What is GSTR-4?

GSTR-4 is a GST return that needs to be filed by taxpayers in India who have opted for the Composition Scheme. The Composition Scheme is a simplified scheme for small businesses that allows them to pay a fixed rate of tax based on their turnover and avoid the complexities of regular GST compliance. GSTR-4 is a quarterly return that contains details of the outward supplies made by the taxpayer, taxes paid, and the input tax credit claimed.

The form is intended to provide a summary of the taxpayer’s transactions during a particular quarter and simplify the process of filing GST returns. However, the process of filing GSTR-4 can be confusing for first-time filers, and it is essential to understand the requirements and guidelines for accurate filing.

Get a Free Demo – Best Billing and Invoicing Software

This guide to GSTR-4 aims to provide a comprehensive overview of the form and help taxpayers navigate the process of filing it correctly and on time.

BOOK A FREE DEMO

What is GSTR-4?

As mentioned, GSTR-4 is a GST Return that is to be filed by composition dealers on an annual basis. In fact, it is the only GST Return that taxpayers need to file if they have opted for the composition scheme. This is in contrast to regular taxpayers, who need to file three returns on a monthly basis.

Who Should File GSTR-4?

GSTR-4 is only applicable to taxpayers opting for the GST Composition Scheme. This scheme allows small taxpayers to avoid cumbersome GST formalities and pay GST simply at a set turnover rate. Any taxpayer with an annual turnover of less than Rs. 1.5 Crore may choose this scheme.

The following dealers are recognised as part of the composition scheme:

- Taxpayers who chose the composition scheme before the transition to the GST or their original GST registration and have never opted out since;

- Taxpayers who chose to participate in the composition scheme prior to the commencement of any fiscal year since the implementation of the GST regime;

- Taxpayers first chose composition but then decided against it at any time during the year.

Get a Free Trial – Best Accounting Software For SMEs

What is the Format of GSTR-4?

The GSTR-4 is composed of the following components:

- The GSTIN

- Name of the taxpayer

- Details of the total turnover of the previous financial year will need to be filled in once by you.

- Details of inward supplies, including those eligible for a reverse charge, are also part of GSTR components.

Inward supply details include the following:

- Inward supplies from unregistered persons

- Inward supplies from registered suppliers (attracting reverse charge)

- Inward supplies from registered suppliers (other than reverse charge)

- Import of services (subject to reverse charge)

- Any revisions to inward supply details, including credit and debit notes, stated in returns for a previous tax period.

- Taxes on outward supplies made, including advance and goods returned, during the tax period you’re filing returns for.

- Any revisions to outward supplies details mentioned in previous GSTR 4 returns for earlier tax periods.

- Any advances you have paid for reverse charge supplies are listed in this section. Also, any taxes paid on advances that you paid earlier but received the invoice for only now should be mentioned here.

- Any received TDS credit. This table will require details such as the GSTIN of the deductor, the TDS amount, and the gross invoice value.

- Total tax liability and tax payment made with segregation according to heads of cess, CGST, SGST, IGST, and UTGST.

- Any payable or paid interest and late fees (including details of the same).

- Refund claims can be made in this section for past excess taxes you paid. You can claim a refund under the taxation, interest, and penalty sections. fees, and others.

- All payments made in cash, including tax, interest, and late fees, must be listed here.

Also Check-Out Insights on – Transitioning To GST

Prerequisites for Filing GSTR-4

The composition taxpayer must have met the following prerequisites before drafting and filing GSTR-4:

- A minimum of one day within the applicable financial year was spent signing up and choosing the composition scheme.

- Filed all pertinent form CMP-08 statements for each fiscal year’s four quarters.

- Note the total turnover that was recorded for the previous fiscal year.

How to File GSTR-4?

The following are the steps for filing an annual GSTR-4 online:

- Step 1: Access the GST portal and sign in with your login credentials.

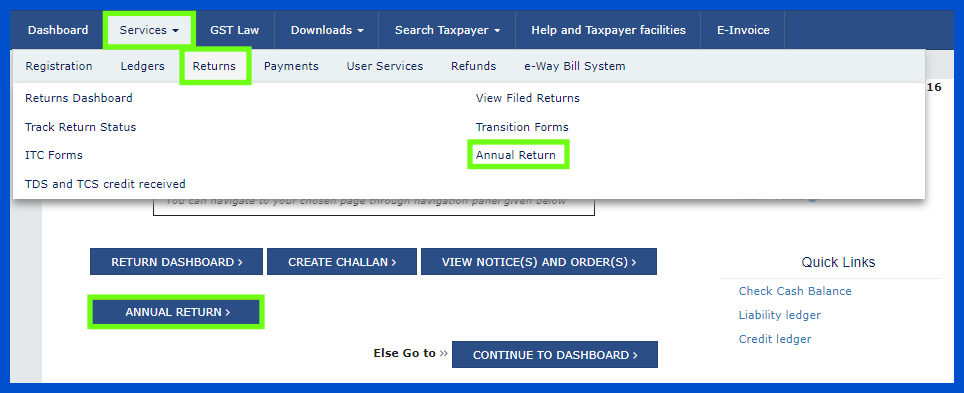

- Step 2: Navigate to the Annual Return section by selecting Services > Returns > Annual Return from the options available.

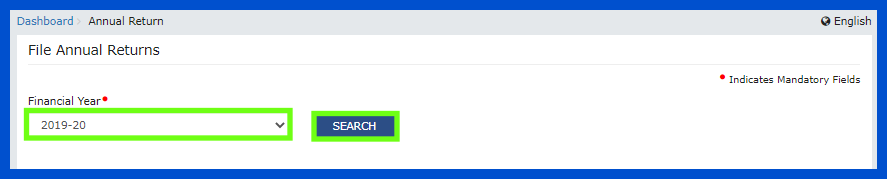

- Step 3: On the dashboard, click the ‘File Annual Returns’ button and select the relevant financial year for which you wish to file the return.

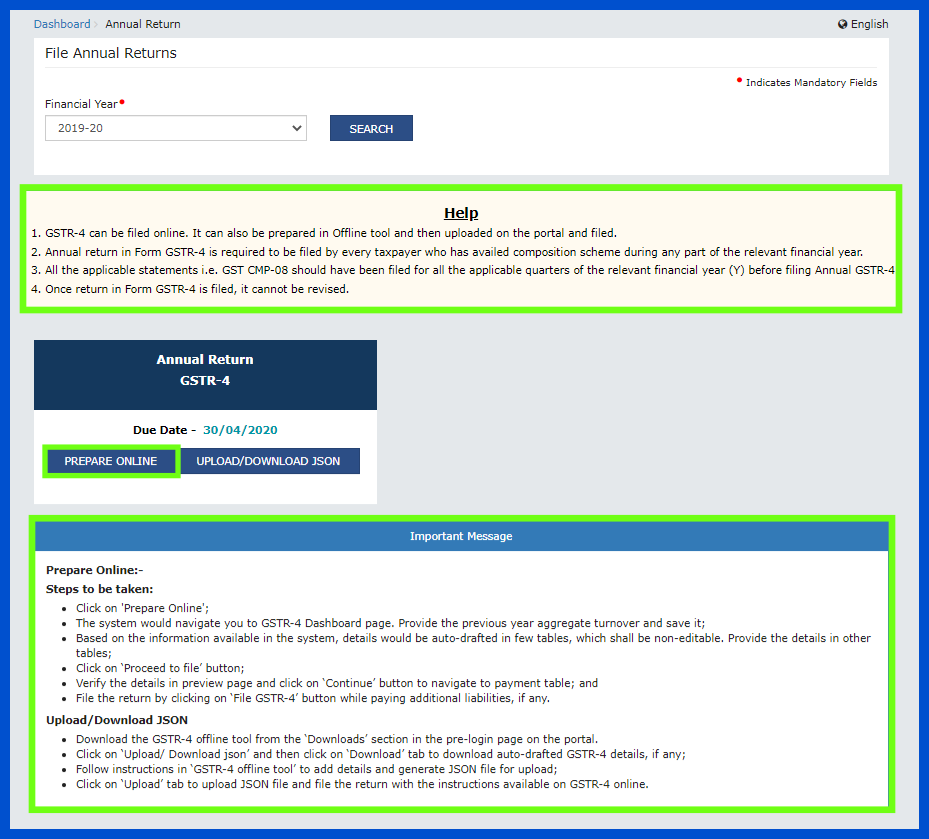

- Step 4: Carefully read the help instructions and messages provided on the page, and then select the PREPARE ONLINE option to proceed.

- Step 5: Enter all the necessary information required in the various tables of GSTR 4, as per the format of GSTR-4 discussed above.

- Step 6: Once you have entered all the relevant details, review the updated GSTR 4 return by clicking on either the ‘Download GSTR 4 Summary (PDF)’ or ‘Download GSTR 4 (Excel)’ button.

- Step 7: After verifying the accuracy of the information entered, select the declaration checkbox and provide an authorised signatory. Finally, click on the FILE GSTR 4 button to submit the return.

- Step 8: A warning message will appear on the screen. Select YES and then choose either FILE WITH DSC or FILE WITH EVC to complete the filing process.

How to Revise GSTR-4?

GSTR-4 is a quarterly return filed by businesses under the Composition Scheme. Once filed, GSTR-4 cannot be revised. However, any errors made while filing the return can be corrected in that financial year’s annual return (GSTR-9A). If you realize a mistake in your GSTR-4 after submission, you must report and rectify it while filing GSTR-9A, which covers the total returns filed under the Composition Scheme. Therefore, it is important to double-check the data before submitting GSTR-4 to avoid any issues later.

GSTR-4 Late Fees and Penalty

Filing GSTR-4 after the due date attracts late fees and penalties. The late fee for filing GSTR-4 is ₹50 per day (₹25 under CGST and ₹25 under SGST) for each day of delay. This fee applies from the day after the due date until the return is filed. However, if there is no tax liability (nil return), the late fee is reduced to ₹20 per day (₹10 under CGST and ₹10 under SGST).

The maximum late fee is capped at ₹5,000, meaning it won’t exceed this amount, regardless of how late the return is filed. Delayed filing can also lead to the restriction of certain benefits, such as availing input tax credit. Businesses should ensure timely filing of GSTR-4 to avoid unnecessary penalties and compliance issues. Additionally, repeated delays can cause legal problems, so keeping track of deadlines and submitting returns on time is important to maintain good standing with the GST authorities.

Conclusion

Filing GSTR-4 is an important requirement for taxpayers who have opted for the Composition Scheme in India. It is an annual return that provides a summary of the taxpayer’s transactions during the past financial year and simplifies the process of GST compliance for composition dealers.

This guide to GSTR-4 provides a comprehensive overview of the form and the steps involved in filing it correctly.Filing GST Returns can be a complicated process, so it is recommended that you use a robust GST Accounting Software like BUSY to make the process easy and simple, ensuring GST compliance for your business.

- GST Rates for ProductsGST Rates: water cooler GST rate sports item GST rate GST on used cars fire extinguisher GST rate GST on loan dustbin GST rate GST on sunglasses GST on fabric GST for hotel industry GST on banking services GST on napkins share market gst rate GST on catering services event management GST rate GST on headphones lottery GST rate GST on helmet vermicompost GST rate diaper GST rate gst on e rickshaw

Frequently Asked Questions

- Who needs to file GSTR-4?GSTR-4 must be filed by businesses registered under the GST composition scheme. These businesses have a turnover of up to ₹1.5 crore and pay a fixed percentage of their turnover as GST. They must file this return annually instead of monthly GSTR-1 and GSTR-3B.

- What details are required to be filed in GSTR-4?GSTR-4 requires details of total sales, purchases, and taxes paid during the year. It includes outward supplies made, inward supplies received from registered and unregistered persons, import of services, and tax liability.

- What is the penalty for non-filing of GSTR-4?For late filing of GSTR-4, a penalty of ₹200 per day (₹100 each for CGST and SGST) is imposed, subject to a maximum of ₹5,000. Interest at 18% per annum may also be levied on any outstanding tax liability.

- What documents do I need to file GSTR-4?To file GSTR-4, you need invoices for all sales and purchases made during the year, tax payment receipts, details of imports (if any), and a summary of your turnover and tax liabilities. These details help calculate your GST dues.