GST Registration Certificate – Everything You Need to Know

A GST Registration Certificate (Form GST REG-06) is provided to all businesses and individuals registered under the Goods and Services Tax (GST) Act. The GST Certificate is one of the most important documents your business must obtain while registering for GST. In this article, we will discuss all you need to know about this crucial document, including its importance, uses and how to download GST certificate from GST portal.

BOOK A FREE DEMO

What is a GST Certificate?

A GST Registration Certificate is a document that confirms and proves that your business has registered under GST. It gives your business the authority to collect and pay GST on the goods and services it supplies to customers. You can claim an Input Tax Credit with your certificate. It is because the GST authority officially recognises you as a supplier.

The GST Registration certificate has essential details like your GSTIN, Business Name, and registration date. Businesses under GST must display their GST Registration Certificate at their central location and any other listed places. You should display the certificate in a visible spot.

If they fail, they are liable to pay a penalty of ₹25,000. – You can obtain a new GST Registration certificate from the GST Portal. – This is necessary when there are changes to the details you provided in your old certificate.

Importance of a GST Registration Certificate

Once you download GST certificate and and have a valid one, your business is registered under the GST Act, which allows you to access various benefits.

- You are legally recognised as a supplier of goods and services

- You can charge your customers GST for the Government. You can also give them tax credits for your goods and services.

- You can claim an Input Tax Credit of taxes already paid, allowing you to reduce your tax burden. To avail of ITC, you must issue a valid GST Invoice to your customers, requiring a GST Registration Certificate.

- The mechanism allows for a seamless flow of Input Tax Credits from you (the supplier) to your customers (the recipients) at the national level.

- GST registration increases your credibility, showing that your business complies with the prevailing tax laws.

Download From Here – GST Billing Software for Small & Medium Businesses

Important Information in a GST Registration Certificate

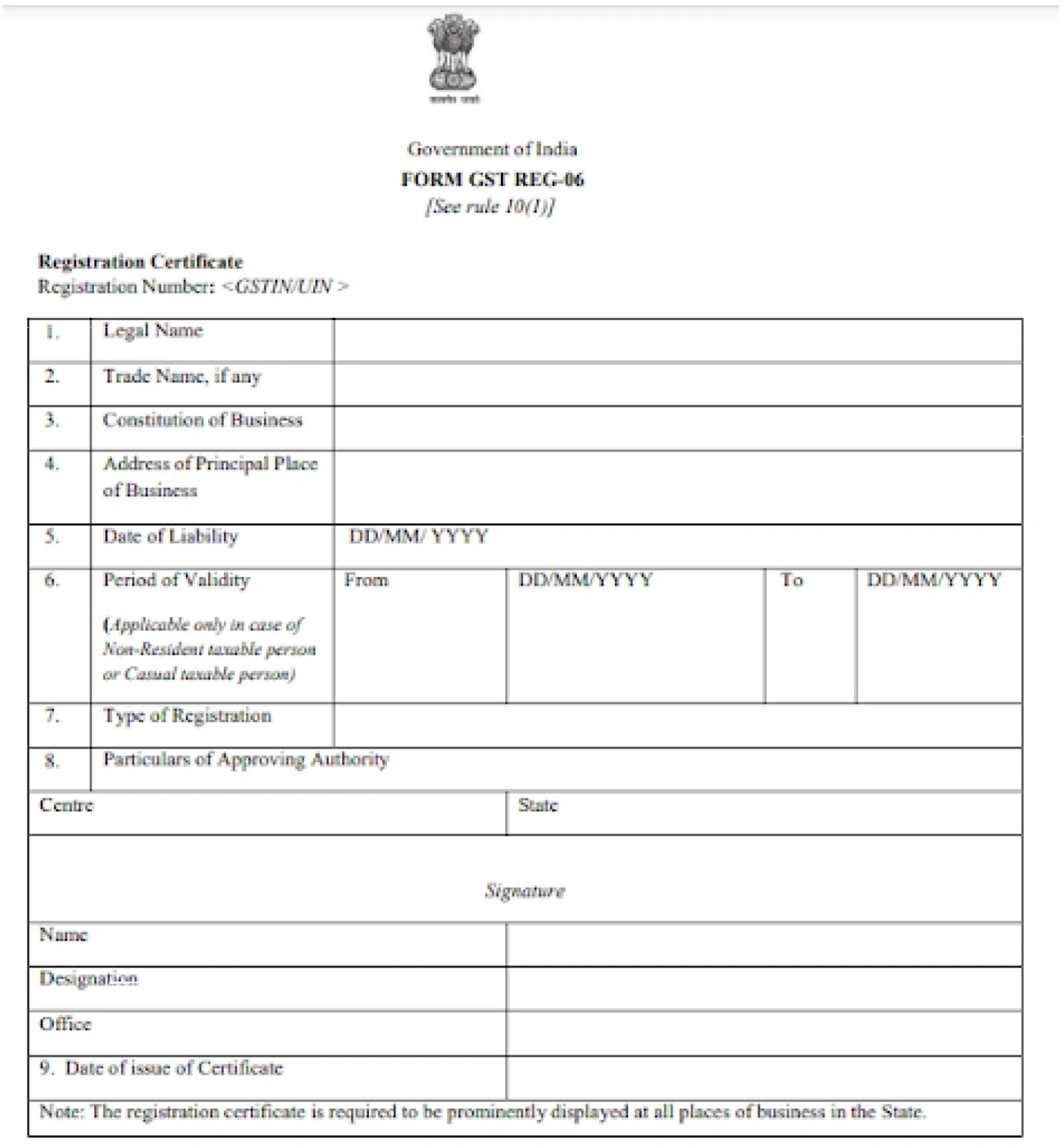

The GST Registration Certificate has three components:

- Main Registration Certificate

- Annexure-A

- Annexure-B

The Main Registration Certificate includes the following information:

- GST Identification Number (GSTIN) of the Taxpayer

- Business Legal Name and Business Trade Name

- Structure of the Business (eg. Sole Proprietorship, Partnership, Company, HUF etc)

- Address of the Primary Place of Business

- Date of Liability

- Validity Period

- Type of Registration

- Details of the Approving Authority (Name, Designation, Jurisdiction and Signature)

- Date of Certificate Issue

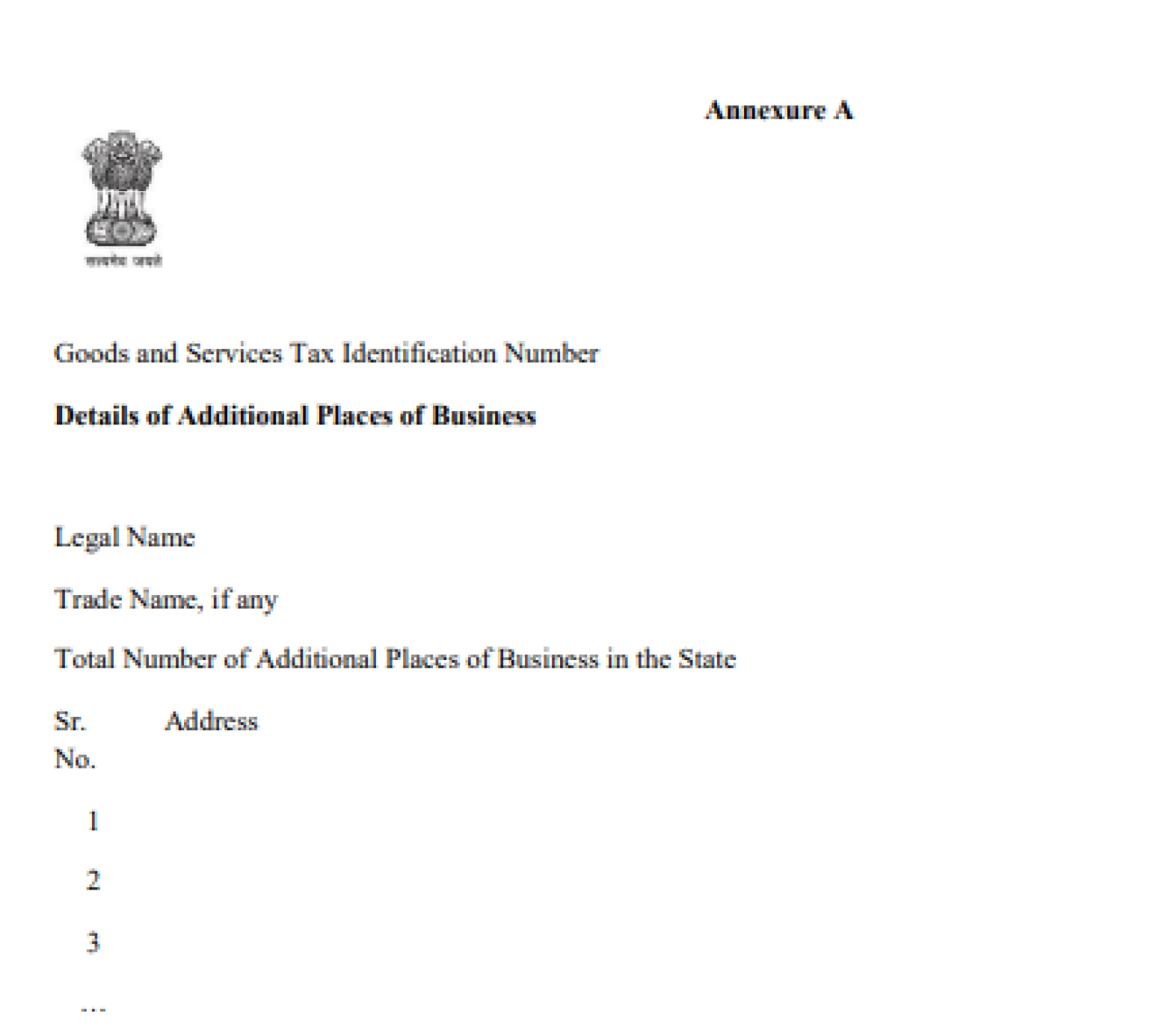

Annexure-A provides the following details:

- GSTIN

- Legal Name of Business

- Trade Name of Business (if available)

- Additional places of business (other than the primary place)

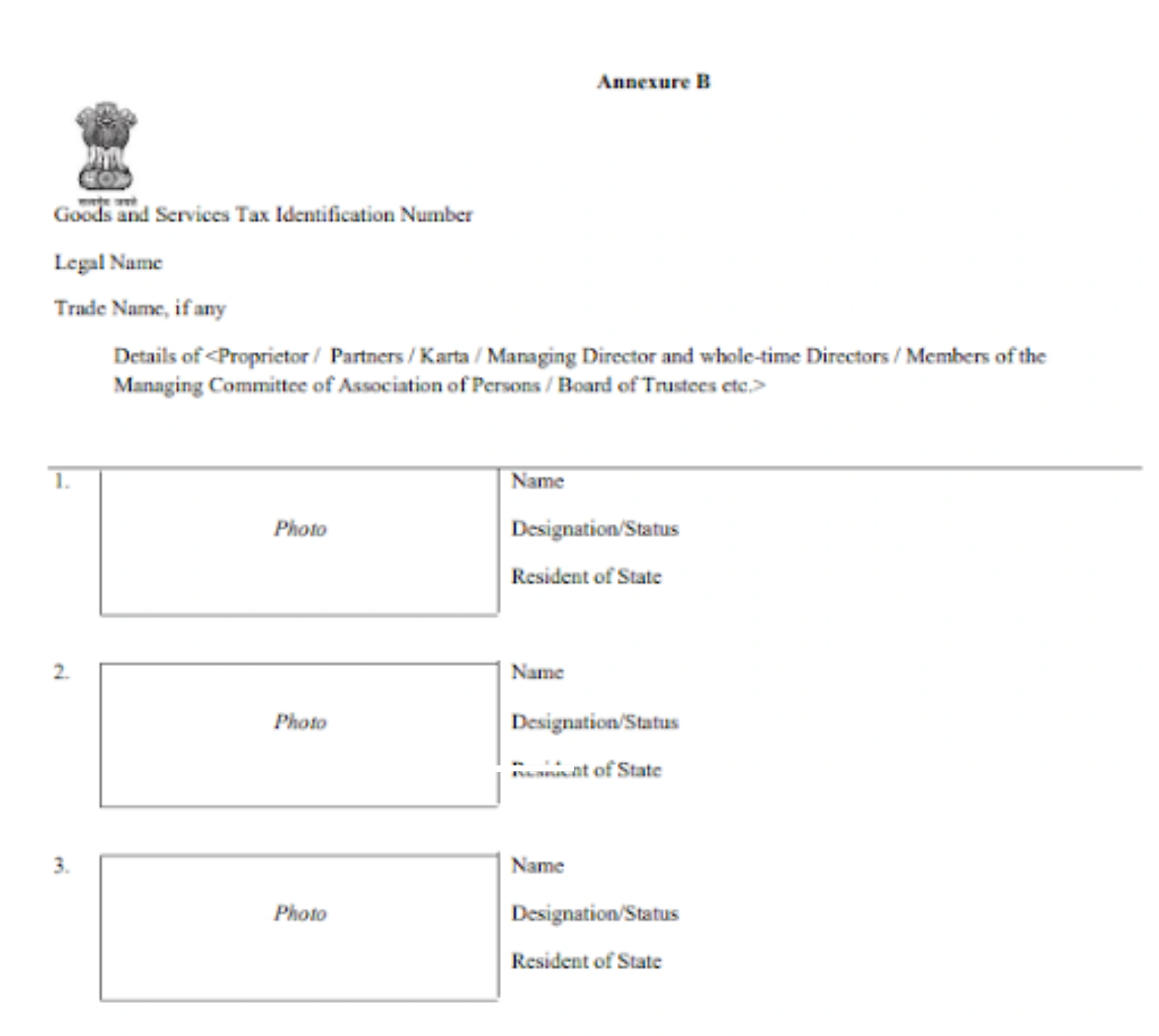

Annexure-B includes:

- GSTIN

- Legal Name of Business

- Trade Name (if applicable)

- Information about the proprietor (in case of sole proprietorship), partners (in case of partnerships, Karta (in case of HUF), managing and whole-time directors (in case of companies) etc. Details such as photo, name, and designation of the concerned person are required).

Get Here – Accounting Software for Small & Medium Businesses

Sample of a GST Registration Certificate

Here is a GST certificate sample:

Below is a sample of Annexure-A:

Below is a sample of Annexure-B:

How to do GST Certificate Registration?

Eligible persons must visit the GST Portal website to submit their application for GST registration. Registration is approved once the proper officer has verified the application. If an application is submitted within 30 days from the date of liability, registration will be granted from when the liability for registration arose. But if it isn’t submitted within that time frame, the registration is considered valid from the day it is granted. Read our step by step guide to GST Registration to learn more

Get Here: BUSY 21 Software Download Free

How to download GST Certificate?

To download GST certificate, follow this step-by-step process

- Visit www.gst.gov.in and login with your account details

- Go to the “Services” Tab

- Select “User Services”

- Choose “View/Download Certificate”

- Click “Download”

For a more detailed explanation, continue reading.

Step 1 – Visit the GST Portal and Login with Account Details

Step 2 – Navigate to Services > User Services > View/Download GST Certificate

Step 3 – Click the Download Icon

What is the validity of the GST registration certificate?

The GST certificate is valid from the date the person became liable for GST registration if they submit the registration application within 30 days of such liable date. If not, then validity starts from the date of granting the certificate under the CGST Rules 9(1), 9(3), and 9(5).

For instance, if an application falls under cases of delay by the officer under CGST Rule 9(5), the officer needs to send the signed registration certificate within 3 working days from the period given under the same subrule.

The certificate has no expiry time limit if issued to all regular taxpayers. It remains valid as long as the GST registration is valid and not surrendered or cancelled. However, a casual taxable person’s registration certificate becomes invalid since the GST registration remains valid for 90 days. However, the taxpayer can extend its validity or renew it by the end of the validity period.

Conclusion

You may have understood how to get GST certificate and why it is essential to your business’s tax compliance. The certificate serves as evidence of your GST Registration and entitles you to the benefits of GST Registration. You can easily download GST certificate by following the steps shown above. Always show your GST Registration Certificate in a visible spot at your primary and other business locations. If you recently signed up for GST, you may require reliable Free GST Accounting Software to manage your business’s GST needs efficiently.

- GST Rates for ProductsGST Rates: chalk GST rate GST on fertilizer GST for food business yarn GST rate GST on commercial rent GST on marble GST on builder rent GST rate GST rate for contractor GST for construction materials GST on cloud kitchen GST on pencil GST on cryptocurrency GST on freight charges GST on footwear GST on sugar GST on advocate services GST on e commerce operator GST for fmcg products GST on upi transaction