- A GST-compliant invoice must be issued by the seller.

- The seller must have deposited the tax to the government.

- The phone must have been received by the buyer.

- ITC is not allowed if the phone is used for personal or mixed use.

Get a Free Demo of – BillingSoftware for Mobile Stores

Unique Features of BUSY Accounting Software For the iPhones Industry

- Track IMEI numbers during purchase, sale, and returns for complete device traceability.

- Manage serial numbers for accessories and electronic items with warranty tracking.

- Get real-time inventory updates for mobile phones, parts, and accessories.

- Handle multiple brands and models with easy categorization and filtering.

- Manage repair jobs with detailed job cards, service status, and cost tracking.

- Track stock across multiple locations like showrooms, warehouses, and service centres.

- Analyze sales reports by brand, model, customer, or salesperson