New GST on Tyres: What You Should Know

Quick Summary

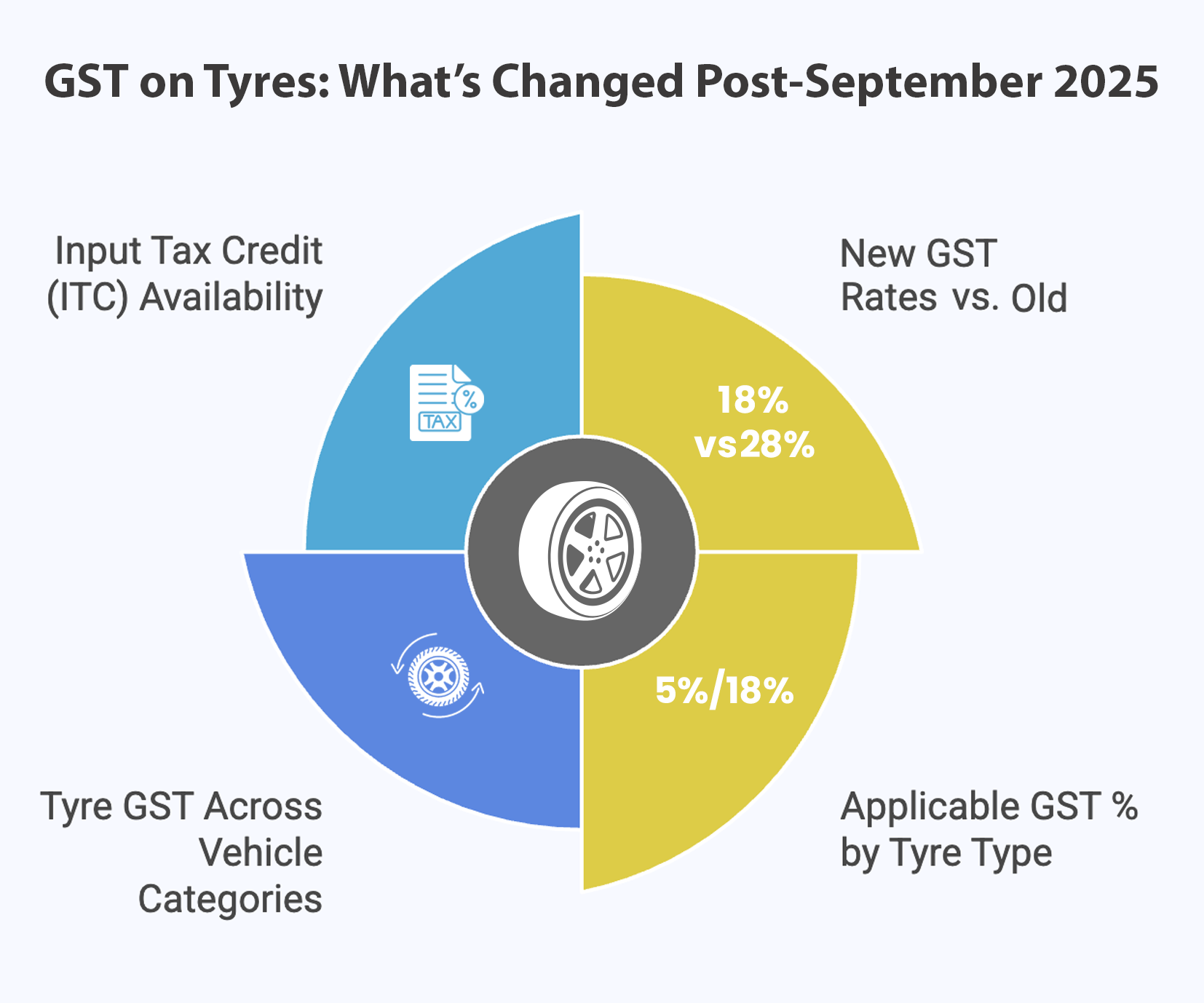

- The GST rate for car, motorcycle, scooter, bus, truck, and aircraft tyres is now 18%, while bicycle and agricultural vehicle tyres are taxed at 5%.

- Before September 2025, car, motorcycle, scooter, bus, and truck tyres had a higher GST rate of 28%, and bicycle and agricultural tyres were at 12%.

- The GST reform has simplified the tax structure for tyres, making it easier for businesses to claim Input Tax Credit.

- Imported tyres have the same GST rates as locally made ones, and retreaded tyres are taxed at 18%.

- Bicycle inner tubes have a GST rate of 5%, but most other inner tubes are taxed at 18%.

Tyres are an essential part of any vehicle, and understanding the GST rates applied to them is important for both buyers and businesses. The gst on tyres varies depending on the type of tyre and its intended use. In this blog, we’ll cover everything you need to know — including HSN codes, GST rates, and answers to commonly asked questions.

Book A Demo

New GST Rate on Tyres in India

The Government of India is updating GST rates effective after 22 Sep 2025. Below are the expected new GST rates for tyres by vehicle type (no compensation cess).

| Tyre Type | HSN Code | New GST Rate |

|---|---|---|

| Car Tyres | 4011.10 | 18% |

| Motorcycle/Scooter Tyres | 4011.40 | 18% |

| Bicycle Tyres | 4011.50 | 5% |

| Bus and Truck Tyres | 4011.20 | 18% |

| Agricultural Vehicle Tyres | 4011.61 | 5% |

| Aircraft Tyres | 4011.90 | 18% |

Note: Under the updated slabs, previous 28% lines move to 18% and former 12% lines align to 5%, unless a specific exception is notified.

Old GST Rate and HSN Codes for Tyres

(Old GST Rates – Applicable Until 21st September)

The GST rates on tyres are not the same across all vehicle types. Here’s a quick look at the applicable rates:

| Tyre Type | HSN Code | GST Rate |

|---|---|---|

| Car Tyres | 4011.10 | 28% |

| Motorcycle/Scooter Tyres | 4011.40 | 28% |

| Bicycle Tyres | 4011.50 | 12% |

| Bus and Truck Tyres | 4011.20 | 28% |

| Agricultural Vehicle Tyres | 4011.61 | 12% |

| Aircraft Tyres | 4011.90 | 18% |

Get a Free Demo of – Accounting Software for Auto Parts Store

Breakdown of Tyre GST Rates

- GST on Car Tyres (HSN Code: 4011.10) – 28%

- Motorcycle/Scooter Tyres (HSN Code: 4011.40) – 28%

- Bicycle Tyres (HSN Code: 4011.50) – 12%

- Bus and Truck Tyres (HSN Code: 4011.20) – 28%

- Agricultural Vehicle Tyres (HSN Code: 4011.61) – 12%

- Aircraft Tyres (HSN Code: 4011.90) – 18%

Get a Free Trial – Best Accounting Software For Small Business

How GST Has Affected the Tyre Industry

The introduction of GST brought all tyre-related taxes under one umbrella, replacing VAT, excise, and other indirect taxes. Here’s how it has impacted the tyre industry:

- Simplified tax structure

- Easier claim ITC

- More consistent pricing across states

- Better compliance and transparency

The consistent gst on tyres in India has made business smoother for tyre manufacturers and traders.

Explore a Free Demo of – Best Inventory Management Software For Small Business

Conclusion

Whether you’re a vehicle owner, a tyre dealer, or in the transport business, knowing the gst on tyres helps you make informed decisions. While items like bicycle and agricultural tyres enjoy a lower GST rate of 12%, others like car tyres and truck tyres are taxed at 28%.

Understanding these rates ensures better compliance and helps businesses claim Input Tax Credit . So next time you’re dealing with tyres, keep these GST slabs and HSN codes in mind.