ITC 01 Form – Claim ITC on New GST Registration

Form GST-01 is used to claim Input tax credit by taxpayers that have newly registered under GST. Newly registered persons need to declare any existing stock of inputs, capital goods and/or finished goods at their place of business as on the day they obtained their GST registration. They do this through filing Form GST-01, which is a mandatory requirement in order to claim ITC on such stock.

BOOK A FREE DEMO

Conditions for Filing ITC 01

In the following situations, you must submit a declaration using ITC – 01:

- If an application for GST registration is submitted within 30 days of the taxpayer becoming liable to make GST payments.

- When an individual chooses to voluntarily register under GST.

- When a taxpayer decides to opt out of the composition scheme but keeps their normal taxpayer status.

- When a formerly exempt supply of goods or services becomes taxable.

Types of ITC Allowed for Newly Registered Taxpayers

Given below are the different types of input tax credits allowed for newly registered GST taxpayers

- ITC on inputs held in stock on the cut-off date

- ITC on inputs used in semi-finished goods on the cut-off date

- ITC on inputs used in finished goods on the cut-off date

- ITC on capital goods on the cut-off date

Exempted supply becomes taxable only when a composition dealer opts out of the composition system.

Schedules and Deadlines for Submitting an ITC Claim

To be eligible to claim ITC, a person must complete Form ITC – 01 within 30 days after becoming eligible (within 30 days after GST registration is granted or opting out of the composition scheme).

| Case | Cut-off date | No. Of times ITC can be claimed by filing ITC 01 |

|---|---|---|

| If an application for GST registration is submitted within 30 days of the taxpayer becoming liable to make GST payments. | One day before the date he becomes liable to pay GST. | Once |

| When an individual chooses to voluntarily register under GST | One day before the date GST Registration is granted | Once |

| When a taxpayer decides to opt out of the composition scheme but keeps their normal taxpayer status. | As of the previous day if he chooses to make his tax in the traditional way. | Once every year |

| When a formerly exempt supply of goods or services becomes taxable. | Preceding the date on which the supply becomes taxable | Once every month |

Considerations for Submitting Form ITC 01

- A taxpayer must know what he is eligible to claim as input tax credit. For instance, you can’t use Form ITC 01 to claim ITC on services received. ITC on capital goods can be claimed in the following situations:

- When a composition dealer decides to opt out of the composition scheme

- When an exempted supply becomes taxable

- You are expected to provide invoice wise details of ITC on purchases up till the cut-off date.

- You need to file Form ITC 01 within 30 days of the date of GST registration, or the date you have opted out of the composition scheme.

- In the case of inputs, invoices up to one year old may be claimed, while invoices up to five years old can be claimed for capital goods.

- When the claim for ITC is more than INR 2 lakhs, you must upload a Chartered Accountant’s certificate or Cost Accountant’s certificate when filing Form ITC 01.

Get a Free Trial – Best Accounting Software For SMEs

Form ITC 01 Filing Procedure Broken Down Step by Step

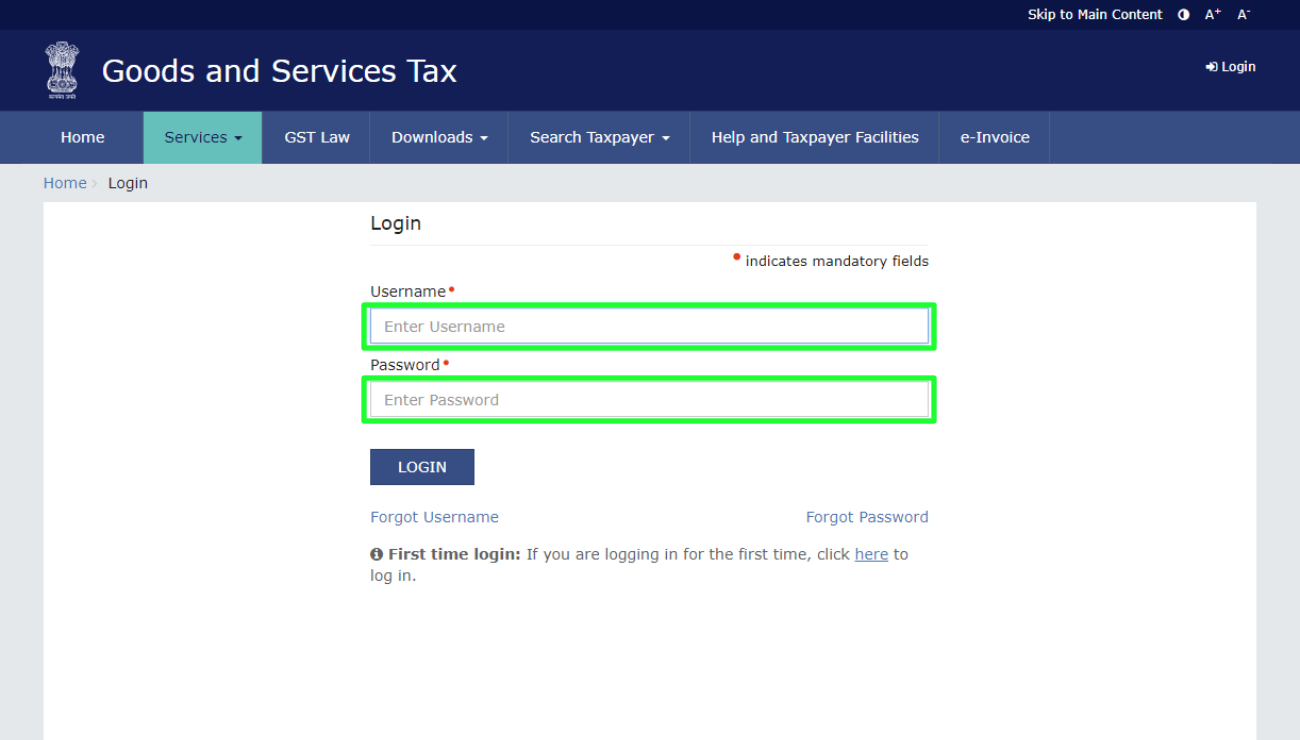

Step-1: Login to the GST portal.

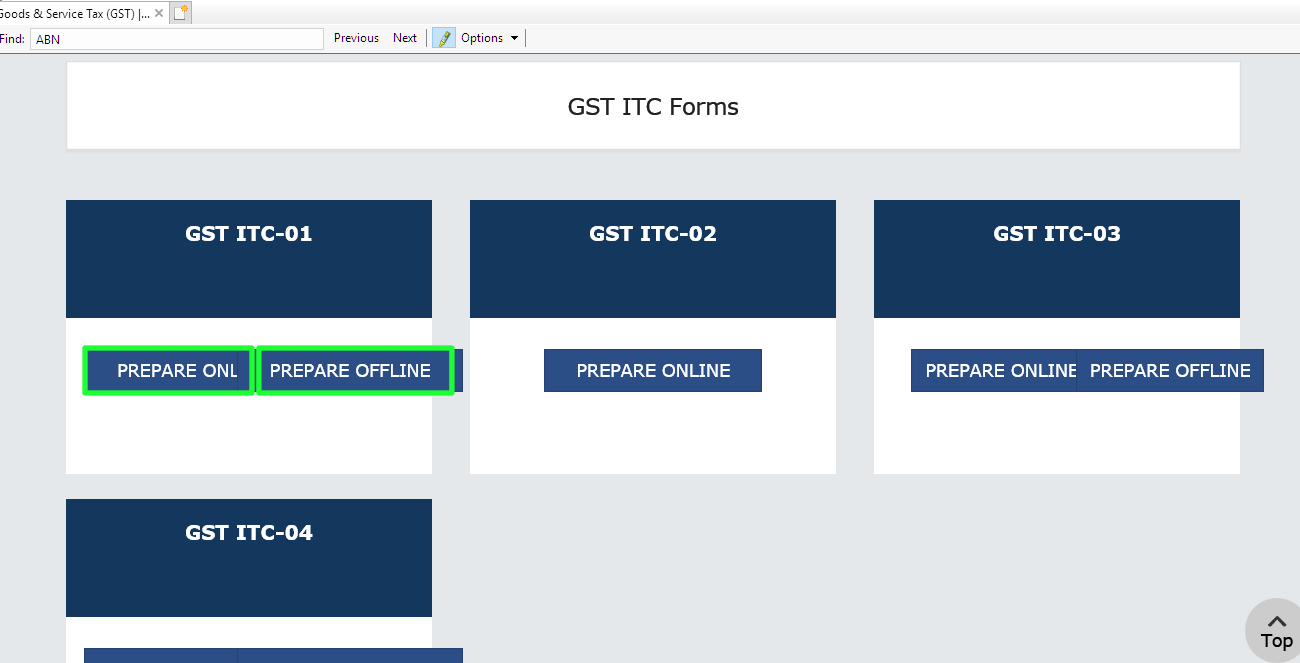

Step-2: Click on Services > Returns > ITC forms > ITC 01.

Click on “Prepare online” or “Prepare offline.”

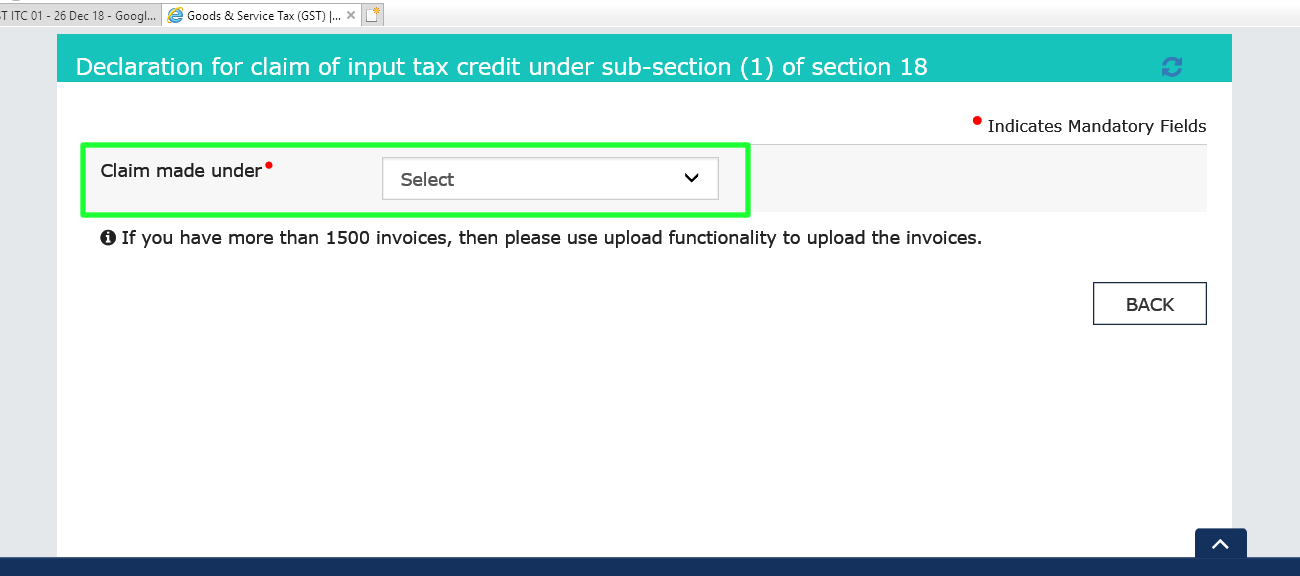

Step-3: Select the type of ITC Claim and fill in the required details. In the ‘Claims made under tab, select the clause and sub-clause of Section 18 under which you are making the claim. The fields will remain the same in either case.

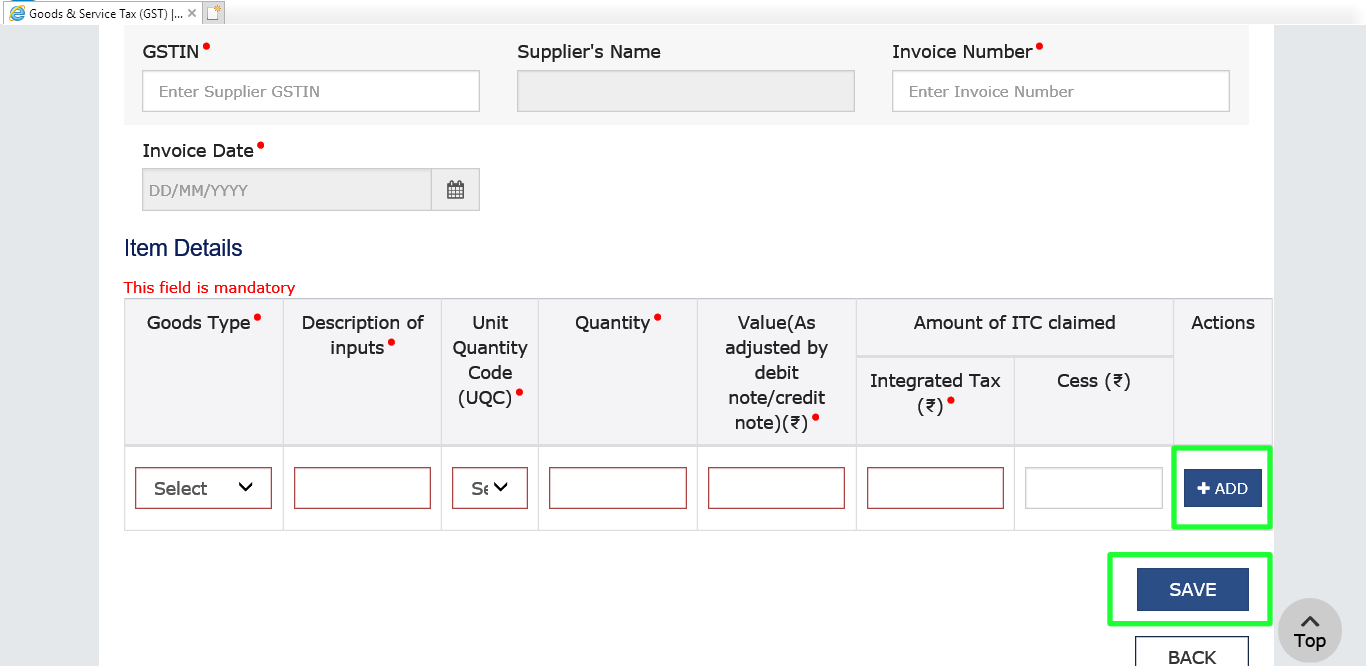

Please follow the steps below to provide the appropriate invoice information:

- Choose the product category. Choose from (i) raw materials, (ii) materials used in production, or (iii) fixed assets. Therefore, taxpayers who file Form ITC – 01 must keep a thorough stock register documenting the acquisition and use of inputs.

- Supplier GST Identification Number (GTIN)

- Type in the Invoice Number and the Due Date (This date cannot be more than one year in the case of inputs and five years in the case of capital goods previous to the approval date for registration.)

- Code for Unit Quantity

- Merchandise description – components

- Enter Quantity

- The cost must be entered. (The stated amount of the invoice should reflect the value of any debit or credit notes that have been issued concerning the invoice in question.)

- The amount of ITC must be entered (CGST and SGST or IGST)

Note: For claims under Section 18(1)(d), you also need to enter the date on which the items became taxable. To add additional invoices, click the ‘Add’ button; to submit, select the ‘Save’ button.

Step-4: After you’ve entered all of the invoice information, choose Preview > Submit > Proceed

Please be aware that once the status changes to “submitted” or you click “Proceed,” no changes can be made.

Step 5: Put your CA certificate here if you need one. For claims above INR 2 lakhs, an up-to-date certificate and Chartered Accountant or Cost Accountant information are required. Please fill in the following information:

- The firm’s name

- Certifying CA’s name

- Membership number

- The certificate should be uploaded in JPEG format that should not exceed 500 KB

- Certificate issuance date

Step 6: Remember to use DSC or EVCO while filling out the Form. After the Form has been filed successfully, the user may choose an authorized signatory from a drop-down menu and then click the “File using DSC” or “File using EVC ” button to complete the filing process using a digital signature or electronic verification code. After a return is submitted, the taxpayer will get an ARN via SMS or email. GST ITC 01 is now filed. After submitting Form ITC 01, the ITC claims are available in the electronic credit ledger.

- GST Rates for ProductsGST Rates: GST for marriage hall GST for car GST on online gaming GST for vegetables cold drinks GST rate GST for restaurant GST on electricity GST for spices GST for bakery products GST rate for transportation GST for computer parts GST on camera GST on vehicle insurance gst on postpaid mobile bill GST for silk sarees GST on plastic items GST on consultancy services GST on movie tickets GST for electrical items GST on insurance premium

Frequently Asked Questions

- What is Form ITC-01?Form ITC-01 is a declaration filed under GST to claim Input Tax Credit (ITC) on goods or services. It is used by registered taxpayers who become eligible for ITC under specific circumstances, such as new registration, change from composition to regular scheme, or exemption withdrawal.

- Who can file Form ITC-01?Form ITC-01 can be filed by taxpayers who recently obtained GST registration, transitioned from the composition scheme to the regular scheme, or became eligible for ITC after exemption withdrawal. The applicant must hold a valid GST registration and maintain proper records to claim ITC.

- What are the conditions for filing Form ITC-01?To file Form ITC-01, the taxpayer must possess a valid GSTIN, hold tax invoices for inputs, inputs in semi-finished goods, finished goods, or capital goods, and file within the specified time frame. Goods and services should have been procured within the eligibility period for claiming ITWhat details need to be provided in Form ITC-01?C.

- When should Form ITC-01 be filed?Form ITC-01 must be filed within 30 days of becoming eligible for ITC. This could be due to GST registration, change in tax scheme, or withdrawal of exemption. Filing within the prescribed time ensures compliance and enables credit claims.

- Can ITC be claimed for capital goods using Form ITC-01?Yes, Input Tax Credit (ITC) can be claimed for capital goods using Form ITC-01. Taxpayers must provide details of tax invoices for eligible capital goods and ensure proper documentation. The ITC claim must align with GST rules and the prescribed timelines.

- What details need to be provided in Form ITC-01?Details required in Form ITC-01 include GSTIN, invoice details of goods, inputs in finished/semi-finished goods, capital goods, and tax amounts for which ITC is claimed. Accurate and complete documentation ensures successful submission and processing of ITC claims.

- What happens after Form ITC-01 is submitted?After submission, the tax authorities verify the details. The claimed ITC amount is credited to the taxpayer’s electronic credit ledger if approved. Discrepancies or errors may result in delays, rejection, or additional clarification queries from the authorities.

- What are the common errors to avoid while filing Form ITC-01?Avoid common errors such as incorrect GSTIN, mismatched invoice details, claiming ITC beyond the time limit, or missing documents. Double-check tax amounts and ensure all mandatory fields are filled accurately to prevent rejection or delay in ITC processing.

- Can ITC be claimed for services through Form ITC-01?Yes, if the taxpayer becomes eligible under GST provisions, ITC for services can be claimed using Form ITC-01. Invoice details and tax amounts for eligible services must be provided. For successful claims, ensure timely filing and adherence to GST regulations.