Reversal of Input Tax Credit In GSTR-2

The tax that a person already paid at the time of the purchase of goods or services and which is eligible as a deduction from the tax due is referred to as an input tax credit.

The reversal of input tax credit refers to the situation where a business owner needs to reverse the credit he had claimed earlier. This can happen for several reasons, such as the goods or services for which the credit was claimed were used for non-business purposes, the supplier failed to pay tax to the government, or the business owner failed to pay the supplier within the specified time period. In such cases, the business owner must reverse the input tax credit and pay the corresponding tax amount to the government.

BOOK A FREE DEMO

Conditions for ITC Reversal in GST

The conditions under which ITC Reversals are required are as follows:

- If the recipient fails to pay the decided amount to the supplier. The ITC reversal is required within 180 days from the date of the invoice.

- The GST amount of the purchased capital goods has been claimed as depreciation under the Income Tax Act.

- An exempt supply has been made using inputs utilising the calculation for common credits below regularly (monthly or annually). If inputs are only utilised to create exempt supplies, they must be reversed as soon as it is discovered that a claim has been made.

- Some inputs utilised to manufacture supplies were later used for non-commercial or personal reasons. The reversal is required to utilise the regular calculation for common credits (monthly or annually).

- On the cancelling of GST registration, ITC reversal shall be claimed.

- Reversal of 50% of ITC by banks and other financial institutions subject to particular regulations. The reversal must be claimed when filing regular returns.

- On blocked credits, ITC has been accessed. The reversal should be claimed while submitting regular returns up until the deadline for submitting yearly returns.

- Inputs used in products that were distributed as samples for free. The reversal is accessible when the regular returns for the month in which those free samples were distributed were filed.

- It is possible to claim reversal for inputs used in goods that were stolen, lost, or otherwise damaged when the regular returns for the month the loss occurred were filed.

Reasons that Require Reversal of ITC

There are multiple scenarios under which a taxpayer is required to reverse the Input Tax Credit (ITC). Two of the most common reasons include:

1. Blocked Credits under Section 17(5): ITC cannot be claimed on certain expenses such as:

- Motor vehicles (for personal use)

- Food, beverages, and outdoor catering

- Club memberships and personal expenses

- Works contracts (except for plant and machinery)

2. Mismatch Between GSTR-2A and GSTR-3B: If the ITC claimed in GSTR-3B is not reflected in GSTR-2A or GSTR-2B, it may be ineligible and must be reversed unless the mismatch is resolved.

Other reasons include:

- Non-payment to suppliers within 180 days

- Goods lost, stolen, or destroyed

- Supplies used for exempt or personal purposes

BUSY Software automatically detects mismatches and helps users track blocked credits to ensure proper ITC reversal and compliance.

Rules Governing ITC Reversal: Rule 42 & Rule 43

Rule 42 and Rule 43 of the CGST Rules define how to reverse ITC on inputs and input services (Rule 42) and capital goods (Rule 43) when they are used for both taxable and exempt supplies.

- Rule 42: Requires proportionate reversal of ITC based on turnover if inputs are used for both taxable and exempt supplies.

- Rule 43: Involves a similar proportionate reversal method for capital goods over a 5-year period.

These rules ensure that ITC is claimed only for the portion used in taxable supplies. BUSY Software automates Rule 42/43 calculations, saving hours of manual work and reducing the risk of errors during monthly return filing.

Eligibility for ITC Returns in GST

A registered taxpayer is eligible to claim ITC returns once the following prerequisites are fulfilled:

- Payment to the supplier of goods and services is made within 180 days of the invoice issuance.

- Capital goods and inputs are not used for personal benefit.

- Exempted supplies must not be provided using inputs or capital goods.

- The GST returns are filed on time.

How to Calculate ITC?

Let’s consider an example to understand better how the input tax credit is calculated.

For Rs. 500, Mr Sharma, a steel manufacturer, purchased raw steel to make steel plates and glasses. He spent another Rs. 100 on more raw materials. Assume that the GST for steel is 18%, and the GST for the other raw materials is 28%. As a result, the business invested Rs. 90 in raw steel and Rs. 28 in other raw materials. Mr Sharma spent a total of Rs. 118 on input tax.

Mr Sharma chooses to sell his goods at Rs. 800 plus GST after taking into consideration the cost of producing the steel plates and glasses utilising the other raw materials. Mr Sharma will generate an invoice for Rs. 944 on the steel plates and glasses if the tax on a steel utensil is 18%, making the tax on his goods Rs. 144.

Therefore, Mr Sharma pays the distributor Rs. 144 in GST for each sale. He paid Rs. 118 in GST when he bought his input raw materials. He can now deposit the Rs. 26 difference with the government after subtracting the INR 118 he paid toward input GST from the Rs. 144 GST. Retailers and distributors charge GST and are eligible for the Input Tax Credit at all subsequent levels.

Calculating ITC Reversal under Rule 42

Rule 42 applies to the reversal of input services. The first step in calculating input tax reversal under this rule is to distinguish the individual credits that are not claimable from the total ITC. A few variables that are used during the process that aid in the calculation are T, T1, T2, and T3, where,

- T represents the overall input tax-paid credit on goods and services.

- T1 is the particular credit given to inputs meant for non-commercial use.

- T2 is the amount of input tax charged on materials used to make illegal exempt supplies.

- T3 is the amount of input tax that section 75 considers to be “blocked credits.”

The next step is calculating the common credit and deducting T1, T2, and T3 from the entire ITC. The equation for it is:

C1 = T – (T1+T2+T3)

This will derive T4, a credit specifically for input services or inputs utilised to create taxable supply only. This group of products comprises zero-rated exports and deliveries to special economic zones.

Taking the difference between C1 and T4 will result in Common Credit, represented by the letter C2. This is based on the assumption that the inputs were utilised partially for a taxable supply and partially for non-business reasons. Thus,

C2 = C1 – T4

The amount of ITC to be reversed from the common credit mentioned above can then be calculated as follows:

The ITC that can be attributed to exempt supplies that are derived from the common credit is computed as follows,

D1 = (E÷F) × C2

Here,

E denotes the total value of exempt supplies received during the tax period.

F denotes the entire revenue generated by the registered person in the state over the tax year.

The next step is to calculate D2, which is related to non-business uses and represents 5% of the C2 carbon credit.

D2 = 5% of C2

Further, to calculate C3, which is the eligible ITC derived from the common credit, which is denoted as,

C3 = C2 – (D1 + D2)

The ITC that needs to be reversed will be determined using the calculations from D1 and D2.

For instance, let’s think about the following scenario for Kerala supplies in June 2022:

ITC (T) total = Rs 2,00,00

Personal usage inputs (T1) = Rs 9500

Exempt supply (T2) inputs = Rs 15,000

Block credits (T3) = Rs 6000

Taxable supply inputs (T4) = Rs 1,20,000

The total exempt supply value (E) is less than = Rs 2,30,000

Kerala’s total annual revenue (F) = Rs 4,00,000

Thus using C1 = T – (T1 + T2 + T3),

C1 = Rs 1,69,500

The common credit C2 = C1 – T4

Thus,

C2 = Rs 49,500

Further,

D1 = (E÷F) × C2

D1 = 28,462.5

D2 = 5% of C2

D2 = 1423.125

Thus,

C3 = C2 – (D1 + D2)

C3 = Rs 19,614.38

Thus you arrive at the ultimate value to be reversed.

Calculating ITC Reversal under Rule 43

Capital goods are the subject of rule 43’s ITC reversal computation. However, before beginning the process, the first step is to determine whether the ITC meets the following requirements:

- Capital goods used for non-business purposes or for making exempt external supplies are covered by the ITC.

- ITC on capital items utilised in the production of non-exempt supplies.

While the reporting period is based on the supply made in a specific month, the useful life of capital items is assumed to be five years. Therefore, the first step in performing the operations is to divide the credit by 60 to determine the ITC attributable to one month.

Here, common credit is denoted as “Tc,” which, when divided by 60, yields “Tm,” which represents the amount of ITC attributed to the tax period.

“Tr” represents the total Tm of the capital goods.

The common credit for exempt suppliers, denoted by the symbol “Te,” is calculated as follows,

Te = ( E÷ F ) × Tr

Where E denotes the total value of the exempt supply,

Total turnover, the registered person’s status, is denoted by the letter F.

Te is, therefore, the calculated ITC reversal amount for capital items.

Throughout the useful life of the relevant capital goods, the sum Te and the applicable interest must be added to the output tax liability of each tax period.

Calculating ITC Reversal under Rule 44A

Suppose a registered person’s registration is revoked for whatever reason, or they opt to pay tax using the composition system. In that case, this provision is intended to reverse the ITC they previously earned.

The ITC should be reversed and calculated proportionately to the bills on which credit was requested for inputs maintained in stock or contained within semi-finished or finished goods that are kept in stock. ITC will be given if the registered person switches to the composition scheme or cancels their registration.

The pro-rata ITC for the capital goods will be decided. Because of this, the ITC for the asset’s remaining useful life must be reversed upon cancellation of registration or switching to the composition system.

The balance transitional ITC for gold bars was reversed on July 1st, 2017. This rule applies to ITC claims made under the transitional provisions of the CGST Act. As of July 1, 2017, the taxpayer could only claim a maximum of 1/6 of the credit for gold bars or gold jewellery held by them. This clause states that when delivering either the gold bar or the gold jewellery made from the raw gold bars, a complete 5/6th of a credit line must be repaid.

Reporting Reversal of ITC under GST

GSTR-3B and GSTR-9 are required to report ITC reversal of GST returns.

Reporting ITC Reversal in GSTR-3B

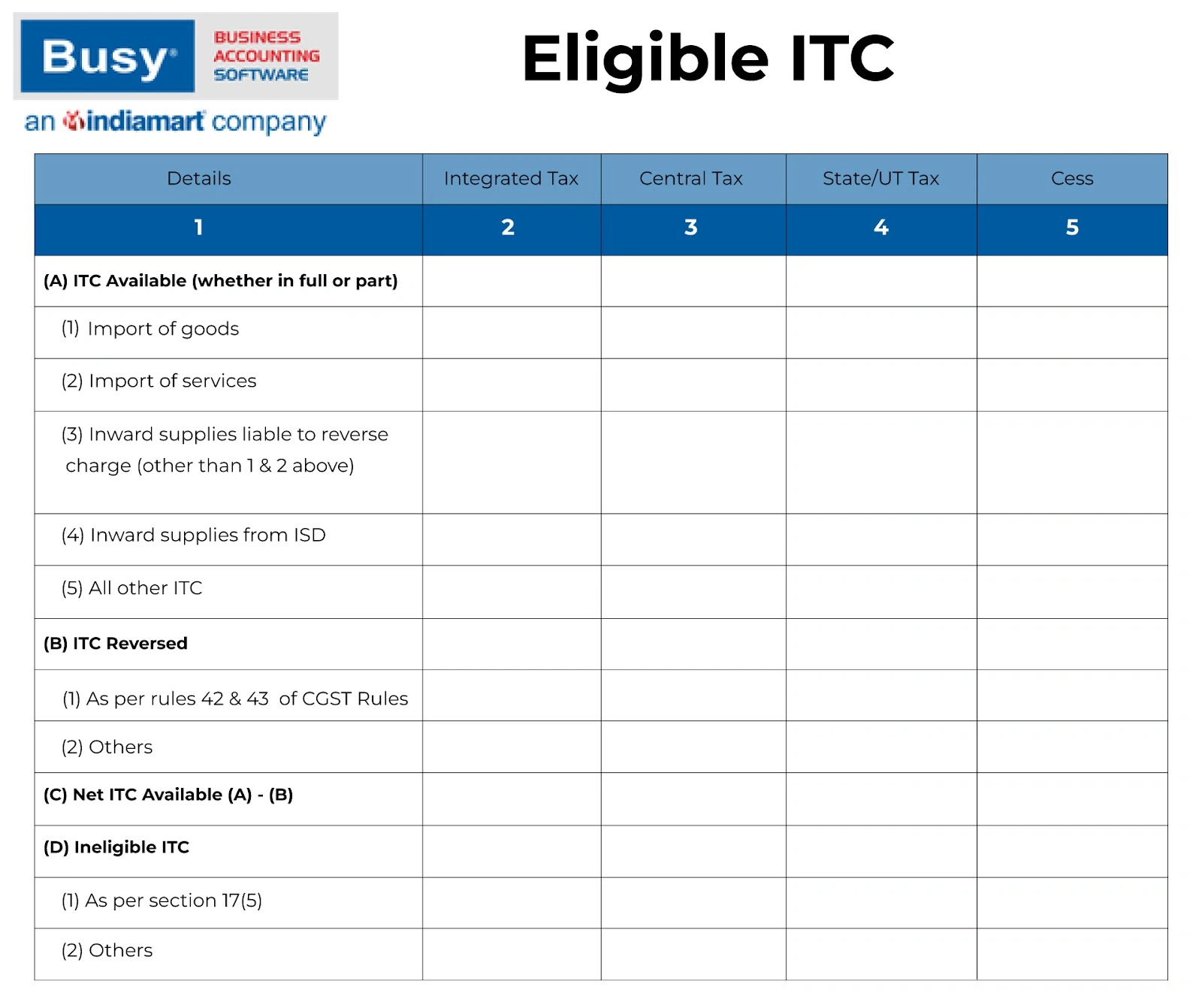

The ITC reversal amount must be calculated by the taxpayer and entered in GSTR-3B Table 4B. Two types of ITC reversals must be reported:

- The ITC attributable to non-business or exempt items must be determined per rules 42 and 43 of CGST/SGST Rules and recorded in this section. As a result, this form is not pre-populated.

- “Others,” where disclosing an ITC reversal caused by other circumstances is necessary.

Reporting ITC Reversal in GSTR-9

Likewise, information on ITC reversed for the entire year must be included in the annual return GSTR-9. Where possible, information is automatically filled in depending on the information provided in the monthly GSTR 3B form; however, the taxpayer may make changes as necessary.

Reasons that Require Reversal of ITC

There are multiple scenarios under which a taxpayer is required to reverse the Input Tax Credit (ITC). Two of the most common reasons include:

1. Blocked Credits under Section 17(5): ITC cannot be claimed on certain expenses such as:

- Motor vehicles (for personal use)

- Food, beverages, and outdoor catering

- Club memberships and personal expenses

- Works contracts (except for plant and machinery)

2. Mismatch Between GSTR-2A and GSTR-3B: If the ITC claimed in GSTR-3B is not reflected in GSTR-2A or GSTR-2B, it may be ineligible and must be reversed unless the mismatch is resolved.

Other reasons include:

- Non-payment to suppliers within 180 days

- Goods lost, stolen, or destroyed

- Supplies used for exempt or personal purposes

BUSY Software automatically detects mismatches and helps users track blocked credits to ensure proper ITC reversal and compliance.

Rules Governing ITC Reversal: Rule 42 & Rule 43

Rule 42 and Rule 43 of the CGST Rules define how to reverse ITC on inputs and input services (Rule 42) and capital goods (Rule 43) when they are used for both taxable and exempt supplies.

- Rule 42: Requires proportionate reversal of ITC based on turnover if inputs are used for both taxable and exempt supplies.

- Rule 43: Involves a similar proportionate reversal method for capital goods over a 5-year period.

These rules ensure that ITC is claimed only for the portion used in taxable supplies. BUSY Software automates Rule 42/43 calculations, saving hours of manual work and reducing the risk of errors during monthly return filing.

Reversal of ITC Provisions

If the supplier has included information on the tax invoice or debit note in Form GSTR-1, mirroring it in the recipient’s Form GSTR-2B, the recipient is eligible for an input tax credit.

In other words, if the supplier has not provided Form GSTR-1, the input tax credit will not be recorded in Form GSTR-2B, and the recipient will not be allowed to use the input tax credit.

- The CGST Act, 2017, Section 16 Subsection (2) Clause (aa):

Only if the supplier has included information on the tax invoice or debit note in Form GSTR-1, reflecting it in the recipient’s form GSTR-2B, is the recipient eligible for an input tax credit. In other words, if the supplier has not provided Form GSTR-1, the input tax credit will not be recorded in Form GSTR-2B, and the recipient will not be allowed to use the input tax credit. - The Central Goods and Services Tax Act, 2017’s Section 16(2)(b a):

Under the provisions of section 16(2)(b a), for instance, the receiver is only allowed to claim input tax credits that are not restricted (i.e., not ruled ineligible) as a result of the six circumstances listed under section 38 sub-section (2). It’s interesting to note that each of the six scenarios that render an input tax credit inadmissible in the hands of the recipient entirely depends on the supplier’s proper compliance. - The Central Goods and Services Tax Act of 2017’s Section 16(2)(c) :

The supplier must have deposited the tax to the government either through an electronic cash ledger or an electronic credit ledger for the recipient to be eligible for the input tax credit. The purchaser will not be qualified to claim the input tax credit if the supplier fails to pay the tax, even if the buyer has dutifully paid the tax to the supplier. - The claim of ITC and temporary acceptance under Section 41 of the CGST

The Finance Act of 2022 replaces the entirety of Section 41’s provisions relating to the use of the input tax credit. According to the new rules, the recipient must reverse the input tax credit if the supplier doesn’t pay the tax. Additionally, interest must be added to the ITC reversal. - Blocking of Credit, Rule 86A of the CGST:

One of the terms states that if the supplier is discovered to be nonexistent, the recipient will not be eligible for the input tax credit.

ITC Reversal in GSTR-2

In GST, Input Tax Credit (ITC) allows businesses to offset the taxes paid on purchases against the taxes collected on sales. However, there are situations where businesses must reverse or cancel the ITC claimed. One such instance occurs in GSTR-2, which is the return form where details of purchases are declared.

ITC reversal in GSTR-2 happens when the conditions for claiming credit are not met. This can occur due to reasons such as:

- Non-payment of taxes: by the supplier: If a supplier has not paid the taxes on time, the ITC claimed by the recipient must be reversed.

- Mismatched invoices: If the invoices reported by the supplier do not match the details in the buyer’s GSTR-2, the ITC claimed needs to be adjusted or reversed.

- Credit on blocked items: Certain items are not eligible for ITC under GST, like motor vehicles or personal expenses, and if claimed, the ITC will be reversed.

The reversal process ensures that businesses only claim credit on eligible purchases and helps maintain the integrity of the GST system. Reversing ITC ensures compliance and prevents misuse of the credit mechanism under GST.

Also Check-Out Insights on – Transitioning To GST

ITC Reversal in GSTR-2 and GSTR-3B

Though GSTR-2 was initially part of the GST return system, it has been kept in abeyance. Currently, taxpayers handle ITC reversal in GSTR-3B, using the following fields:

- Table 4(B): For ITC reversals (permanent and temporary)

- Table 4(D): For ineligible ITC under Section 17(5)

When reconciliation reveals excess ITC claimed or ineligible credits, these must be reversed in the appropriate section of GSTR-3B.

BUSY Software helps you track reversal reasons, prepares GSTR-3B-ready data, and ensures the right amount is reversed under the correct heads.

Documentation and Reconciliation Best Practices

Proper documentation and monthly reconciliation are critical to ensure ITC reversals are accurate and defensible during audits.

Best Practices:

- Match purchase invoices with GSTR-2B every month

- Maintain proper vendor-wise reconciliation reports

- Keep records of payments made within 180 days for ITC eligibility

- Document reasons for blocked credit or exempt usage

- Maintain a trail of manual reversals and calculations

BUSY Software supports all of these with automated reconciliation tools, ITC tracking reports, and document retention features that simplify both audit readiness and monthly compliance.

Impacts of ITC Reversal

Reversing ITC affects both your working capital and compliance health. If done incorrectly or delayed, it can result in:

- Interest liability on excess credit claimed

- Penalty notices under Section 73 or 74

- Mismatch in annual returns (GSTR-9 vs. 3B/2B)

- Reduced cash flow due to lower available ITC

Consistent and accurate ITC management ensures that your GST returns reflect true liability and helps avoid departmental scrutiny.

Conclusion

It is beneficial to keep the credit for earlier-used inputs so that it is added to the output tax liability. Thus, it would effectively invalidate any prior claims of credit. And last, the interest in ITC reversal varies depending on the reversal executed.

It can be challenging to comprehend and calculate ITC Reversal. Utilising fully automated software that can handle time-consuming tasks on your behalf helps you save time and effort. BUSY Accounting Software offers such software, an automated and scalable solution to all the laborious tasks of computing input tax credit, reversals, common credit, and other GST-related tasks.

- GST Rates for ProductsGST Rates: chalk GST rate GST on fertilizer GST for food business yarn GST rate GST on commercial rent GST on marble GST on builder rent GST rate GST rate for contractor GST for construction materials GST on cloud kitchen GST on pencil GST on cryptocurrency GST on freight charges GST on footwear GST on sugar GST on advocate services GST on e commerce operator GST for fmcg products GST on upi transaction

Frequently Asked Questions

- Why is the reversal of Input Tax Credit required in GSTR-2?Reversal of Input Tax Credit (ITC) in GSTR-2 is required to ensure that businesses do not claim ITC on ineligible or incorrect transactions. It helps maintain compliance with GST laws, especially when goods/services are not used for business purposes or are returned, leading to a revision of the credit.

- When should the reversal of ITC be done in GSTR-2?ITC should be reversed in GSTR-2 when the input goods or services are not used for taxable supplies, goods are returned, or when there is non-payment of invoices within a specified time frame. Reversal also occurs if the supplier does not report invoices or if goods are utilized for non-business purposes.

- What are the common reasons for the reversal of ITC in GSTR-2?Common reasons for ITC reversal in GSTR-2 include non-payment of tax by the supplier, returned goods, goods used for personal purposes, or invoices not reported in the GSTR-1. Other reasons can be mismatch of data between GSTR-2A and GSTR-3B or changes in business circumstances.

- How does the reversal of ITC affect a business’s GST liability?The reversal of ITC increases a business’s GST liability, as the credit that was previously claimed is removed from the input tax balance. This means the business will need to pay GST on those amounts either through cash or using available credits, affecting cash flow and tax calculations.

- What documents are required for the reversal of ITC in GSTR-2?Documents required for ITC reversal in GSTR-2 include purchase invoices, debit notes, delivery challans, and relevant supplier returns. Additionally, the business must have proof of returned goods, evidence of non-payment, and any supporting documentation related to mismatched transactions between GSTR-2A and GSTR-3B.

- How is the reversal of ITC reflected in GSTR-2?Reversal of ITC is reflected in GSTR-2 under the section for reversed input tax credit. The amount of reversed ITC is entered in the relevant fields, and it reduces the available credit for the business. This adjustment ensures that the credit claim aligns with eligible transactions and the tax liability is accurate.

- Can the reversal of ITC be claimed back later in GSTR-3B?Yes, the reversal of ITC in GSTR-2 can potentially be claimed back in GSTR-3B, if the conditions for re-claiming the credit are met, such as when the supplier makes payment or the goods are correctly utilized for taxable purposes. This depends on the rectification of the underlying issue.

- Is there a time limit for the reversal of Input Tax Credit in GSTR-2?Yes, there is a time limit for the reversal of ITC in GSTR-2. ITC must be reversed within the time period specified by the GST law, generally by the due date for filing returns of the month in which the transaction occurs. Specific conditions, such as the invoice date, also impact the time limit.