Matching, Reversal and Reclaim of ITC

Input tax credit (ITC) is the credit a registered taxpayer can claim for the tax paid on the purchases made for business purposes. Matching, reversal, and reclaiming of input tax credit refer to the process of reconciling the ITC claimed by the taxpayer with the tax liability payable to the government.

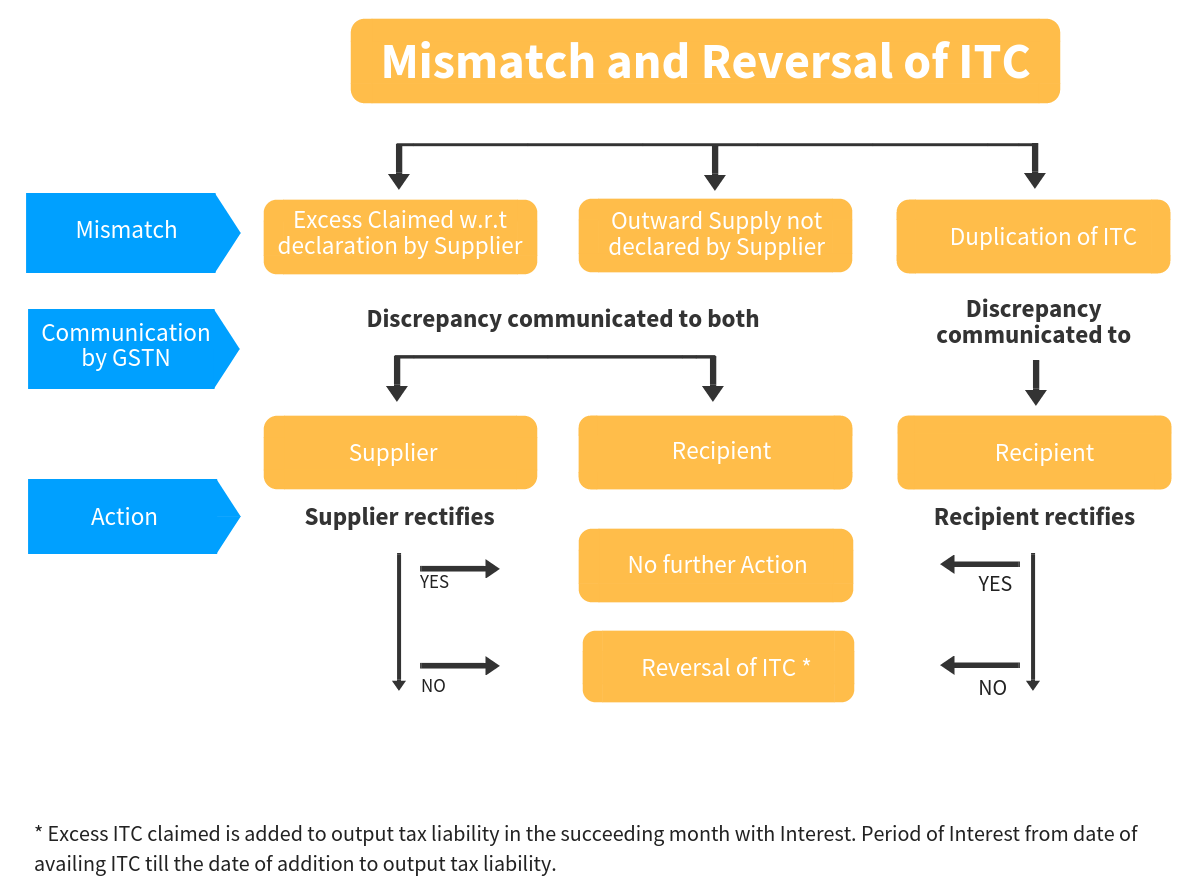

Matching refers to the process of matching the ITC claimed by the taxpayer with the details of the outward supplies added by the supplier in their GST/VAT return. This ensures that the supplier has correctly reported the sales made to the taxpayer and that the taxpayer has rightfully claimed the ITC.

Reversal refers to the process of reversing the ITC claimed by the taxpayer in the case the supplier fails to verify the details of the outward supplies or reports incorrect details in their GST/VAT return. This prevents the taxpayer from claiming ITC that is not due to them.

Reclaim refers to the process of reclaiming the ITC that the taxpayer reversed. This can happen if the supplier reports the correct details of the outward supplies in their subsequent GST/VAT return or if the taxpayer proves they are eligible for the reversed ITC.

BOOK A FREE DEMO

Modes Of Communicating Differences Noticed In Returns By Officers

Any discrepancy discovered by the authorised official must be reported to the relevant person using Form GST ASMT-10. The form consists of:

- Observations made by the officer

- Time available for the taxpayer to provide his explanation for this notice.

- Tax amount that is different may or may not be included in the form.

Get a Free Trial – Best Accounting Software For Small Business

Actions Available To Taxpayers Who Receive Notice

Duplication Of The ITC Claim By Recipient

The beneficiary will be informed if a claim has already been submitted and is duplicated. The ITC will be added to the recipient’s output tax due for the month the duplication was communicated if the correction is not made.

If there are additions, the recipient will be obligated to pay an interest of 18% from the day the ITC was claimed until the additions were made in returns on the amount added to the output tax due.

Re-Claim Of ITC

Reclaiming the ITC involves recovering the amount previously reversed due to discrepancies in the supplier’s declared amount of duplicate ITC claims. Only the supplier can make such reclaims by providing the details of invoice and/or debit notes in their valid return for the relevant period in which the incorrect details were noticed. Any interest paid earlier due to excess ITC claims will be refunded to the recipient’s electronic cash ledger. However, if the ITC was claimed for duplication, no refund will be processed.

What Does a Mismatch in Credit Mean for Issuing Scrutiny Notices?

A mismatch in Input Tax Credit (ITC) occurs when the ITC claimed by a taxpayer in their GSTR-3B does not align with the ITC available in GSTR-2A or GSTR-2B. Such discrepancies often trigger scrutiny notices from tax authorities.

The GST system relies on matching ITC to ensure tax compliance and prevent fraudulent claims. Mismatches can arise due to:

- Supplier Non-Compliance: Suppliers failing to report transactions or file returns.

- Data Entry Errors: Incorrect invoice details or mismatched amounts.

- Timing Differences: Reporting differences between monthly or quarterly filings.

When discrepancies are identified, authorities issue notices under Section 61 of the CGST Act, requiring taxpayers to explain the differences or correct errors. Ignoring these notices can result in penalties, interest, and even denial of ITC. Businesses should reconcile their returns regularly and ensure suppliers are compliant to avoid scrutiny.

Get a Free Trial – Best GST Accounting Software For Small Business

Any Differences Between Your Monthly/Quarterly/Yearly GST Returns?

Differences between monthly, quarterly, and yearly GST returns typically arise due to reporting errors, timing mismatches, or reconciliation issues:

- GSTR-1 vs. GSTR-3B:

Sales declared in GSTR-1 may differ from tax paid in GSTR-3B due to data entry errors or adjustments. - GSTR-3B vs. GSTR-2B:

Claimed ITC in GSTR-3B may not match available ITC in GSTR-2B due to supplier non-compliance or reporting delays. - GSTR-3B vs. GSTR-9:

Annual reconciliations in GSTR-9 may highlight differences in turnover, tax liability, or ITC claims across the year.

Such differences require careful scrutiny, as they may lead to notices, penalties, or ITC reversals. Businesses should ensure accurate reporting and regular reconciliation to maintain compliance and minimize errors.

Rectification of Discrepancies

Discrepancies in GST returns must be rectified promptly to avoid penalties and legal issues. Here are the steps to resolve them:

- Identify the Discrepancy:

Compare GSTR-1, GSTR-3B, and GSTR-2B to identify mismatched details, such as invoices, ITC claims, or tax payments. - Verify Records:

Cross-check invoices, purchase registers, and supplier filings to determine the source of the error. - Communicate with Suppliers:

For ITC mismatches, contact suppliers to ensure they file accurate returns or rectify errors in subsequent filings.

Get a Free Trial – Best E Way Bill Software

Revise Returns (if allowed):

Errors in GSTR-1 or GSTR-3B can be corrected in subsequent returns within the prescribed time frame.

Respond to Notices:

If a scrutiny notice is received, provide a detailed explanation with supporting documents to justify the claim or payment.

Utilize the GSTR-9 Annual Return:

Rectify yearly discrepancies through GSTR-9, which allows adjustments and reconciliation for the entire financial year.

Regular reconciliation and robust record-keeping are essential to minimize discrepancies and ensure smooth compliance.

Reversal and Reclaim of ITC

Input Tax Credit (ITC) must be reversed when the conditions for claiming credit are no longer met—such as non-payment to suppliers within 180 days, exempted supplies, or personal use. However, once compliance is restored (like payment to the vendor), the ITC can be reclaimed in future returns. Accurate tracking of reversals and reclaiming credit at the right time is critical to avoid interest and penalties. BUSY Accounting Software automatically flags such transactions, prompts for reversal entries, and allows you to reclaim eligible ITC efficiently, ensuring smooth and compliant credit management throughout the year.

ITC Mismatch and Impact on GSTR-9 & GSTR-9C

Mismatch in ITC claims between GSTR-3B and GSTR-2A/2B can result in discrepancies in annual returns (GSTR-9) and audit reports (GSTR-9C). Overclaimed ITC can attract notices, interest, and demand from GST authorities, while underclaiming leads to loss of credit. It is crucial to reconcile monthly GST returns with books and supplier filings before filing annual returns. BUSY Software offers advanced reconciliation features that detect mismatches between purchase records and GSTR-2A/2B data, helping users submit error-free GSTR-9 and GSTR-9C with full confidence and minimal risk of audit complications.

Tools and Best Practices to Avoid Mismatches

To avoid ITC mismatches and GST filing issues, businesses must adopt best practices like timely invoice booking, monthly reconciliation, vendor follow-ups, and accurate return filing. Using automated tools like BUSY Accounting Software helps streamline this process. BUSY provides purchase vs. GSTR-2A/2B reconciliation, mismatch detection, vendor-wise ITC reports, and GST return tracking. These features ensure every eligible ITC is claimed correctly and any discrepancies are resolved before filing. Regular data hygiene, audit trails, and smart dashboards in BUSY empower businesses to stay compliant and prevent future mismatches or notice-triggering errors.

What Does a Mismatch in Credit Mean for Issuing Scrutiny Notices?

A mismatch in Input Tax Credit (ITC) occurs when the ITC claimed by a taxpayer in their GSTR-3B does not align with the ITC available in GSTR-2A or GSTR-2B. Such discrepancies often trigger scrutiny notices from tax authorities.

The GST system relies on matching ITC to ensure tax compliance and prevent fraudulent claims. Mismatches can arise due to:

- Supplier Non-Compliance: Suppliers failing to report transactions or file returns.

- Data Entry Errors: Incorrect invoice details or mismatched amounts.

- Timing Differences: Reporting differences between monthly or quarterly filings.

When discrepancies are identified, authorities issue notices under Section 61 of the CGST Act, requiring taxpayers to explain the differences or correct errors. Ignoring these notices can result in penalties, interest, and even denial of ITC. Businesses should reconcile their returns regularly and ensure suppliers are compliant to avoid scrutiny.

Any Differences Between Your Monthly/Quarterly/Yearly GST Returns?

Differences between monthly, quarterly, and yearly GST returns typically GST returnsarise due to reporting errors, timing mismatches, or reconciliation issues:

GSTR-1 vs. GSTR-3B:

Sales declared in GSTR-1 may differ from tax paid in GSTR-3B due to data entry errors or adjustments.

GSTR-3B vs. GSTR-2B:

Claimed ITC in GSTR-3B may not match available ITC in GSTR-2B due to supplier non-compliance or reporting delays.

GSTR-3B vs. GSTR-9:

Annual reconciliations in GSTR-9 may highlight differences in turnover, tax liability, or ITC claims across the year.

Such differences require careful scrutiny, as they may lead to notices, penalties, or ITC reversals. Businesses should ensure accurate reporting and regular reconciliation to maintain compliance and minimize errors.

Explore a Free Demo of – Best Inventory Management Software For Small Business

Rectification of Discrepancies

Discrepancies in GST returns must be rectified promptly to avoid penalties and legal issues. Here are the steps to resolve them:

Identify the Discrepancy:

Compare GSTR-1, GSTR-3B, and GSTR-2B to identify mismatched details, such as invoices, ITC claims, or tax payments.

Verify Records:

Cross-check invoices, purchase registers, and supplier filings to determine the source of the error.

Communicate with Suppliers:

For ITC mismatches, contact suppliers to ensure they file accurate returns or rectify errors in subsequent filings.

Revise Returns (if allowed):

Errors in GSTR-1 or GSTR-3B can be corrected in subsequent returns within the prescribed time frame.

Respond to Notices:

If a scrutiny notice is received, provide a detailed explanation with supporting documents to justify the claim or payment.

Utilize the GSTR-9 Annual Return:

Rectify yearly discrepancies through GSTR-9, which allows adjustments and reconciliation for the entire financial year.

Explore a Free Demo of – Automated E-invoice Software for Easy Compliance

Regular reconciliation and robust record-keeping are essential to minimize discrepancies and ensure smooth compliance.

Conclusion

Matching, reversal, and reclaiming of Input Tax Credit (ITC) are essential processes in the GST system. Timely and accurate matching of ITC helps prevent fraud and errors, while the reversal of ITC is necessary in cases where the taxpayer is not eligible for the credit. Reclaiming of ITC is possible if the taxpayer has rectified the issues leading to the reversal. Proper compliance with the regulations outlined by the government is crucial to ensure a smooth and hassle-free ITC process.

- GST Rates for ProductsGST Rates: GST on ac GST for laptops GST on iphone GST for hotel room GST on flight tickets GST on silver GST for tv wood GST rate GST on train tickets GST on water bottle GST for medicines GST on tyres GST in garments GST on milk GST on stationery GST on tractor GST for food GST rate on tiles GST on sweets GST on gold

Frequently Asked Questions

- What is meant by matching of ITC?Matching of ITC ensures that the credit claimed by the recipient matches the tax paid and reported by the supplier in their GST returns.

- Why is the matching of ITC important?ITC matching ensures compliance, prevents fraudulent claims, and allows businesses to claim eligible credits without disputes.

- Can ITC be reclaimed after reversal?Yes, ITC can be reclaimed if the supplier corrects their return, and the details reflect in GSTR-2B within the allowed timeframe.

- What are common reasons for reversal of ITC?Reasons include supplier non-compliance, incorrect invoice details, ineligible credit claims, or goods/services not used for business purposes.

- What is the role of GSTR-2B in ITC matching?GSTR-2B provides a static, auto-drafted statement of ITC, helping taxpayers reconcile and match ITC with their purchase records.

- What happens if there is a mismatch in ITC details?Mismatches may lead to scrutiny notices, denial of ITC, penalties, or the need for rectifications in subsequent returns.

- How can taxpayers prevent ITC mismatches?Taxpayers should reconcile monthly returns, verify supplier compliance, and ensure accurate invoice details to avoid mismatches.