GST State Code List & Jurisdiction

In GST, the State Code is a two-digit number that shows which state or union territory a business belongs to. It is part of the GSTIN (Goods and Services Tax Identification Number) and helps decide if a sale is within the state or between states.

GST Jurisdiction tells you which tax office is responsible for your area. This is important when you need help with GST issues, filing papers, or solving problems.

For businesses, knowing your state code and jurisdiction makes GST work easier and error-free.

BOOK A FREE DEMO

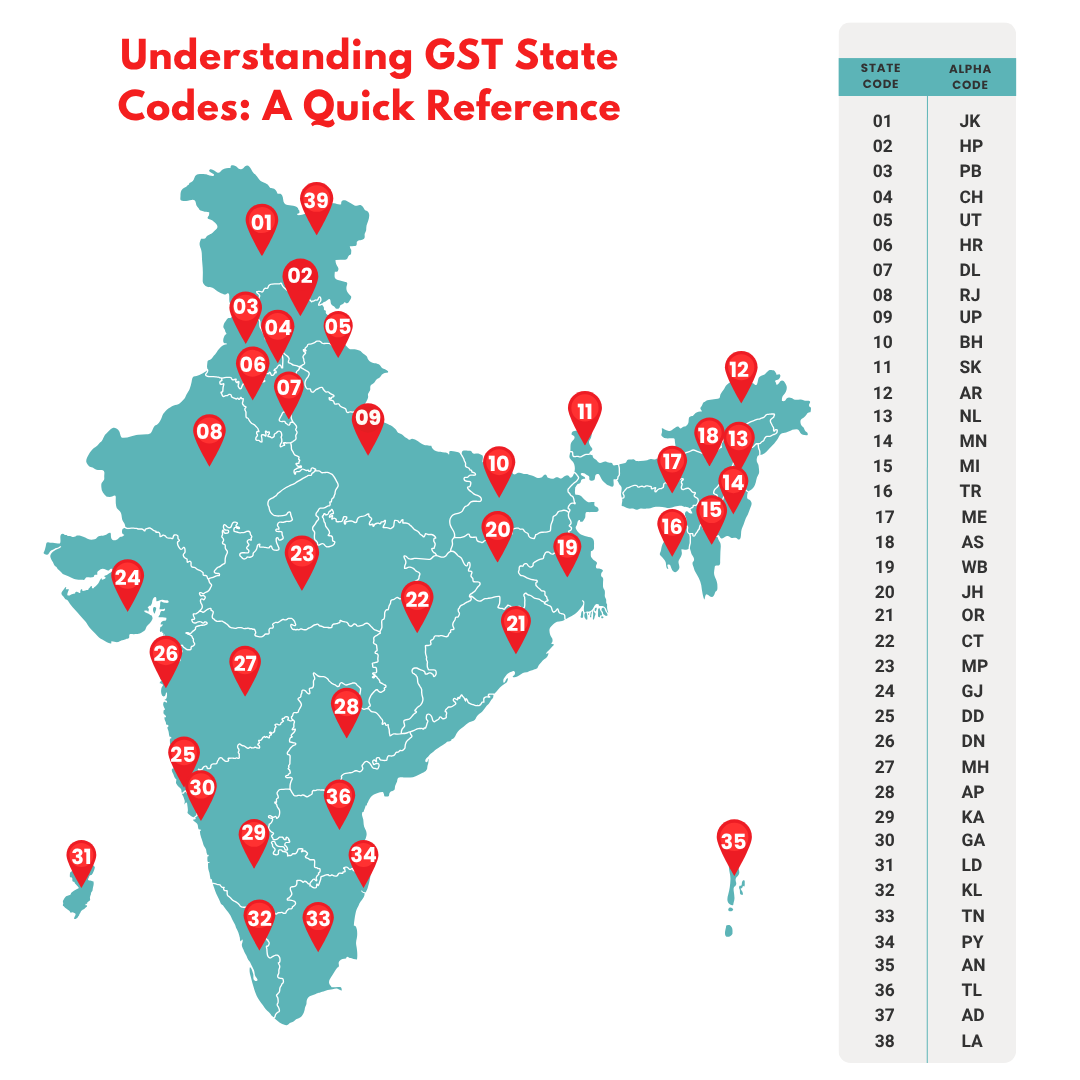

Examples of GST State Code List of India

The GST state code is a two-digit number assigned to every state and union territory in India. These codes are important for identifying the location of GST-registered taxpayers. For example:

- 01 for Jammu & Kashmir

- 07 for Delhi

- 09 for Uttar Pradesh

- 27 for Maharashtra

These codes are part of the GSTIN (Goods and Services Tax Identification Number), a unique 15-digit number given to every registered business. The first two digits represent the state code, followed by the taxpayer’s PAN and other specific details.

State codes are particularly important for filing GST returns, generating invoices, and determining the type of GST applicable—whether CGST/SGST for intra-state transactions or IGST for inter-state transactions. For instance, if you are a business owner in Delhi selling goods to Maharashtra, the system uses state codes (07 for Delhi and 27 for Maharashtra) to calculate the appropriate tax.

You can find the complete list of GST state codes on the official GST portal or consult your GST registration certificate. Keeping this information handy ensures you can easily prepare accurate invoices and avoid mistakes in tax filings.

Where Do We Need State Code in GST?

State codes in GST are used in various tax filing and compliance aspects. They help determine where the goods or services are supplied and the type of GST applicable.

For businesses, the most common place you’ll see state codes is in GSTIN, invoices, and GST returns. Let’s say you are based in Uttar Pradesh (state code 09) and sell goods to a customer in Delhi (state code 07). These codes help the system recognize the transaction as inter-state, applying IGST instead of SGST/CGST. If you sell within Uttar Pradesh, the state code remains 09, and SGST/CGST is applied.

State codes also play a key role when filing GST returns. They ensure your sales and purchases are correctly categorized based on the supply location. Any error in entering state codes can lead to wrong tax calculations or delayed compliance, causing unnecessary issues.

Therefore, understanding and correctly using state codes is vital. Double-check the state codes of your customers and suppliers while preparing invoices or filing returns to avoid any discrepancies.

Classification of GST Jurisdictions

GST jurisdictions are divided into State GST (SGST) and Central GST (CGST). Each has its role in ensuring compliance and monitoring taxpayers under GST.

- State GST Jurisdictions: These are managed by the state tax departments and cover businesses operating within the state. For example, if your business is in Delhi, your jurisdiction will fall under the Delhi GST department.

- Central GST Jurisdictions: These are managed by the Central Board of Indirect Taxes and Customs (CBIC) and cover businesses with inter-state operations or those requiring central oversight.

Knowing your GST jurisdiction is essential for several reasons. It helps you identify the correct office for resolving GST queries, submitting documents, or seeking clarifications. This information is on your GST registration certificate under the “Jurisdiction” section.

If you’re unsure about your jurisdiction, visit the GST portal or contact your local tax office. Properly identifying your jurisdiction ensures that the right authority handles any correspondence or compliance requirements.

GST State Code List

Here is the list of GST state/union territory codes to search for the right code for your business.

| State Code | State/Union Territory Name | Alpha Code |

|---|---|---|

| 01 | Jammu and Kashmir | JK |

| 02 | Himachal Pradesh | HP |

| 03 | Punjab | PB |

| 04 | Chandigarh | CH |

| 05 | Uttarakhand | UT |

| 06 | Haryana | HR |

| 07 | Delhi | DL |

| 08 | Rajasthan | RJ |

| 09 | Uttar Pradesh | UP |

| 10 | Bihar | BH |

| 11 | Sikkim | SK |

| 12 | Arunachal Pradesh | AR |

| 13 | Nagaland | NL |

| 14 | Manipur | MN |

| 15 | Mizoram | MI |

| 16 | Tripura | TR |

| 17 | Meghalaya | ME |

| 18 | Assam | AS |

| 19 | West Bengal | WB |

| 20 | Jharkhand | JH |

| 21 | Odisha | OR |

| 22 | Chhattisgarh | CT |

| 23 | Madhya Pradesh | MP |

| 24 | Gujrat | GJ |

| 25 | Daman & Diu | DD |

| 26 | Dadra & Nagar Haveli | DN |

| 27 | Maharashtra | MH |

| 28 | Andhra Pradesh (Before Division) | AP |

| 29 | Karnataka | KA |

| 30 | Goa | GA |

| 31 | Lakshadweep | LD |

| 32 | Kerala | KL |

| 33 | Tamil Nadu | TN |

| 34 | Pondicherry | PY |

| 35 | Andaman and Nicobar Islands | AN |

| 36 | Telangana | TL |

| 37 | Andhra Pradesh (Newly Added) | AD |

| 38 | Ladakh | LA |

| 97 | Other Territory | – |

| 99 | Centre Jurisdiction | – |

Get a Free Trial – Best E Way Bill Software

How to Find or Search for GST Jurisdiction?

Finding your GST jurisdiction is simple. It is determined by the area where your shop or business is located. You are assigned a jurisdiction when you register for GST, and this information is recorded on your GST registration certificate.

Here are the steps to find your jurisdiction:

- Check Your GST Registration Certificate: Log in to the GST portal and download your registration certificate. Look under the “Details of Jurisdiction” section. This will show both your state and central jurisdiction.

- Use the GST Portal: The GST portal has a jurisdiction search tool. Enter your state, district, or pin code to find the appropriate jurisdiction.

- Contact Your Local Tax Office: If you face any difficulty, visit your local GST office. Officers there can guide you in identifying your jurisdiction.

Knowing your jurisdiction helps address GST-related concerns, such as submitting amendments, resolving disputes, or clarifying doubts. For smooth GST compliance, always keep this information updated and accessible.

Searching State Jurisdictions in GST

State tax departments manage state jurisdictions under GST. If your business operates locally, your tax-related matters will usually fall under the state jurisdiction.

To search for your state jurisdiction:

- Visit the official website of your state’s tax department.

- Look for a tool or section like “Find Your Jurisdiction.”

- Enter your business location details, such as district or pin code.

For example, if you run a business in Lucknow, Uttar Pradesh, the search tool will identify the tax office responsible for your area. This jurisdiction information is important for matters like submitting documents, responding to notices, or seeking help with GST-related queries.

Make sure you correctly identify your state jurisdiction during GST registration to avoid errors that might delay your compliance process.

Get a Free Trial – Best Accounting Software For Small Business

Searching Central Jurisdictions in GST

Central jurisdictions are managed by CBIC and oversee inter-state businesses and other specific cases. To search for your central jurisdiction:

- Visit the CBIC’s official website.

- Use the “Jurisdiction Finder” tool available on the site.

- Enter your business address or pin code to get the details.

The tool will provide the name, address, and contact information of your designated central tax office. Having this information is essential, especially if you deal with inter-state transactions or need assistance with IGST matters.

Keeping your central jurisdiction information handy ensures you know where to turn for help with GST compliance.

Check on the GST Registration Certificate

Your GST registration certificate is a vital document that contains key details about your business, including your GSTIN, business name, and jurisdiction.

To check this information:

- Log in to the GST portal with your credentials.

- Go to the “Services” section and click on “View/Download Certificates.”

- Open your certificate and locate the “Jurisdiction” section.

This section will show both your state and central jurisdiction. Ensure the details are accurate, as any errors could lead to issues in filing returns or responding to tax notices. If you spot a mistake, update it immediately through the GST portal.

How to Get the Contact Details of the GST Jurisdictional Officer?

To resolve GST-related issues or seek clarifications, you may need to contact your jurisdictional officer. Follow these steps:

- Visit the GST portal or your state tax department’s website.

- Use the jurisdiction search tool to find the contact details of your designated officer.

- Note down their name, office address, email, and phone number.

These officers can assist with matters like amendments, notices, or inspections. Having their contact details ready ensures quicker resolution of any issues.

Explore a Free Demo of – Best Inventory Management Software For Small Business

How to Correct a Wrongly Informed GST Jurisdiction?

If you mistakenly provided incorrect jurisdiction details during registration, you must correct them immediately. Here’s how:

- Log in to the GST portal.

- Navigate to “Services” > “Amendment of Registration.”

- Select “Core Fields” and update the jurisdiction details.

- Upload the necessary documents and submit the changes.

Once approved, the system will show you the correct jurisdiction. Correcting this error ensures smoother interactions with GST authorities and avoids unnecessary delays or penalties.

- GST Rates for ProductsGST Rates: GST on ac GST for laptops GST on iphone GST for hotel room GST on flight tickets GST on silver GST for tv wood GST rate GST on train tickets GST on water bottle GST for medicines GST on tyres GST in garments GST on milk GST on stationery GST on tractor GST for food GST rate on tiles GST on sweets GST on gold

Frequently Asked Questions

- How to find the state code in the GST number?The GST state code is the first two digits of the GSTIN (15-digit GST number). It represents the state where the business is registered. For example, if your GSTIN starts with “27,” your business is registered in Maharashtra.

- What is state code 99 in GST?State code 99 in GST is assigned to taxpayers located outside India. It is used for foreign entities or non-resident taxable persons registering under GST in India.

- When was GST started in India?GST was introduced in India on July 1, 2017. It replaced multiple indirect taxes like VAT, service tax, and excise duty, simplifying the tax system across the country.

- Which state GST code is 27?GST state code 27 belongs to Maharashtra It is used in GSTINs of businesses registered in this state for tax compliance.

- What is the 29 State Code of GST?GST state code 29 represents Karnataka. Businesses registered in Karnataka will have this code at the beginning of their GSTIN.

- What is 37 State code in GST?GST state code 37 belongs to Andhra Pradesh. It is used for businesses operating under GST in Andhra Pradesh.

- What is the 33 State code in GST?GST state code 33 represents Tamil Nadu. Businesses registered in Tamil Nadu will see this code at the start of their GSTIN.

- What is the importance of the GST State Code?GST state codes are crucial for identifying the state of registration. They help determine if a transaction is intra-state or inter-state, ensuring the correct GST type (CGST, SGST, or IGST) is applied.

- How is the GSTIN structured?The GSTIN is a 15-digit number:

- First 2 digits: State code

- Next 10 digits: PAN of the business

- 13th digit: Entity code

- 14th digit: Blank (default “Z”)

- 15th digit: Checksum.

- Can the GST State Code be changed after registration?Yes, if your business shifts to another state, you must cancel the current GST registration and apply for a new GSTIN with the updated state code.

- How does the GST state code affect E-Way Bill generation?The GST state code helps identify The origin and destination states of E-Way Bills. It ensures proper tax calculations (IGST or SGST/CGST) for the movement of goods across states.